Swiss Franc The Euro has risen by 0.43% to 1.1747 CHF. EUR/CHF and USD/CHF, March 26(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates After a poor start in Asia, equities recovered. The MSCI Asia Pacific initially extended last week’s losses and fell to its lowest level since February 12 before recovering to finish near its highs, 0.4% above last week’s close. European...

Read More »US Imports: A Little Inflation For Yellen, A Little More Bastiat

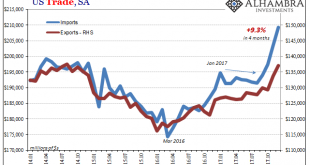

US imports rocketed higher once again in December, according to just-released estimates from the Census Bureau. Since August 2017, the US economy has been adding foreign goods at an impressive pace. Year-over-year (SA), imports are up just 10.4% (only 9% unadjusted) but 9.3% was in just those last four months. For most of 2017, imports were flat and even lower. The question is, obviously, what has changed? Did the boom...

Read More »FX Daily, January 10: Yen Short Squeeze Extended

Swiss Franc The Euro has risen by 0.31% to 1.1725 CHF. EUR/CHF and USD/CHF, January 10(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Sparked by fears that the BOJ took a step toward the monetary exit by reducing the amount of long-term bonds it is buying, there is an apparent scramble to cover previously sold yen positions. The dollar finished last week near JPY113.00....

Read More »FX Daily, November 30: US Dollar Comes Back Bid, but Brexit Hopes Underpin Sterling

Swiss Franc The Euro has risen by 0.37% to 1.1705 CHF. EUR/CHF and USD/CHF, November 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar is broadly firmer. The rise in US yields yesterday has seen the greenback extend its recovery against the yen. It briefly pushed through JPY112.40, after dipping below JPY111.00 at the start of the week, for the first time...

Read More »FX Daily Rates, November 24: Euro Continues to Push Higher

Swiss Franc The Euro has risen by 0.38% to 1.1674 CHF. EUR/CHF and USD/CHF, November 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The euro is edging higher to trade at its best levels since the middle of last month. It is drawing closer to the $1.1880 area, which if overcome, could point to return to the year’s high seen in early September near $1.2100. There is a...

Read More »FX Daily, October 30: Dollar Slips in Consolidative Activity

Swiss Franc The Euro has risen by 0.29% to 1.606 CHF. EUR/CHF and USD/CHF, October 30(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The markets are mixed, mostly responding to idiosyncratic developments, as the week’s large events loom ahead. These BOJ, BOE, and FOMC meetings, eurozone flash CPI and US jobs reports. In addition, US President Trump is expected to...

Read More »FX Daily, October 19: Kiwi Drop and Sterling Losses Punctuate Subdued FX Market

Swiss Franc The Euro has fallen by 0.25% to 1.1539 CHF. EUR/CHF and USD/CHF, October 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these...

Read More »The Gold-Backed-Oil-Yuan Futures Contract Myth

On September 1, 2017, the Nikkei Asian Review published an article titled, “China sees new world order with oil benchmark backed by gold”, written by Damon Evans. Just below the headline in the introduction it states, “China is expected shortly to launch a crude oil futures contract priced in yuan and convertible into gold in what analysts say could be a game-changer for the industry”. Not long after the Nikkei piece...

Read More »It Was Collateral, Not That We Needed Any More Proof

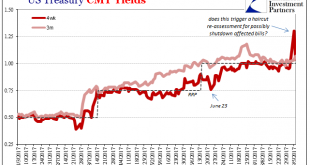

Eleven days ago, we asked a question about Treasury bills and haircuts. Specifically, we wanted to know if the spike in the 4-week bill’s equivalent yield was enough to trigger haircut adjustments, and therefore disrupt the collateral chain downstream. US Treasury, Jan - Sep 2017(see more posts on U.S. Treasuries, ) - Click to enlarge Within two days of that move in bills, the GC market for UST 10s had gone...

Read More »Swimming The ‘Dollar’ Current (And Getting Nowhere)

The People’s Bank of China reported this week that its holdings of foreign assets fell slightly again in August 2017. Down about RMB 21 billion, almost identical to the RMB 22 billion decline in July, the pace of forex withdrawals is clearly much preferable to what China’s central bank experienced (intentionally or not) late last year at ten and even twenty times the rate of July and August. The US Treasury Department...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org