Swiss Franc EUR/CHF - Euro Swiss Franc, March 07(see more posts on EUR/CHF, ) - Click to enlarge GBP/CHF The pound has continued to gradually slide lower against the Swiss Franc with rates for this pair falling to 1.2350. GBP CHF is particularly week on two counts: The safe haven status of the Swiss Franc and Brexit. Sterling continues to remain under a degree of pressure as the Brexit uncertainty continues to loom with Article 50 still expected to be invoked later this month. The House of Lords will be scrutinising the Brexit Bill once again today and there is likely to be an amendment requested that will seek a final vote on the terms of the Brexit deal offered by the European Union. This is likely to see the pound weaken in the short term as it could ultimately mean that Brexit is delayed whilst things are held up in the House of Lords. Tomorrow sees Philp Hammonds first budget which could create substantial volatility for the pound. Any revision of UK growth forecast for 2017 could see the pound rally on the news and any funds set aside to tackle Brexit. Any war chest offered to tackle Brexit and keep the economy on course could also be seen as a positive for the pound.

Topics:

Marc Chandler considers the following as important: AUD, CAD, EUR, Featured, FX Trends, GBP, newslettersent, USD, Yuan

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Marc Chandler writes March 2025 Monthly

Mark Thornton writes Is Amazon a Union-Busting Leviathan?

Swiss Franc |

EUR/CHF - Euro Swiss Franc, March 07(see more posts on EUR/CHF, ) |

GBP/CHFThe pound has continued to gradually slide lower against the Swiss Franc with rates for this pair falling to 1.2350. GBP CHF is particularly week on two counts: The safe haven status of the Swiss Franc and Brexit. Sterling continues to remain under a degree of pressure as the Brexit uncertainty continues to loom with Article 50 still expected to be invoked later this month. The House of Lords will be scrutinising the Brexit Bill once again today and there is likely to be an amendment requested that will seek a final vote on the terms of the Brexit deal offered by the European Union. This is likely to see the pound weaken in the short term as it could ultimately mean that Brexit is delayed whilst things are held up in the House of Lords. Tomorrow sees Philp Hammonds first budget which could create substantial volatility for the pound. Any revision of UK growth forecast for 2017 could see the pound rally on the news and any funds set aside to tackle Brexit. Any war chest offered to tackle Brexit and keep the economy on course could also be seen as a positive for the pound. It is generally believed that the House of Lords will end up backing down on these amendments which would suggest a potential rally once some clarity is offered. Those clients selling Swiss Francs may wish to consider moving into pounds whilst sterling is under pressure. The pound could turn around very quickly if it is perceived that UK Prime Minister Theresa May is in a strong a negotiating position as possible. |

