The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn. But President Trump also sees the tariffs as a way to pressure the Chinese authorities into a ‘deal’, with the aim to reduce the bilateral trade deficit by USD 100bn. Such a deal would echo US trade policy towards Japan in the 1980s, when the US negotiated quotas on Japanese cars. Since the announcement, media reports have been

Topics:

Thomas Costerg considers the following as important: Featured, Macroview, newsletter, Pictet Macro Analysis, Swiss and European Macro

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

The Trump Administration last week announced tariffs of 25% on USD 60bn worth of imports from China (out of USD506bn of total Chinese merchandise imports). The list of products targeted, still has to be thrashed out. The official aim is to sanction China for alleged theft of US firms’ intellectual property; the US Trade Representative (USTR) estimates the damage amounts to USD 50bn. But President Trump also sees the tariffs as a way to pressure the Chinese authorities into a ‘deal’, with the aim to reduce the bilateral trade deficit by USD 100bn. Such a deal would echo US trade policy towards Japan in the 1980s, when the US negotiated quotas on Japanese cars.

Since the announcement, media reports have been suggesting that a trade ‘deal’ is possible and that early discussions have been held. The good news is that Treasury Secretary Steve Mnuchin has kept the door open to his Chinese counterparts and seems eager to find an agreement.

Assuming US trade rhetoric does not escalate, we think the impact of the tariffs on both US GDP and inflation this year should be below 0.1 percentage point. We therefore maintain our 2018 forecasts of 3.0% annual GDP and 1.9% core PCE inflation for the US. In fact, the impact could be even less as it is plausible that the tariffs will be diluted.

| For China, the impact of the tariffs on growth is similarly limited, and also likely to be below 0.1% of GDP. The Chinese government has a strong incentive to avoid a trade war with the US. A trade agreement that involves China promising to lower trade barriers and grant wider market access to US industries is possible. |

Exports to / Imports from China, USD bn (merchandise trade only), 1994 - 2018 |

Tariff threat has spurred a US-China dialogueSince the partial tariffs on imports from China were announced on 22 March, there has been dialogue with China, leaving the door open for an agreement and a potential softening of the US stance. There will be a 30-day ‘comment period’ before the tariffs are triggered, also leaving space for both parties to find a deal. Of special note are media reports that Treasury Secretary Steve Mnuchin has kept in touch with his Chinese counterparts in recent days. Mnuchin said he was “cautiously hopeful” an agreement could be reached. Some press reports have suggested that China could be ready to import more US semiconductors, for instance. Mnuchin has hinted he would like tariffs on China’s car imports from the US to be reduced, and the Chinese authorities might be willing to accommodate him. We also note that the tone in President Trump’s remarks as he announced the tariffs last week was quite positive, calling China a “friend” and saying he has “tremendous respect” for President Xi Jinping. President Trump seems eager simply to obtain China’s cooperation to reduce the US trade deficit with China by USD100bn – Trump’s key goal. On 27 March, Trump sent a Twitter message that “in the end, all [countries] will be happy”. The tariffs were less aggressive than some press reports hinted they might be. While the USTR estimates the intellectual property (IP) issues cost US firms USD 50bn, Trump’s proposal to levy a 25% tariff on USD60bn of Chinese imports would yield ‘just’ USD15bn – equivalent to only 0.08% of US GDP. |

