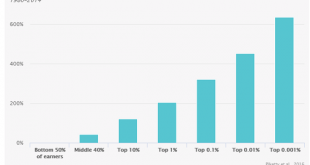

If we look at these charts, it looks like only the top 10%, or perhaps the top 20% at best, might qualify as “middle class” by the metrics described below. The conventional definition of working class is based on income and education:the working class household earns between $30,000 and $69,000 annually, and the highest education credential in the household is a two-year community college degree or trade certification....

Read More »Swiss restaurant ranked best in the world

© RESTAURANT DE L’HÔTEL DE VILLE A ranking by Elite Traveler placed the restaurant Hôtel de Ville de Crissier first in a list of the world’s 100 best restaurants, eight places higher than last year. The ranking is based on the votes of readers of the magazine, which is distributed to private jet companies around the world. Franck Giovannini, the restaurant’s chef, follows a long line of award winning chefs at the...

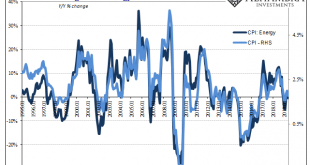

Read More »When Verizons Multiply, Macro In Inflation

Inflation always brings out an emotional response. Far be it for me to defend Economists, but their concept is at least valid – if not always executed convincingly insofar as being measurable. An inflation index can be as meaningful as averaging the telephone numbers in a phone book (for anyone who remembers what those things were). If you spend $1,000 a month on food for your family, and food prices rise 6% generally...

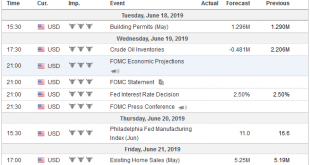

Read More »FX Weekly Preview: FOMC, EMU PMI, and Pre-G20 Positioning: Crossroads and Crosswinds

The week ahead is likely to provide some clarification for investors on three fronts that have been a source of uncertainty. The FOMC meeting, with updated forecasts, is center stage. The credit markets are pushing the Fed to be aggressive but can be disappointed. In the eurozone, the preliminary PMI may confirm a modest, even if uneven recovery. The G20 summit is the focus of much attention as many see it as the last...

Read More »Saab withdraws from Swiss fighter jet test flights

The Swiss government has set a budget of CHF6 billion ($6 billion) for new jets to replace its ageing fleet and has been evaluating different planes at the Swiss army airbase, in Payerne, including the Lockheed Martin F-35A fighter jet Saab’s Gripen E fighter jet will not participate in tests this month in Switzerland, the Swedish company said on Thursday. This follows a recommendation by the Swiss defence procurement...

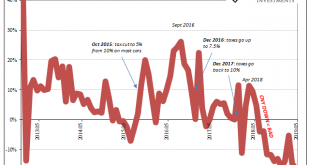

Read More »Dimmed Hopes In China Cars, Too

As noted earlier this week, the world’s two big hopes for the global economy in the second half are pinned on the US labor market continuing to exert its purported strength and Chinese authorities stimulating out of every possible (monetary) opening. Incoming data, however, continues to point to the fallacies embedded within each. The US labor market is a foundation of non-inflationary sand, and China’s “stimulus” is...

Read More »FX Daily, June 14: Waning Risk Appetite Going into the Weekend

Swiss Franc The Euro has fallen by 0.02% at 1.1201 EUR/CHF and USD/CHF, June 14(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: Worries about an escalation in the Gulf following US accusations that Iran was behind yesterday’s two attacks and weaker growth impulses, while trade tensions remain high, are dampening risk appetites ahead of the weekend. Equities are...

Read More »A Stock Market Crash Scenario

Herds get spooked and run. That’s the crash scenario in a nutshell. We have all been trained by a decade of central bank saves to expect any stock market swoon will soon be reversed by central bank sweet talk and/or rate cuts. As a result of such ever-present central bank willingness to intervene in the stock market, participants have been trained to believe a stock market crash is no longer possible: should the market...

Read More »Pound to Swiss Franc forecast: Brexit limbo hurting Sterling

Political uncertainty & Brexit cause sterling weakness The pound’s value is being predominantly dictated by Brexit. Over the past month sterling has gradually declined in value against the Swiss franc. There is potential for further falls for the pound due to the lack of clarity surrounding Brexit and the leadership battle for the new Conservative leader. There are candidates for the role of Prime Minister who have...

Read More »Bund yields-Heading further down?

Our central forecast is for Bund yields to rise (feebly) into positive territory by the end of this year, although risks are tilting to the downside. Four main factors have been driving down the 10-year Bund yield, which reached an all-time low of -0.26% on June 7. Considering changing circumstances, we have lowered our year-end target for the 10-year Bund yield from 0.3% to 0.1% and expect it to remain in negative...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org