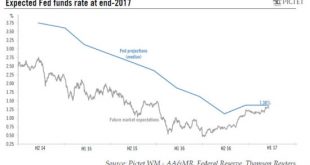

The Federal Reserve is probably looking back at 2017 with satisfaction. After on the rate rise expected on 13 December, it will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by markets. In fact, broader financial conditions have eased this year despite the...

Read More »Fed’s enthusiasm on tax cut plans remains limited

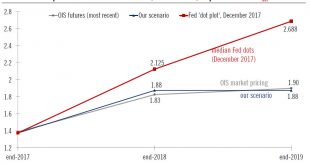

The Fed hiked rates 25bps at its 13 December meeting, as widely expected. We are keeping our scenario unchanged and we expect two rate hikes next year.The 13 December Fed decision – and Chair Yellen’s last press conference – was much as expected. The Fed hiked rates 25bps, bringing the interest rate on excess reserves to 1.5%. Meanwhile, Fed officials maintained their rate-hiking forecasts for next year: three rate increases, according to the ‘dot plot’.Chair Janet Yellen was cautious about...

Read More »Fed rate unlikely to move much above 2% next year

The Fed is expected to raise rates again this week. But it continues to wrestle with low core inflation, while the impact of tax cuts will need to be monitored. After the quarter-point rate rise expected on 13 December, the Federal Reserve will have pushed through the three rate hikes it signalled earlier in the year. For once, it has not under-delivered. Meanwhile, the gradual, ‘passive’ decline in the Fed’s balance sheet has been mostly ignored by...

Read More »US growth forecast raised

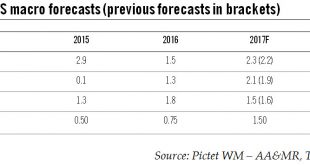

Global growth, post-hurricane reconstruction and higher oil prices are all provided a boost to the US growth outlook. But uncertainty still hangs over tax cuts and the Fed.We are raising our US GDP forecast for 2017 (+0.1 percentage point to 2.3%) and 2018 (+0.3 point to 2.0%) on the back of stronger momentum in Q4 2017. Accelerating global growth is a tailwind for the US economy – as seen in the recent sharp pick up in exports, particularly to emerging markets. Reconstruction efforts in the...

Read More »Federal Reserve – New sheriff in town

Janet Yellen’s likely successor is cut from the same cloth as Janet Yellen. The Fed will remain prudent when it comes to rate hikes, but its stance on banking deregulation will merit watching.On 2 November, President Trump nominated Jerome (‘Jay’) Powell to succeed Janet Yellen at the helm of the Federal Reserve System, confirming recent press speculation. The next step before the new Fed chairman can enter office next February is Senate confirmation. This looks unlikely to be problematic...

Read More »Markets react well to Fed hike

Financial conditions remain accommodative, perhaps setting the stage for next hike in June.In line with what almost every forecaster was expecting, the Federal Open Market Committee (FOMC) decided at its latest policy meeting to raise the Fed funds rate target range by 25bp to 0.75%-1.0%. Fed Chair Janet Yellen explained that the decision to raise rates was appropriate “in light of the economy’s solid progress toward our goals of maximum employment and price stability“. Financial markets...

Read More »Early rate hike means change in our U.S. rates scenario

Hawkish comments from several Fed officials mean we now expect three quarter-point rate hikes from the Fed this year, with the first coming this month.As we don’t expect any big negative surprise in the February employment report (to be released on Friday), the probability of a hike next week has risen sharply. We are therefore changing our forecasts for Fed rates this year. Our main scenario is now that the Fed will first hike in March, instead of June. Moreover, to be more consistent with...

Read More »Modest changes in latest Fed statement

The statement at the end of the Fed’s latest policy meeting did hint at increasing inflation and seemed to prepare the ground for a December rate hike.As widely expected, the Federal Open Market Committee (FOMC) remained on hold at its policy meeting on November 2 meeting and there were only slight modifications in the FOMC statement.The Fed modestly upgraded its assessment of inflation and provided further hints of a December rate rise, saying that the case for a hike “has continued to...

Read More »A December Fed rate hike is looking likely

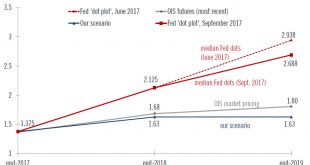

While the Fed stood pat at its September meeting, we continue to expect one quarter-point rise in rates this year, and two more in 2017. The Federal Open Market Committee (FOMC) left interest rates unchanged at the end of its latest policy meeting on September 21. However, the Fed adopted a more hawkish tone, reintroduced in its statement a sentence saying risks in the US economy were roughly balanced, and affirmed that the case for a rate hike has strengthened. Significantly, three voting...

Read More »Bernanke’s Advice: More Emphasis on Data, Less on Fed Guidance

Summary: Bernanke reviews the changes in the long-term dot plots. There as been a clear trend toward lower long-term growth, unemployment and Fed funds equilibrium. The full adjustment may not be over. Former Fed Chair Bernanke keeps a blog at Brookings. His latest post offers insight into how to think about Federal Reserve, and in particular, Fed officials’ understanding of the US economy. Bernanke’s...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org