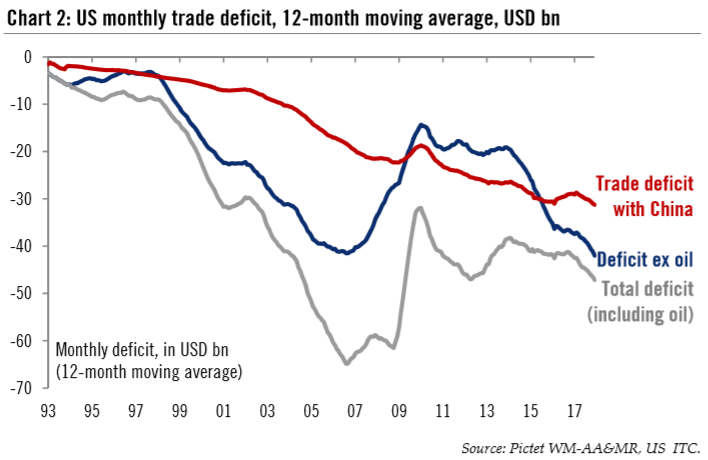

US Monthly Trade Deficit, 12-month Moving Average, USD bn, 1993 - 2018 |

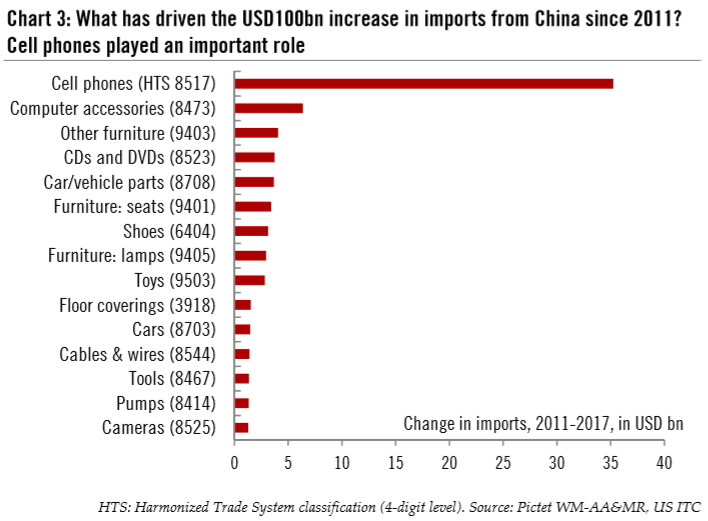

Rapidly rising cell phone imports explain the booming deficitEven after his announcement of trade tariffs, it remains unclear how president Trump aims to achieve the stated USD 100bn reduction of the US trade deficit with China. Many in his Administration – including perhaps Mnuchin – seem more eager in promoting exports to China than restraining imports from it. The latter would be harmful to the US economy since they could depress consumption by increasing consumer prices. US merchandise imports from China totalled USD505bn in 2017, up 9.2% from 2016. They have been growing at an average pace of 4.0% per annum since 2011, when imports were USD399bn. It is likely that the Trump Administration is looking at the reasons behind this USD 100bn increase in imports in six years. Our own analysis of US trade data finds that there was a USD 35bn increase in imports of cell phones from China, far outstripping other categories, including computer accessories, electronics, furniture, toys and shoes (see chart 3). While the media has highlighted US authorities’ push to increase exports of semiconductors to China, little so far has been said about the possibility that Trump wants to lessen the US’s appetite for China-made cell phones. However, we note that the USTR singled out the broad ‘telecommunications equipment’ category as potentially within the scope of the 25% tariff. |

US Imports from China, 2011 - 2018 |

A minimal impact on US GDP and inflation for now

When assessing the proposed tariffs’ impact on US GDP, one needs to take into account many ‘microeconomic’ factors, including the elasticity of demand for goods (the likely variation of demand due to a price change), as well as the potential for substitution, in particular the chance that US-made goods substitute Chinese imports.

On top of this, one needs to understand to what extent higher prices can be passed on to consumers, and whether importers will absorb the tariffs by cutting their profit margins. Bottom line, the question is whether there is demand-destruction (bad for consumption and therefore GDP) or demandswitching (neutral for growth).

