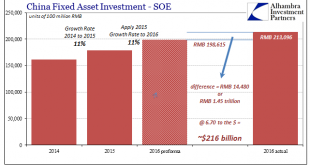

All the way back in January I calculated the total size of China’s 2016 fiscal “stimulus.” Starting in January 2016, authorities conducted what was an enormous spending program. As it had twice before, the government directed increased “investment” from State-owned Enterprises (SOE).By my back-of-the-envelope numbers, the scale of this fiscal side program was about RMB 1.45 trillion, or nearly 2% of GDP. It was about...

Read More »FX Daily, September 07: ECB Focus for Sure, but not Only Game in Town

Swiss Franc The Euro has risen by 0.35% to 1.1433 CHF. FX Rates The US dollar is trading broadly lower. The ECB meeting looms large. Many, like ourselves, expected that when Draghi said in July that the asset purchases would be revisited in the fall, it to meant after the summer recess, not a legalistic definition of when fall begins. Still, there have been some reports, citing unnamed sources close to the ECB, that...

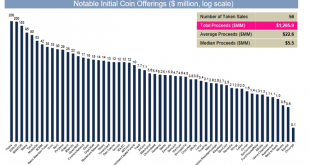

Read More »Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver

Bitcoin Fork, Hyped ICOs – Immutable Gold and Silver Latest developments show risks in crypto currencies Confusion as bitcoin may split tomorrow SEC stepped into express concern over ICOs ICOs have so far raised $1.2 billion in 2017 ICOs preying on lack of understanding from investors Physical gold not vulnerable to technological risk Beauty and safety in simplicity of gold and silver Forks and ICOs solves bitcoin v...

Read More »FX Daily, August 08: Trade Featured as Dollar Drifts Lower

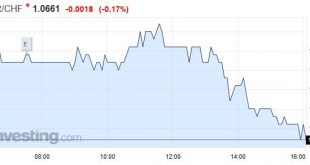

Swiss Franc The euro has depreciated by 0.17 to 1.1451 CHF. EUR/CHF and USD/CHF, August 08(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The US dollar has a slightly lower bias today, but the against most of the major currencies, it is consolidating within the range set at the end of last week. The main exceptions are sterling and the Canadian dollar. They had extended...

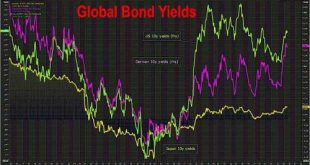

Read More »Bond Selloff Returns As EM Fears Rise; Oil Slides; BOJ Does Not Intervene

U.S. index futures point slightly lower open. Asian shares rose while stocks in Europe fell as energy producers got caught in a downdraft in oil prices and reversed an earlier gain after Goldman unexpectedly warned that WTI could slide below $40 absent "show and awe" from OPEC. The dollar rose, hitting a four-month high against the yen and bonds and top emerging market currencies were back under pressure on Tuesday, following last week’s hawkish rhetoric from central bankers. Nonetheless,...

Read More »PBoC: Mechanical Tightening PBoC is China Central Bank

The mainstream narrative as it relates to Chinese money is “tightening.” Having survived the economic downturn last year, we are to believe that the PBOC is once again on bubble duty. They raised their reverse repo rates, considered to be their policy benchmarks, three times up to mid-March. The central bank also increased the rate on its Medium Term Lending Facility (MLF) which has been a main source of RMB liquidity...

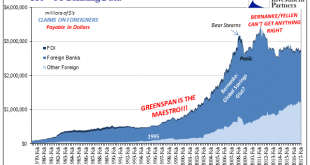

Read More »To The Asian ‘Dollar’, And Then What?

The Bretton Woods system was intentionally set up to funnel monetary convertibility through official channels. The primary characteristic of any true gold standard is that any person who wishes can change paper claims into hard money. It was as much true in any one country as between those bound by the same legal framework (property). What might differ were the standards for satisfying those claims (“good delivery”...

Read More »FX Daily, April 14: Holiday Markets Remain on Edge

Swiss Franc EUR/CHF - Euro Swiss Franc, April 14(see more posts on EUR/CHF, ) Source: Investing.com - Click to enlarge FX Rates The holiday-induced calm in the capital markets conceals a high degree of anxiety. The investment climate has been challenged by heightened geopolitical risk and unusual complaints about the US dollar’s strength from the sitting US President. While sending an “armada” toward the Korean...

Read More »FX Daily, April 13: Greenback Stabilizes After Trump Induced Slide

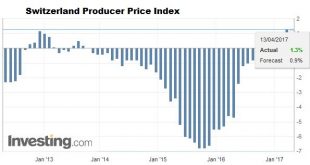

Swiss Franc Switzerland Producer Price Index (PPI) YoY March 2017(see more posts on Switzerland Producer Price Index, ) Source: investing.com - Click to enlarge FX Rates The US dollar slid after US President Trump complained about its strength. The sell-off extended into early Asian activity, before stabilizing. It is mixed in late morning European turnover, which is already lightening up due to the extended...

Read More »FX Daily, March 31: Greenback Finishing Weak Quarter in Mixed Fashion

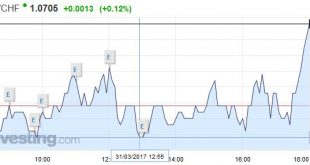

Swiss Franc EUR/CHF - Euro Swiss Franc, March 31(see more posts on EUR/CHF, ) - Click to enlarge FX Rates The US dollar fell against all the major currencies in the first three months of 2017. The weakness initially seemed to be a correction to the rally, which began before the US election last year. The dollar recovered in February, in anticipation of a hawkish Fed in March. The Fed did hike rates, but the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org