Swiss Franc The Euro has fallen by 0.32% at 1.1199 EUR/CHF and USD/CHF, June 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing...

Read More »Swiss government predicts moderate economic growth in 2019

SECO warned that the flagging global economy was slowing Swiss trade abroad: The State Secretariat for Economic Affairs (SECO) is expecting the Swiss economy to grow by +1.2% in 2019, it said on Thursday. It revised its economic forecast upwards slightly from +1.1% in March, following 0.6% growth in the first quarter thanks to vigorous domestic demand. In a statement on Thursdayexternal link, SECO warned that the...

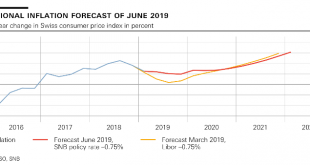

Read More »Monetary policy assessment of 13 June 2019

Swiss National Bank leaves expansionary monetary policy unchanged and introduces SNB policy rate The Swiss National Bank is maintaining its expansionary monetary policy, thereby stabilising price developments and supporting economic activity. Interest on sight deposits at the SNB is unchanged at –0.75%. The SNB will remain active in the foreign exchange market as necessary, while taking the overall currency situation...

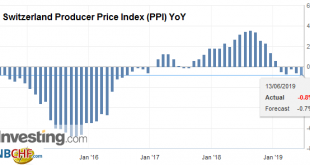

Read More »Swiss Producer and Import Price Index in May 2019: -0.8 percent YoY, unchanged MoM

The Producer Price Index (PPI) or officially named “Producer and Import Price Index” describes the changes in prices for producers and importers. For us it is interesting because it is used in the formula for the Real Effective Exchange Rate. When producers and importers profit on lower price changes when compared to other countries, then the Swiss Franc reduces its overvaluation. The Swiss PPI values of -6% in 2015...

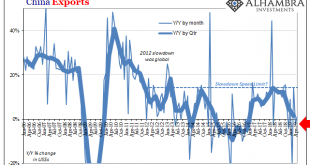

Read More »Commodities And The Future Of China’s Stall

Commodity prices continued to fall last month. According to the World Bank’s Pink Sheet catalog, non-energy commodity prices accelerated to the downside. Falling 9.4% on average in May 2019 when compared to average prices in May 2018, it was the largest decline since the depths of Euro$ #3 in February 2016. Base metal prices (excluding iron) also continue to register sharp reductions. Down 16% on average last month,...

Read More »Paul Tudor Jones Likes Gold

Gold is Paul Tudor Jones’ Favorite Trade Over the Coming 12-24 Months In a recent Bloomberg interview, legendary trader and hedge fund manager Paul Tudor Jones was asked what areas of the markets currently offer the best opportunities in his opinion. His reply: “As a macro trader I think the best trade is going to be gold”. The relevant excerpt from the interview can be viewed below (in case the embedded video doesn’t...

Read More »Great Graphic: Euro’s (OECD) PPP

US President Trump recently bemoaned the fact that the euro is undervalued. While his critics complain that he is prone to exaggeration, in this case, the euro is undervalued. This Great Graphic a 30-year chart of the euro has moved around its purchasing power parity as measured by the OECD. Currently, the euro is about 22% undervalued, and it has been cheap to PPP since for the past five years. The OECD’s model...

Read More »FX Daily, June 12: Anxiety Ticks Up, Risks Pared

Swiss Franc The Euro has risen by 0.08% at 1.125 EUR/CHF and USD/CHF, June 12(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The S&P 500 snapped a five-day advance yesterday and set the heavier tone for equities today. Continued protests in Hong Kong were not shrugged off as they have been in the last couple of sessions. The Hang Seng’s nearly 1.9% decline was...

Read More »What Would It Take to Spark a Rural/Small-Town Revival?

Recent research supports the idea that this under-the-radar migration is already under way. The decline of rural regions and small towns is a global phenomenon, and the causes are many but boil down to two primary dynamics: 1. Cities and megalopolises (aggregations of cities, suburbs and exurbs) attract capital, infrastructure, markets and talent, and these are the engines of job creation. People move to cities to find...

Read More »Switzerland has best winter for 11 years

© Nikittta | Dreamstime.com - Click to enlarge The Swiss Hotel Association recorded a 0.7% increase in overnight stays during the 2018/2019 winter season. From November to April, 16.7 million overnight stays were recorded in Switzerland, 8.8 million by foreign visitors and 7.9 million by Swiss travelers. The increase was highest among foreign visitors. Nights spent by foreign visitors rose 1% to 8.8 million nights. The...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org