We have the luxury, the honor, of speaking to a lot of individual investors here at Alhambra. Whether they are clients or future clients (optimism is my default condition), the most common view of stocks is that they are overvalued and a fall – a large fall – is inevitable. And there is no stock that embodies that view more than Elon Musk’s Tesla Incorporated. It was once known as Tesla Motors but Musk changed the name in early 2017. There may never have been a more...

Read More »Meanwhile, Outside Today’s DC

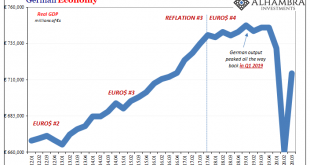

With all eyes on Washington DC, today, everyone should instead be focused on Europe. As we’ve written for nearly three years now, for nearly three years Europe has been at the unfortunate forefront of Euro$ #4. We could argue about whether coming out of GFC2 back in March pushed everything into a Reflation #4 – possible – or if this is still just one three-yearlong squeeze of a global dollar shortage. Either way, Europe gets at it first. In 2018, what had been...

Read More »What’s Going On, And Why Late August?

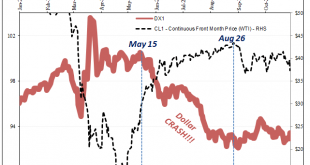

This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here? What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below)....

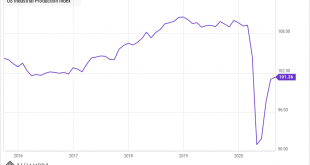

Read More »Yep, There’s A New ‘V’ In Town And The Locals…Don’t Seem To Much Care For It

They should be drooling over the prospects of a clearing path toward normality. The pain and disaster of 2020’s economic hole receding into a more pleasant 2021 which would have been in position to conceivably pay it all back before any long run damage. Getting back to just even with February instead is becoming a distant probability, the kind of non-transitory shortfall with which we’ve grown far too accustomed. Therefore, “they” now salivate (reported to be...

Read More »Monthly Macro Monitor – September (VIDEO)

[embedded content] Alhambra CEO Joe Calhoun and Alhambra’s Bob Williams look at data from the past month and discuss what it means for the economy. You Might Also Like Monthly Market Monitor – July 2020 Most Long-Term Trends Have Not Changed. A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy...

Read More »Monthly Macro Monitor – September 2020

The economic data over the last month continued to improve but the breadth of improvement has narrowed. Additionally, while most of the economic data series are still improving, the rate of change, as Jeff pointed out recently, has slowed. I guess that isn’t that surprising as the initial phase of the recovery comes to an end. 2nd quarter was a giant downdraft and 3rd quarter saw an initial rapid climb out the giant hole dug by the shutdowns (an own goal of epic...

Read More »Uh Oh, The Dollar Has Caught A Bid

Anyone who follows Alhambra knows that we keep an eye on the dollar. It is a very important part of our process of identifying the economic environment. A rising dollar, when combined with a falling rate of growth, can be a lethal combination. That was the situation in March and of course during the financial crisis of 2008. So the recent rally is something that has got our attention. For now, though, we don’t see any significant stresses in the system that would...

Read More »Monthly Market Monitor – August 2020

Many of the weak dollar trends I noted in June’s update have moderated – even as the dollar has weakened further. US stocks surged over the last month, with growth indices leaving their value counterparts in the dust…again. About the only exception on the equity side was China, which outperformed for much the same reason as US growth – technology stocks. Generally, we expect foreign stocks to outperform in a weak dollar environment but so far any outperformance has...

Read More »Eurodollar University’s Making Sense; Episode 24, Part 2: Peering Behind The (Unemployment Rate) Curtain

———WHERE——— AlhambraTube: https://bit.ly/2Xp3roy Apple: https://apple.co/3czMcWN iHeart: https://ihr.fm/31jq7cI Castro: https://bit.ly/30DMYza TuneIn: http://tun.in/pjT2Z Google: https://bit.ly/3e2Z48M Spotify: https://spoti.fi/3arP8mY Castbox: https://bit.ly/3fJR5xQ Breaker: https://bit.ly/2CpHAFO Podbean: https://bit.ly/2QpaDgh Stitcher: https://bit.ly/2C1M1GB Overcast: https://bit.ly/2YyDsLa SoundCloud: https://bit.ly/3l0yFfK PocketCast: https://pca.st/encarkdt...

Read More »Monthly Market Monitor – July 2020

Most Long-Term Trends Have Not Changed A lot has changed over the last 4 months since the COVID virus started to impact the global economy. Asia was infected first with China at ground zero. Their economy succumbed first with a large part of the country shut down to a degree that can only be accomplished in an authoritarian regime. The rest of Asia responded to the initial outbreak better than the Chinese (and most everywhere else we now know) and generally mitigated...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org