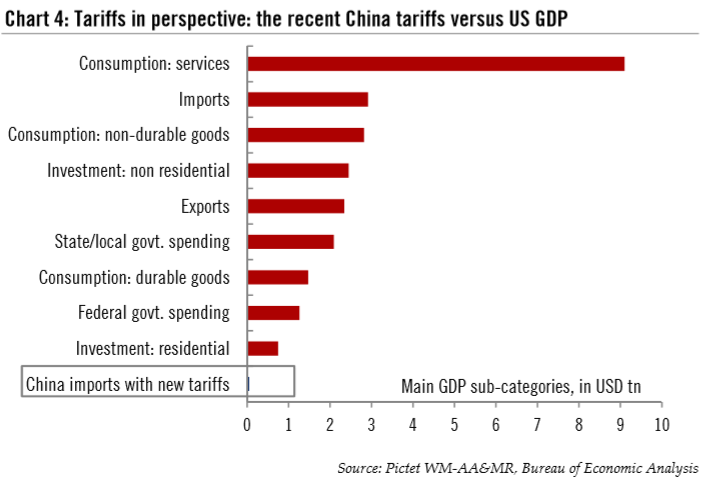

A preliminary analysis based on information already released suggests that tariffs may not necessarily affect US demand much and that the USD 60bn of Chinese imports targetted by Trump represent little compared with total US demand. Total US consumption amounted to USD 13,393bn in 2017. Even if only nondurable goods are counted, USD 60bn of imports only represent 2.1% of the total.

Importantly, even if fully passed on to consumers, a 25% tariff may not be punitive enough to destroy demand, especially for high-price (and highmargin) goods such as electronics. We believe some firms may decide to eat into their margins to keep market share. In any case, in many categories, there is no US-made equivalent for Chinese imports, so some demand may simply switch to imports from other countries. For instance, cell phone imports from Vietnam might increase if tariffs fall on China-made cell phones since there are currently no producers of cell phones within the US.

This demand-switching mechanism explains why we believe US imports may not necessarily fall after the tariffs, and why the drag on GDP growth from imports may therefore continue. Since 2010, net exports (imports less exports) have subtracted 0.2ppt from US growth on average each year.

| Turning to US exports, we believe China’s announcement of higher tariffs on USD3bn worth of US goods in retaliation for the aluminium and steel tariffs announced early March will not have any meaningful impact, as total US exports to its global partners are worth USD 2,344bn.

Worth monitoring is whether financial-market conditions tighten as a result of trade-war fears, which could affect US growth down the line. High yield (HY) bond spreads are of particular interest since bond-market funding conditions are a major driver of US growth. HY bond spreads over US 10year Treasuries have averaged 323 basis points so far in Q1 2018. The spread is actually lower than in Q4 2017, indicating that financial conditions remain accommodative and supportive of US activity. For all these reasons, we believe that the tariffs on imports from China will impact US GDP growth by less than 0.1 percentage point, even if fully implemented. |

China Tariffs VS US GDP |

| We believe that the tariffs will have a very modest impact on US inflation— also less than 0.1 percentage point (0.25*0.4%=0.1%). Imported goods have been a major ‘deflationary’ force in recent years, which higher tariffs on China-made clothing could halt, at least temporarily. However, it is not clear that clothing is being targeted by the Trump tariffs and China could be quickly supplanted by other low cost suppliers like Vietnam and Bangladesh.

In any case, services (chiefly healthcare and rents) rather than nondurable goods remain the major driver of US inflation. Clothing only represents 3.1% of total US consumer spending, versus 8.0% for healthcare, for instance. Consumer electronics (video equipment, information processing equipment) amounts to USD 220bn of US household spending, just 1.8% of consumption. That said, we are keeping an eye on the dollar-renminbi exchange rate, which could amplify price moves – perhaps as much as the tariffs. We note that the US dollar has dropped 3.5% so far this year against the Chinese renminbi, having already fallen 6.3% in 2017. We are keeping our forecast for US GDP growth of 3.0% this year unchanged. Recent solid capital goods orders data supports this call and bodes well for our key forecast of a sharp increase in corporate investment this year (+7% in our baseline scenario). Robust business sentiment also fits in with our forecast for GDP growth in 2018. We continue to see core PCE inflation of 1.9% this year. While it is true that the Federal Reserve has become more sensitive to international developments (it purposely kept rates on hold during China- and Brexit-related fears in mid-2016 for example), we think the Fed will continue its current rate-hiking campaign despite the recent tariff announcements. Several Fed policymakers have stated that it is too early to judge the impact of the proposed tariffs on US growth, and many might think that there is less than meets the eye in the Trump Administration’s move. We continue to believe the next quarter-point rate hike will be in June. |

