– Gold gains in USD, GBP, EUR, CAD, AUD, NZD, JPY – Gold gains in CNY, INR & most emerging market currencies– Gold surges 31.5% in British pounds after Brexit shock– Gold acted as hedge and safe haven in 2016 … for those who need safe haven– Furthers signs of market having bottomed and bodes well for 2017 – What drivers will gold respond to in 2017? – EU elections and contagion risk, Geo-politics, terrorism, war...

Read More »European Stocks Greet The New Year By Rising To One Year Highs; Euro Slides

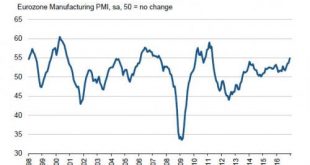

While most of the world is enjoying it last day off from the 2017 holiday transition, with Asia’s major markets closed for the New Year holiday, along with Britain and Switzerland in Europe and the US and Canada across the Atlantic, European stocks climbed to their highest levels in over a year on Monday after the Markit PMI survey showed manufacturing production in the Eurozone rose to the highest level since April...

Read More »Q1 – Q3 2016 China Net Gold Import Hits 905 Tonnes

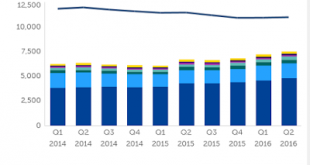

Submitted by Koos Jansen from BullionStar.com Withdrawals from the vaults of the Shanghai Gold Exchange, which can be used as a proxy for Chinese wholesale gold demand, reached 1,406 tonnes in the first three quarters of 2016. Supply that went through the central bourse consisted of at least 905 tonnes imported gold, roughly 335 tonnes of domestic mine output, and 166 tonnes in scrap supply and other flows recycled...

Read More »China Update

Introduction by George Dorgan My articles About meMy booksFollow on:TwitterFacebookGoogle +YoutubeSeeking AlphaCFA SocietyLinkedINEconomicBlogs Summary: The evolving political situation in China is worth monitoring. China’s trade surplus with the US has fallen this year. It has been roughly 20 years since China was formally labeled a currency manipulator. Trump has indicated he would do so. There have...

Read More »Risk Happens Fast

By Chris at www.CapitalistExploits.at As a teenager brimming with testosterone my reptilian brain loved action movies. Top of my list were Steven Seagal movies. Clearly it wasn’t for his acting skills, which are only marginally better than Barney the dinosaur. What I loved about Seagal was that he was both deadly and terribly fast. His opponents had mere seconds before their arms, legs, or other bones were snapped like...

Read More »Yuan Not

Summary: The yuan has weakened and Chinese shares have sold off, yet global capital markets are taking little notice. August 2015 and again in January 2016, markets seemed to be hypersensitive. Yuan’s decline has been modest, orderly, and not eliciting a negative response by policymakers, including US Treasury Dept. There were two dogs that did not bark this year. There are the Japanese yen, which despite...

Read More »IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

Summary: The increase in the yen’s share of reserves was flattered by the yen’s 9% appreciation. The dollar and euro’s share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan’s share of reserves. The IMF provides the most authoritative data on central bank reserves. The composition is...

Read More »Is The US Dollar Set To Soar?

Which blocs/nations are most likely to face banking/liquidity crises in the next year? Hating the U.S. dollar offers the same rewards as hating a dominant sports team: it feels righteous to root for the underdogs, but it’s generally unwise to let that enthusiasm become the basis of one’s bets. Personally, I favor the emergence of non-state reserve currencies, for example, blockchain crypto-currencies or...

Read More »U.S. Imports Record Amount Of Gold From Switzerland In July

U.S. Gold Imports from Switzerland Monthly It seems as if the tide has changed as the U.S. imported a record amount of gold from Switzerland in July. Normally, the flow of gold from the United States has been heading toward Switzerland. For example, when the U.S. exported a record 691 metric tons (mt) of gold in 2013, Switzerland received 284 mt, which accounted for 41% of the total. Compare that to the paltry 3...

Read More »Gold Wins In Three Out Of Four Scenarios, Macquarie Warns “None Of Them Are Good For The Economy”

Submitted by Valentin Schmid via The Epoch Times, Warren Buffett claims that gold is worthless because it doesn’t produce anything. Fair point, but what if the other sectors of the economy also stop producing? “If you think of gold, the only way gold loses is if normal business and private sector cycles come back. If that is the case, gold goes back 100 dollars per ounce. The other outcomes, deflation, stagflation, hyperinflation are good for gold,” said Viktor Shvets,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org