This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here? What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below). More so when as much as what. “When” had been late August – the 26th, to be precise. And this was actually the second inflection, beginning on August 27, the first one tracing back all the way to June 5 when nobody, I mean nobody, was thinking about more COVID. In early June, the sky was the limit,

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, average inflation targeting, bonds, contango, currencies, DJIA, Dollar, DXY, economy, Featured, Federal Reserve/Monetary Policy, inflation, inflation expectations, interest rate swaps, Jackson Hole, jay powell, Markets, money printing, newsletter, oil prices, QE, S&P 500, S&P 500, stocks, swap spreads, WTI, wti futures curve

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| This isn’t about COVID. It’s been building since the end of August, a shift in mood, perception, and reality that began turning things several months before even then. With markets fickle yet again, a lot today, what’s going on here?

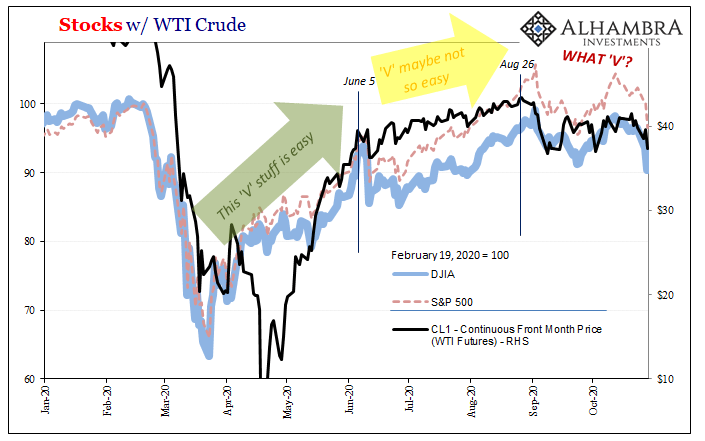

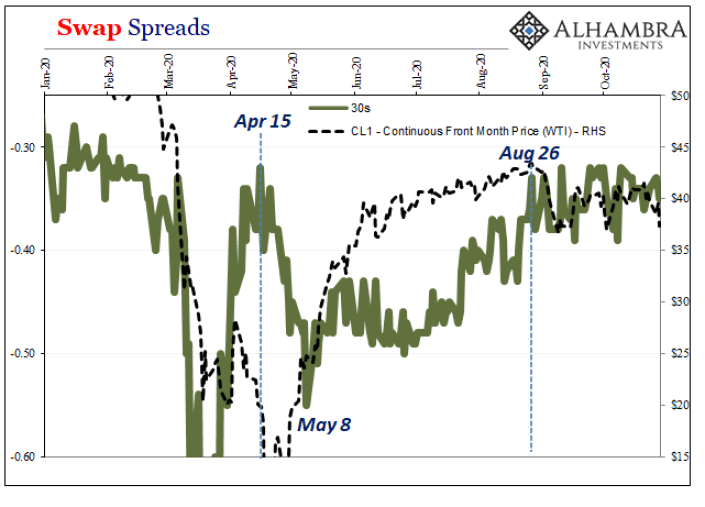

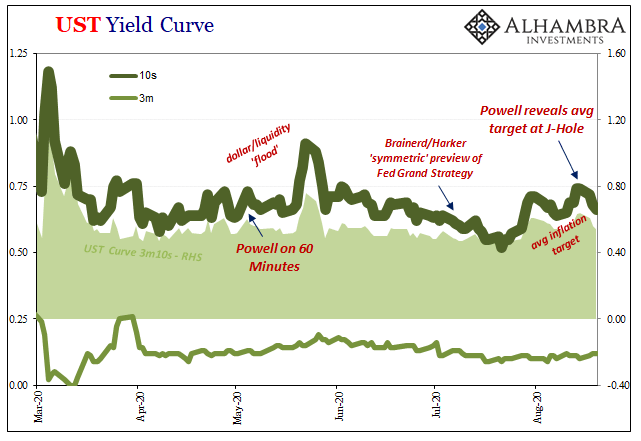

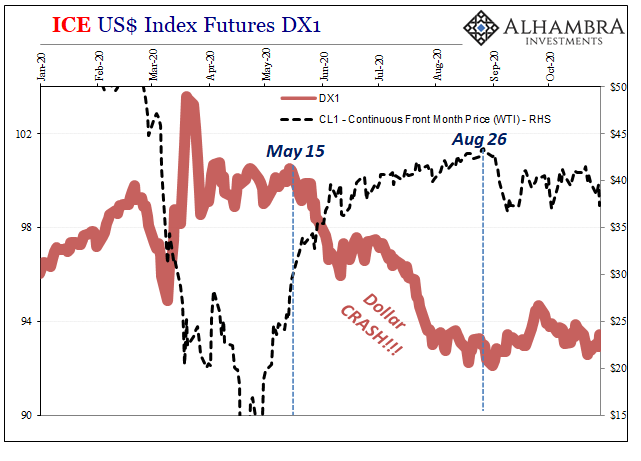

What you’ll hear or have already heard is something about Europe and more lockdowns, fears about a second wave of the pandemic. No, that doesn’t fit the herdlike change in direction you can observe across many different markets (below). More so when as much as what. “When” had been late August – the 26th, to be precise. And this was actually the second inflection, beginning on August 27, the first one tracing back all the way to June 5 when nobody, I mean nobody, was thinking about more COVID. In early June, the sky was the limit, not reinfected case counts. In between June 5 and August 26 (around the end of July), the oil markets had built up more crazy contango. Crazy because, let’s face it, with somewhere around one-fifth of domestic supply taken down it simply boggles the mind how backwardation (which would’ve equaled balanced fundamental factors) remained so elusive. |