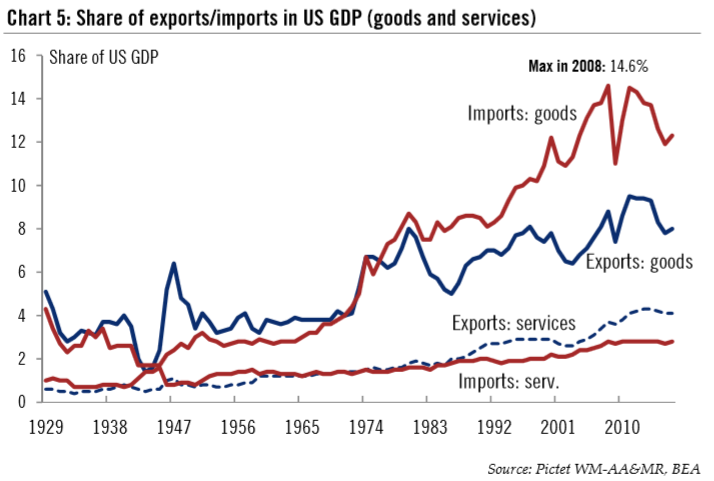

Exports/Imports in US GDP, 1929 - 2018 |

Impact on Chinese activity: likely quite limited

In our view, the direct impact of the recently announced US tariffs, if indeed enacted, on the Chinese economy will be quite limited.

First of all, China’s reliance on exports has declined significantly since it peaked in 2016. In 2017, exports accounted for only 18% of Chinese nominal GDP, compared to 37% in Q3 2016. The USD 60bn worth of Chinese goods due to be subject to the new US tariffs represent 2.7% of Chinese total exports in 2017, or 0.5% of Chinese GDP. Assuming the price elasticity for these goods is equal to 1 (which is an aggressive assumption), then the 25% tariff would lead to a reduction in demand equivalent to 0.1% of Chinese GDP.

As long as things do not escalate further from here, a decline in external demand of this magnitude can be easily offset by adjustments on the domestic front.

As a result, we are leaving our GDP growth forecast for China of 6.5% in 2018 unchanged for the moment. In addition, we believe there is still a chance that the US tariffs will not materialise, at least not fully, if, as seems possible, both countries reach a trade agreement.

It is our view that China has strong incentives to avoid a trade war with the US, as it needs a supportive external environmental to achieve some challenging domestic policy priorities such as deleveraging the economy. Hours after Trump’s announcement of tariffs on USD 60bn of imports from China, the Chinese government unveiled its own plans to impose tariffs on USD 3bn worth of US imports to China (in response to the steel tariffs Trump unveiled early March).

This is fairly modest, as retaliation goes. The products targetted represent less than 2% of Chinese imports from the US in 2017. In addition, none of the top items that China imports from the US (such as industrial machinery and equipment, automobiles and parts, airplanes and soybeans) are included in the list of tariff targets. Rather than preparing for a full-blown trade war, this suggests the Chinese government is keen to leave some room for negotiation.

Media reports about fresh trade talks between the two parties are encouraging. On many occasions, Chinese officials have expressed their willingness to reduce the Sino-US trade imbalance (the latest comments in this direction came from Premier Li Keqiang at the press conference that closed the National People’s Congress earlier this month).

In our view, it is quite likely that an agreement is reached whereby China promises to lower some tariffs and offer wider market acess to US companies. Automobiles and financial services are the two where trade barriers could be most substantially lowered. In addition, China may commit to purchase more products from the US in areas such as energy (liquid gas and crude oil) and semiconductors.

Tags: Featured,Macroview,newsletter