A couple of weeks ago the 10 year Treasury note yield rose 16 basis points in the course of 5 trading days. That move was driven by near term inflation fears as I discussed last week. Long term inflation expectations were and are well behaved. I wrote nearly 2000 words last week about that change in inflation expectations and I’m so glad you took the time to read it. And now you can forget it because over the next four days all but 2 basis points of the move in the...

Read More »Weekly Market Pulse: Inflation Scare!

The S&P 500 and Dow Jones Industrial stock averages made new all time highs last week as bonds sold off, the 10 year Treasury note yield briefly breaking above 1.7% before a pretty good sized rally Friday brought the yield back to 1.65%. And thus we’re right back where we were at the end of March when the 10 year yield hit its high for the year. Or are we? Well, yes, the 10 year is back where it was but that doesn’t mean everything else is and, as you’ve probably...

Read More »Weekly Market Pulse: Perception vs Reality

It was the best of times, it was the worst of times… Charles Dickens, A Tale of Two Cities Some see the cup as half empty. Some see the cup as half full. I see the cup as too large. George Carlin The quote from Dickens above is one that just about everyone knows even if they don’t know where it comes from or haven’t read the book. But, as the ellipsis at the end indicates, there is quite a bit more to the line than the part everyone remembers. It was the best of...

Read More »Weekly Market Pulse: Inflation Scare?

Bonds sold off again last week with the yield on the 10 year Treasury closing over 1.6% for the first time since early June. The yield is now down just 16 basis points from the high of 1.76% set on March 30. But this rise in rates is at least a little different than the fall that preceded it. When nominal rates fell from April through July, real rates fell right along with them. The nominal bond yield fell by 63 basis points and the 10 year TIPS yield fell by 57....

Read More »Weekly Market Pulse: Zooming Out

How often do you check your brokerage account? There is a famous economics paper from 1997, written by some of the giants in behavioral finance (Thaler, Kahnemann, Tversky & Schwartz), that tested what is known as myopic loss aversion. What they found was that investors who check their performance less frequently are more willing to take risk and experience higher returns. Investors who check their results frequently take less risk and perform worse. And that...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Time For A Taper Tantrum?

The Fed meets this week and is widely expected to say that it is talking about maybe reducing bond purchases sometime later this year or maybe next year or at least, someday. Jerome Powell will hold a press conference at which he’ll tell us that markets have nothing to worry about because even if they taper QE, interest rates aren’t going up for a long, long time. That statement might have more credibility if the Fed had been right about just about anything over the...

Read More »Weekly Market Pulse: Happy Anniversary!

Today is the 50th anniversary of the “Nixon shock”, the day President Richard Nixon closed the gold window and ended the post-WWII Bretton Woods currency agreement. That agreement, largely a product of John Maynard Keynes, pegged the dollar to gold and most other currencies to the dollar. It wasn’t a true gold standard as only other countries that were party to the agreement could demand gold in exchange for their dollars, but it was at least a standard of some...

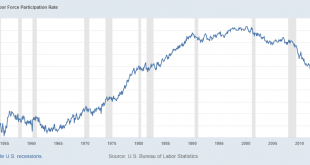

Read More »Weekly Market Pulse: What Is Today’s New Normal?

Remember “The New Normal”? Back in 2009, Bill Gross, the old bond king before Gundlach came along, penned a market commentary called “On the Course to a New Normal” which he said would be: “a period of time in which economies grow very slowly as opposed to growing like weeds, the way children do; in which profits are relatively static; in which the government plays a significant role in terms of deficits and reregulation and control of the economy; in which the...

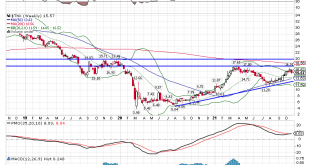

Read More »Gold, Stocks & Commodities- A Complicated Correlation

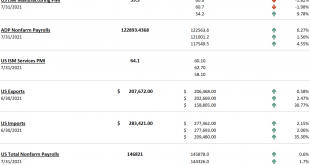

In our July 29 post titled How Gold Stacks Up Against Stocks, Property, Commodities and Big Macs! we showed readers charts of gold as a ratio to other assets and products. We discussed that gold competes with crypto and stocks for the investment dollars. It was clear that gold as a ratio of the S&P 500 Index and of the broader MCSI World Equity Index show that gold is ‘relatively cheap’ compared to these measures. But then we showed that this wasn’t the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org