ICE: US$ Index Futures, DX1 - Click to enlarge |

| Something was not adding up, a big problem that could only have been about gross economic demand. The “V” wasn’t showing up.

Not only that, even the DOLLAR CRASH!!!! got called off. After sinking pulled lower by mostly the euro (which doesn’t matter, but that’s a separate story), suddenly the dollar, at least DXY, wasn’t feeding the flood myth any longer. In other words, practically everything changed – for the intermediate term – starting at August 27. The trajectory here is really easy to put together. From middle April to June 5, solidly positive all throughout. Even the bond market was relatively more reflation-y (though never much) during this period. Rebound, reopening, and the promise of gigantic positive numbers to potentially more than balance out the huge contraction opened up (unnecessarily) during February and March (with its big assist from the equally unnecessary GFC2). Nagging negatives, however, these began to create doubts because they were never properly explained and answered. |

|

| Maybe it wasn’t so easy. Again, economy not disease. Turning everything off like was done, bumping up the already-wary liquidity and money disease lingering in the global economy still since the first GFC a dozen years before, perhaps things might not go so smoothly after all.

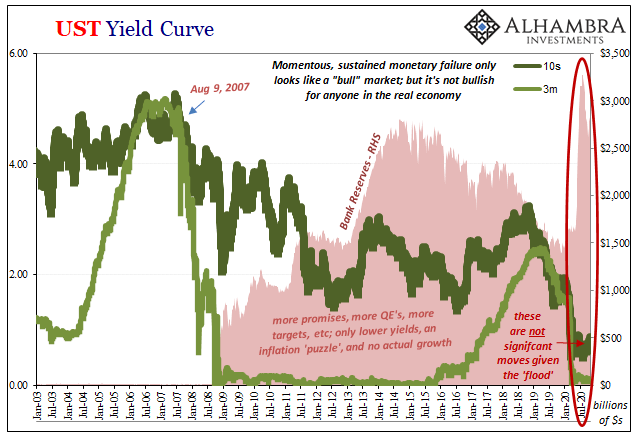

A lot was riding on “stimulus”, especially of the monetary variety. While the US federal government and others around the world were hugely involved in shoveling cash where possible, such aid was less “stimulus” than what we’re told to expect from the Federal Reserve’s big, enormous, huge “flood” of “money printing.” |

