Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon. Our new projection for the GBP/USD rate in the next 12 months now stands at USD1.45 per GBP. Concessions from the UK allow agreement on transition The UK and the EU have reached an agreement on the terms of a 21-month transition deal after Brexit (i.e. March 2019), which lifts the risk of a cliff-edge scenario in the coming months. This agreement was

Topics:

Luc Luyet considers the following as important: Bank of England outlook, Brexit, British Pound, Featured, GBP outlook, Macroview, newsletter, Pictet Macro Analysis, Swiss and European Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Recent positive developments in the United Kingdom (UK), namely the transitional deal reached between the UK and the European Union (EU) on 20 March and the strong job market report on 21 March, call for a more positive short-term outlook for the sterling than previously thought. We therefore revise our projections upward for the sterling on the entire time horizon. Our new projection for the GBP/USD rate in the next 12 months now stands at USD1.45 per GBP.

Concessions from the UK allow agreement on transition

The UK and the EU have reached an agreement on the terms of a 21-month transition deal after Brexit (i.e. March 2019), which lifts the risk of a cliff-edge scenario in the coming months.

This agreement was mostly possible because the UK almost agreed on all conditions imposed by the EU. Notably, the UK agreed to a full alignment of Norther Ireland (part of the United Kingdom) with the EU regulatory framework until a definitive solution is found. The notable EU concession to the UK was the authorisation to negotiate trade agreements during the transition period. Overall, the scope of the UK’s concessions was rather surprising.

For sterling, this agreement removes short-term concerns on growth and allows investors to focus on other drivers.

Strong UK labour market points to a more hawkish BoE

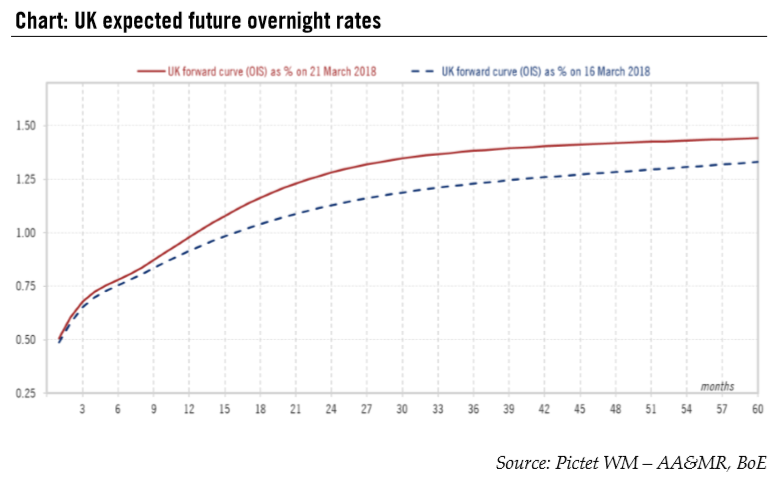

The January labour report, namely the rise in real wage growth, should make the Bank of England (BoE) more comfortable with a tighter monetary policy. On 22 March, the Monetary Policy Committee (MPC) maintained the Bank Rate at 0.50% (by a 7-2 majority). However, the MPC acknowledged that “pay growth continued to pick up” and a tightening labour market, which point to domestic inflationary pressure. Coupled with a rather neutral view on growth, the BoE is likely to raise rates two times this year (May and November).

As the sterling is rather sensitive to short-term rate differentials, and given the reduced Brexit uncertainty in the short-term, sterling should remain supported in 2018.

Still cloudy in the longer term

Although the short-term outlook has improved for sterling, the longer-term outlook remains cloudy at best.

Indeed, political uncertainty should remain rather elevated. Indeed, the agreement on a transition period only postpones Brexit risks from March 2019 to December 2020. Furthermore, given the large amount of concession agreed by the UK government, political risk within the Conservative Party remains high. Overall, it will remain challenging to craft the future postBrexit relationship between the UK and the EU in such a short amount of time.

Moreover, sterling is rather expensive compared to the US dollar in terms of short-term rate differential. This should somewhat limit the upside potential of sterling given our scenario of a more hawkish Fed.

| Finally, UK growth should remain rather weak compared to other major economies. Coupled with a negative basic balance, capital flows do not provide a compelling case for sterling outperformance.

Overall, the key positive factors for sterling remain a more hawkish BoE and its undervaluation. Concerning the BoE, the rather weak consumer spending outlook, gradual inflation moderation towards its 2% target and ongoing Brexit uncertainty should somewhat keep the BoE rather cautious. Undervaluation should remain supportive for GBP (purchasing power parity suggests that sterling is 15% undervalued compared to the US dollar), although this remains a long-term driver. Short-term projection on sterling revised upwardThe recent developments in the UK indicate that out short-term forecasts on sterling needs to be revised (we expected a trough at USD1.35 per GBP). Our new 3-month projection now stands now at USD1.41 per GBP. The 6-month and 12-month views are then adjusted from this new starting point. Consequently, we favour a move toward USD1.42 per GBP in the next six months and toward USD1.45 per GBP in the next 12 months. |

UK Expected Future Overnight Rates |

Tags: Bank of England outlook,Brexit,British Pound,Featured,GBP outlook,Macroview,newsletter