As I sit here Monday evening with the Dow having closed down 2000 points and the 10-year Treasury yield around 0.5%, the title of this update seems utterly ridiculous. With the new coronavirus still spreading and a collapse in oil prices threatening the entire shale oil industry, recession is now the expected outcome. Most observers seem to question only the potential length and depth of the coming downturn. The case of recession does seem to be one of those open...

Read More »QE’s and Rate Cuts: Two Very Different Sets of Sentiment Drawn From Them

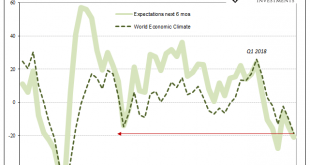

The stock market’s dichotomy grows ever wider. On the one side, record high prices which are being set by the expectations of a trade deal plus renewed worldwide “stimulus.” Sure, officials everywhere were late to see the downturn coming, but they’ve since woken up and went to work. On the other side, though, there’s not nearly the same level confidence. Earnings are derived from several factors but chiefly the economic climate in which companies operate....

Read More »A Bigger Boat

For every action there is a reaction. Not only is that Sir Isaac Newton’s third law, it’s also a statement about human nature. Unlike physics where causes and effects are near simultaneous, there is a time component to how we interact. In official capacities, even more so. Bureaucratic inertia means a lot more than just resistance to change, it also means, at times and in certain capacities, all sorts of biases. When the bureaucracy predicts one set of circumstance,...

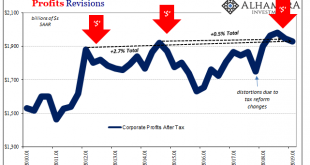

Read More »GDP Profits Hold The Answers To All Questions

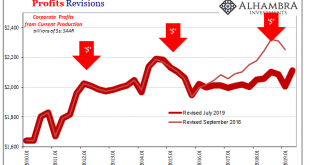

Revisions to second quarter GDP were exceedingly small. The BEA reduced the estimate by a little less than $800 million out of nearly $20 trillion (seasonally-adjusted annual rate). The growth rate therefore declined from 2.03502% (continuously compounded annual rate) to 2.01824%. The release also gave us the first look at second quarter corporate profits. Like the headline GDP revisions, there wasn’t really much to them. At least not when viewed in isolation....

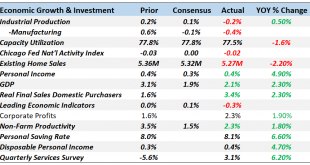

Read More »Monthly Macro Monitor: Does Anyone Not Know About The Yield Curve?

The yield curve’s inverted! The yield curve’s inverted! That was the news I awoke to last Wednesday on CNBC as the 10 year Treasury note yield dipped below the 2 year yield for the first time since 2007. That’s the sign everyone has been waiting for, the definitive recession signal that says get out while the getting is good. And that’s exactly what investors did all day long, the Dow ultimately surrendering 800 points on the day. I don’t remember anyone on CNBC...

Read More »More What’s Behind Yield Curve: Now Two Straight Negative Quarters For Corporate Profit

The Bureau of Economic Analysis (BEA) piled on more bad news to the otherwise pleasing GDP headline for the first quarter. In its first revision to the preliminary estimate, the government agency said output advanced just a little less than first thought. This wasn’t actually the substance of their message. Accompanying this first revision was the first set of estimates for corporate profits. For the second straight...

Read More »Green Shoot or Domestic Stall?

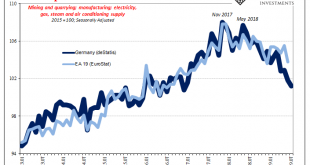

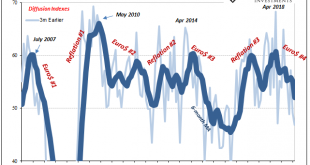

According to revised figures, things were really looking up for US industry. For the month of April 2018, the Federal Reserve’s Diffusion Index (3-month) for Industrial Production hit 68.2. Like a lot of other sentiment indicators, this was the highest in so long it had to be something. For this particular index, it hadn’t seen better than 68 since way back in March 2010, back when the economy looked briefly like it...

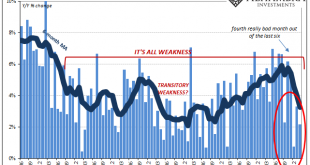

Read More »Retail Sales In Bad Company, Decouple from Decoupling

In a way, the government shutdown couldn’t have come at a more opportune moment. As workers all throughout the sprawling bureaucracy were furloughed, markets had run into chaos. Even the seemingly invincible stock market was pummeled, a technical bear market emerged on Wall Street as people began to really consider increasingly loud economic risks. There had been noises overseas, troubling indications that had gone on...

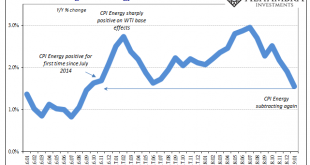

Read More »Inflation Falls Again, Dot-com-like

US inflation in January 2019 was, according to the CPI, the lowest in years. At just 1.55% year-over-year, the index hadn’t suggested this level since September 2016 right at the outset of what would become Reflation #3. Having hyped expectations over that interim, US policymakers now have to face the repercussions of unwinding the hysteria. CPI Changes On Energy 2016-2019 - Click to enlarge Live by oil, now die by...

Read More »2019 Outlook

A discussion of the outlook for 2019 in the markets and the economy by Alhambra CEO Joe Calhoun and the Head of Alhambra Global Investment Research Jeff Snider. [embedded content] Related posts: Euro Credit: 2019 Outlook Gold Outlook 2019: Uncertainty Makes Gold A “Valuable Strategic Asset” – WGC Core Euro Sovereign Bonds 2019 Outlook A Couple...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org