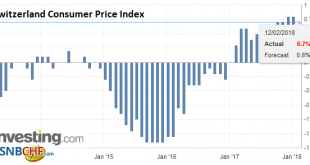

The consumer price index (CPI) fell by 0.1% in January 2018 compared with the previous month, reaching 100.7 points (December 2015=100). Inflation was 0.7% compared with the same month of the previous year. These are the results of the Federal Statistical Office (FSO). Switzerland Consumer Price Index (CPI) YoY, Jan 2018(see more posts on Switzerland Consumer Price Index, ) Source: Investing.com - Click to...

Read More »Strong growth and Abenomics mean Japanese equities continue to provide opportunities

Momentum in the Japanese economy remains strong Japanese growth momentum is at its strongest in over a decade, with the quarterly Tankan survey of business conditions and sentiment strengthening to an 11 – year high in Q4 2017. The economy may have expanded by 1.8% in 2017, up from 0.9% in the previous year. In 2018, the growth rate may moderate slightly to 1.3%, but should remain well above Japan’s potential growth,...

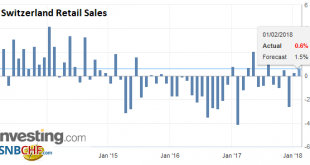

Read More »Swiss Retail Sales, December: +1.5 Percent Nominal and -0.8 Percent Real

The Used Goods Question Retail sales in several countries like Germany, Japan and Switzerland continue to fall or they remain steady for years. In the United States they have strongly risen recently. We should remind readers, that used goods sold via Ebay or similar, are not contained in this statistics. Still they create economic value for the purchases. By mentality, Swiss, Germans or Japanese pay more attention so...

Read More »Tax cuts and ‘animal spirits’ mean higher US growth in 2018

December’s US tax cuts – which saw corporate taxation reduced particularly sharply – are being echoed in signs that ‘animal spirits’ are finally kicking in. Both set the stage, in our view, for higher US growth, in large part driven by greater investment. We therefore upgrade our 2018 US growth forecast from 2.0% to 3.0%. We forecast that real non-residential investment growth will accelerate to 7.0% in 2018, up from an...

Read More »Swiss Trade 2017: Exports at all-time high

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade...

Read More »KOF Economic Barometer: Easing

In January, the KOF Economic Barometer does not continue its upward tendency, which started in September 2017, but has declined. However, despite the decline, the indicator remains well above its long-term average. It still indicates a more dynamic economic development than in mid-2017. The recovery of the Swiss economy is thus likely to continue, albeit with slightly less momentum than indicated in the past few...

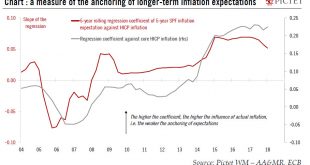

Read More »Europe chart of the week – The beginning of the ‘re-anchoring’

Professional Forecasters survey shows a substantial improvement in economic growth and employment, consistent with the ECB’s own assessment. The ECB will be pleased by its latest Survey of Professional Forecasters (SPF). The headlines are unambiguously positive, fuelled by the uninterrupted improvement in economic data, with expectations of GDP growth and HICP inflation revised higher for the next couple of years,...

Read More »Euro area: Business activity expanding at its fastest pace in nearly 12 years

The flash composite Purchasing Managers’ index for the euro area increased to 58.6 in January from 58.1 in December, above consensus expectations (57.9). The services sector index rose, offsetting the decline in the manufacturing index . Companies also expressed growing optimism about this year’s outlook, with business expectations up to an eight-month high. The only piece of less positive news was a modest drop in...

Read More »Upside risks to wages from IG Metall negotiations

German wage negotiations are in full swing amid growing calls for strikes. This comes at a crucial time for the ECB as strong growth and falling unemployment are expected to feed into higher inflation. IG Metall is by far the most important union to watch, representing almost 4 million German workers and being seen as a benchmark, including in the car industry or the construction sector this year. Importantly, the...

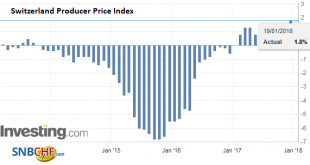

Read More »Swiss Producer and Import Price Index in December 2017: +1.8 YoY, +0.2 MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org