GBP/CHF - British Pound Swiss Franc, March 07(see more posts on GBP/CHF, ) |

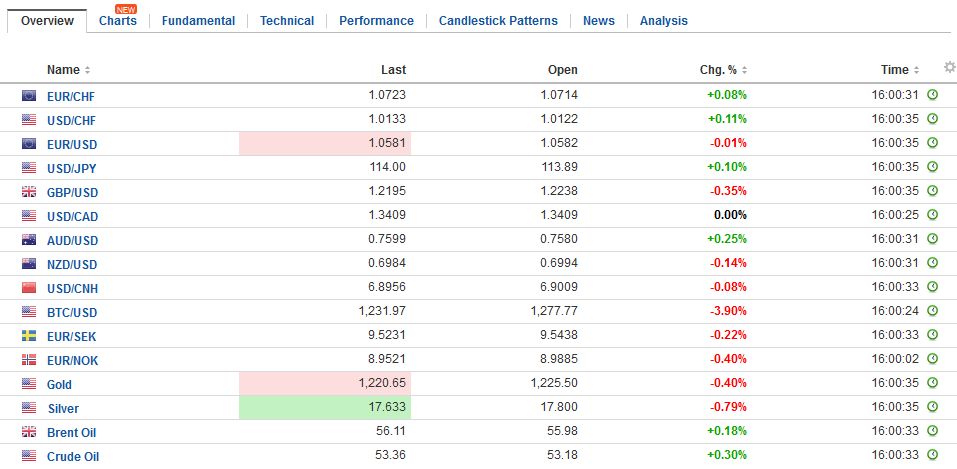

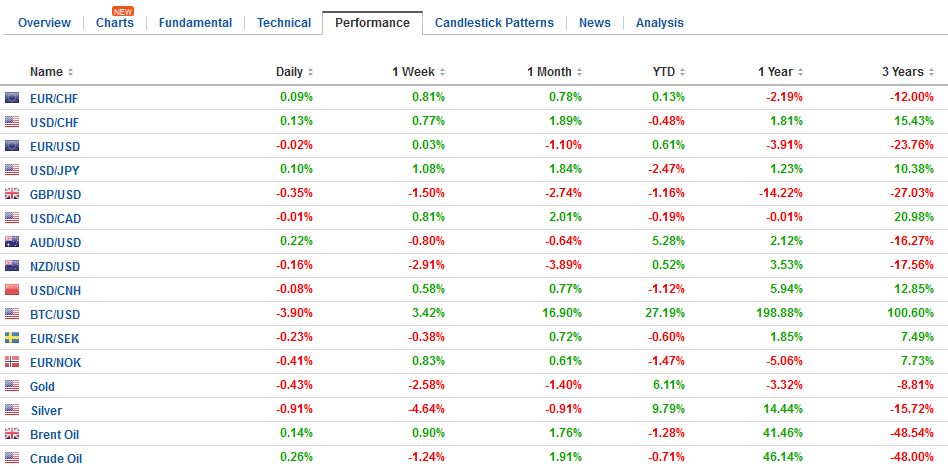

FX RatesThe US dollar has continued to recover from the slide on what still largely appears to have been a buy the rumor sell the fact response to Yellen’s speech just before last weekend. Yellen was the last of around 11 Fed officials that spoke last week, and nearly all but Bullard signaled readiness to hike rates at next month’s meeting. Soft German factory orders and the prospects of another House of Lords inspired amendment to the Brexit bill have helped the dollar. Sterling has been pushed through $1.22 for the first time since January 17. It had been testing the 61.8% retracement of the rally since briefly falling through $!.20. That retracement target was $1.2260. After several tries, it closed below there yesterday and following through selling was seen in the European morning. The next target is near $1.2150. The trend line from the flash crash low and the mid-Jan low comes in now near $1.2050. The amendment that the House of Lords looks set to pass today calls for a more meaningful vote on the final agreement. While Prime Minister May has already made such a concessions, as we noted previously, the way it is currently structured, may give Parliament a choice between the deal May negotiates and no deal. The House of Lords wants a more significant say. The Conservatives do not have a majority in the House of Lords. Labour, Lib Dems, and some Tory defectors look poised to provide a majority. The measures would then return to the House of Commons next week. |

FX Daily Rates, March 07 |

| The euro has also seen follow through selling today after the short squeeze ran out of steam near $1.0640. With today’s losses, the euro nearly retraced 61.8% of its gains off last week dip below $1.05, which comes in near $1.0550. The intraday technicals warn against chasing the euro lows and suggest potential back into the $1.0600-$1.0620 area. However, the two-year interest rate differential is rising to new multi-year highs today near 218 bp, which is eight basis points higher than last week’s close. This acts, we argue, as an important drag on the euro.

Perhaps the biggest surprise today was the increase in China’s reserves. The small increase of $6.9 bln stems a seven-month drop and compares with expectations for a nearly $30 bln decline.The tightening of formal and informal capital controls appear to be working. The gain in reserves is also impressive given the valuation adjustment spurred by the dollar’s broad gains in February. The yuan was steady against the dollar in February (+0.25%), and it is up 0.65% year-to-date. The offshore yuan (CNH) is up 1.1% this year. While a rise in China’s reserves means less intervention, the rise in Switzerland’s reserves means more intervention. Swiss reserve jumped 3.8% in February, the largest rise in a couple of years. Reserves rose to CHF668.2 bln from CHF643.9 bln. Valuation considerations, and especially the euro’s decline likely flattered Swiss reserves, but the increase in sight deposits is consistent with material intervention. The euro toyed with the CHF1.0650 area throughout the month. The single currency is recovering this month and today, near CHF1.0740 is at its best level since late January. The Reserve Bank of Australia met, and as widely expected left policy unchanged. The statement’s reference to improved global backdrop and the strength of local consumption further suggests earlier ideas of a rate cut in H1 are dashed. The Aussie raced through $0.7630 to approach the 50% retracement of its decline from $0.7740 in late February but quickly slipped back below $0.7600. In addition to the interest rate considerations, the rise in the base metals was seen as a supportive factor. Those metal prices are coming off. Yesterday the LME reported the largest rise in copper inventories in 15 years. Copper prices are down today for the fourth session. Iron ore prices were off 2.2% on their third consecutive declining session. |

FX Performance, March 07 |

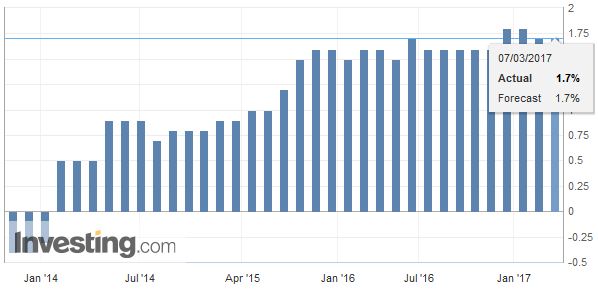

EurozoneThe main news was in the form of disappointing German factory orders. They declined three times more than the Bloomberg median estimate of -2.5%. The decline of 7.4% was the largest decline since the throes of the Great Financial Crisis (January 2009). It completely offsets the 5.2% rise in December. Domestic orders fell 10.5%, and exports orders were off nearly 5%. Investment goods were particularly hard hit, falling 16.8%. The report warns of downside risks to tomorrow’s industrial production report, which was expected to see a 2.7% gain after the 3.0% drop in December. |

Eurozone Gross Domestic Product (GDP) YoY, February 2017(see more posts on Eurozone Gross Domestic Product, ) Source: Investing.com - Click to enlarge |

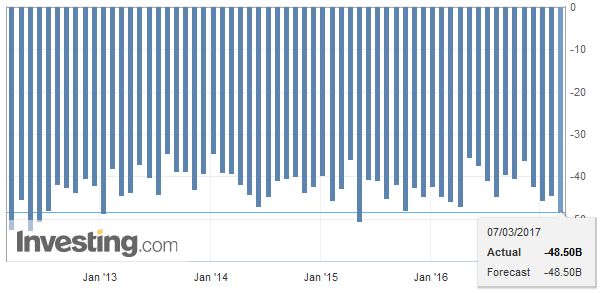

United StatesThe North America session features the US January trade balance and consumer credit late in the session. Canada also reports its merchandise trade figures and then the IVEY PMI. |

U.S. Trade Balance, January 2017(see more posts on U.S. Trade Balance, ) Source: Investing.com - Click to enlarge |

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #GBP,#USD,$AUD,$CAD,$EUR,Featured,newslettersent,yuan