University of Michigan Surveys of Consumers, 1997-2020 |

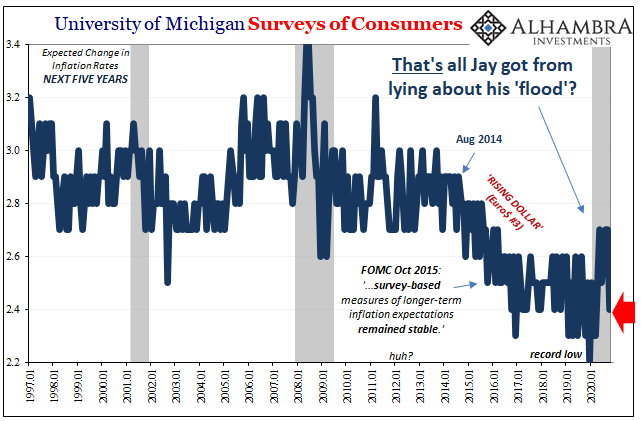

| No time to think about jobless claims and labor market destruction, what with inflation absolutely certain to follow maybe even by the end of the year. Companies and consumers were being prepared to act now before prices rose so quickly. Move up spending and hiring and activity before it was too late, everyone was told (over and over).

Good ol’ fashioned Keynes pump-priming. Except, no one outside the financial media believed it. I mean nobody. The inflation fairy tale which was supposed to get things moving above and beyond the reopening rebound, to add a ton of momentum to the economy while placating and keeping market Cassandras at bay, neither bonds nor consumers seem to have given it serious thought. |

Stocks w/ WTI Crude, 2020 |

| Businesses? Not a chance. Again, jobless claims.

So why August 26 for the top? In WTI, this second inflection shows up beginning on August 27 while in other markets it spread out over the following few days. By early September, it was near-universal, even stocks and DXY. |

Swap Spreads, 2020 |

Of course, August 27 Jay Powell shows up (not physically) at Jackson Hole. The only words to describe his performance and what he announced were “tremendous letdown” even to Fed cultists who desperately want to believe, an unbelievably bad joke which left the world, I think, stunned at such transparent incompetence. The world holding out hope, holding its collective breath waiting to be pleasantly surprised, for once, and Jay did what Jay and his ilk always do. It’s all their capable of:

|

UST Yield Curve, 2003-2020 |

The policy itself no longer matters; the packaging it comes in does.

If you aren’t distracted by the shiny wrapping, you realize what Powell’s saying is that after failing to hit the inflation target for over a decade he’s now going to let inflation run over the target none of them could hit because for more than a decade no one could hit their own target…

These are not serious people and that is why I keep calling for them to be replaced. The zero lower bound was never a trap for the economy, it was always one for central bankers alone – because they have no idea what they are doing, and now, with symmetry being rerun from 2018 and one-sided deviations put into the strategy language, it’s obvious they don’t even have any ideas.

Absurd. With the world struggling to pull itself up out of the toilet, this is what they came up with?

Letdown. Joke. Not serious.

However, as much as I’d like to lay the last few months of increasing doubt and uncertainty entirely at Jay Powell’s more than deserving feet, the average inflation targeting debacle isn’t the sole blame here. Rather, it’s the combination of growing economic doubts combined with the horrible realization what was supposed to be supporting the “V” and guaranteeing its necessary endurance has been nothing more than a stupid, shiny wrapper.

In short, Powell had laid all his cards on the table just as the game was turning against his hand. Aristotle exposed his own bluff for everyone to see at a most inopportune time.

The “flood” now revealed as utter nonsense, what if things start to go (more) wrong again…

Tags: average inflation targeting,Bonds,contango,currencies,DJIA,dollar,DXY,economy,Featured,Federal Reserve/Monetary Policy,inflation,inflation expectations,interest rate swaps,Jackson Hole,jay powell,Markets,money printing,newsletter,oil prices,QE,S&P 500,stocks,swap spreads,WTI,wti futures curve