[unable to retrieve full-text content]If you were waiting for a correction in stock prices to put some money to work, you got your chance last week. The Dow Jones Industrial Average was down nearly 1000 points at the low Monday and closed down 725, a loss of a little over 2%. The S&P 500 did a little better but closed down 1.5%.

Read More »Eurodollar University’s Making Sense; Episode 89, Part 2: Let’s Crack China’s RRR Code

[unable to retrieve full-text content]89.2 China Warns World of (Next?) Dollar Disorder. The People’s Bank of China lowers its bank Required Reserve Ratio to get money into a slowing economy. A lowered RRR means that there aren’t enough (euro)dollars flowing into China. Why? Because there aren’t enough (euro)dollars in the world. A lower RRR is a warning for the whole world.

Read More »Weekly Market Pulse: As Clear As Mud

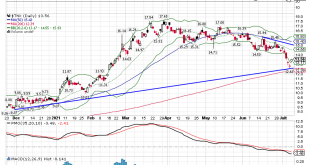

Is there anyone left out there who doesn’t know the rate of economic growth is slowing? The 10 year Treasury yield has fallen 45 basis points since peaking in mid-March. 10 year TIPS yields have fallen by the same amount and now reside below -1% again. Copper prices peaked a little later (early May), fell 16% at the recent low and are still down nearly 12% from the highs. Crude oil has recently joined in, falling 7% from its recent high. Energy stocks are in a full...

Read More »Weekly Market Pulse: Is It Time To Panic Yet?

Until last week you hadn’t heard much about the bond market rally. I told you we were probably near a rally way back in early April when the 10 year was yielding around 1.7%. And I told you in mid-April that the 10 year yield could fall all the way back to the 1.2 to 1.3% range. The bond rally since April has been of the stealth variety, the financial press and market strategists dismissing every tick down in rates as nothing. It was a lonely trade to put on and yes...

Read More »Weekly Market Pulse (VIDEO)

[embedded content] Weekly Market Pulse on June 21, where we look at significant things from last week’s events with Joe Calhoun. [embedded content] You Might Also Like Weekly SNB Sight Deposits and Speculative Positions: Inflation is there, CHF must Rise 2021-06-21 Update June 21 2021: SNB intervening. Sight Deposits have risen by +1.1 bn CHF, this means that the SNB is intervening and...

Read More »Weekly Market Pulse: The Market Did What??!!

One of the most common complaints I hear about the markets is that they are “divorced from reality”, that they aren’t acting as the current economic data would seem to dictate. I’ve been in this business for 30 years and I think I first heard that in year one. Or maybe even before I decided to lose my mind and start managing other people’s money. Because, of course, it has always been this way. Economic data represents the past while markets look to the future. And...

Read More »Weekly Market Pulse: Nothing To See Here. No, Really. Nothing.

The answer to the question, “What should I do to my portfolio today (this week, this month)? is almost always nothing. Humans, and especially portfolio managers, have a hard time believing that doing nothing is the right response….to anything…or nothing. We are programmed to believe that success comes from doing things, not not doing things. And so, often we look at markets on a day to day or week to week basis and think something of significance happened and we...

Read More »Weekly Market Pulse: Buy The Rumor, Sell The News

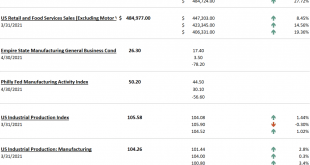

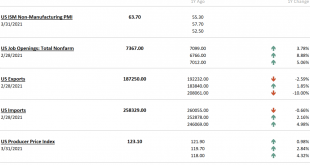

There’s an old saying on Wall Street that one should “buy the rumor, sell the news”, a pithy way to express the efficient market theorem. By the time an event arrives, whatever it may be, the market will have fully digested the news and incorporated it into current prices. And then the market will move on to anticipating the next event, large or small. What prompts this review of Wall Street folk wisdom is the most recent employment report. The BLS reported Friday,...

Read More »Weekly Market Pulse – Real Rates Finally Make A Move

Last week was only four days due to the President’s day holiday but it was eventful. The big news of the week was the spike in interest rates, which according to the press reports I read, “came out of nowhere”. In other words, the writers couldn’t find an obvious cause for a 14 basis point rise in the 10 year Treasury note yield so they just chalked it up to mystery. Of course, anyone who’s been paying attention knows that rates have been rising for almost a year –...

Read More »Eurodollar University’s Making Sense; Episode 46; Part 3: Bill’s Reading On Reflation, And Other Charted Potpourri

46.3 On the Economic Road to NothingGoodVilleRecent, low consumer price inflation readings combined with falling US Treasury Bill yields are cautionary sign posts that say this reflationary path may not be the road to recovery but a deflationary cul-de-sac. [Emil’s Summary] Having studied monetary policy for several years it was only natural that your podcaster spent considerable time contemplating the essential elements of fiction. Some experts say there are five...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org