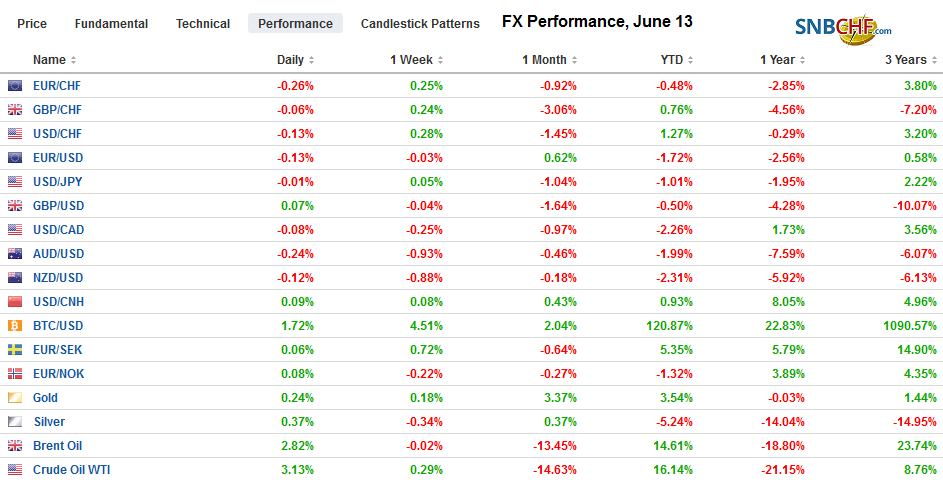

Swiss Franc The Euro has fallen by 0.32% at 1.1199 EUR/CHF and USD/CHF, June 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing tariffs to the remaining goods the US buys from China that have not already been penalized. Yesterday as the euro, which the US President noted was undervalued, was approaching two-and-a-half month highs, he knocked it to its lowest level since last week’s jobs disappointing by threatening to impose

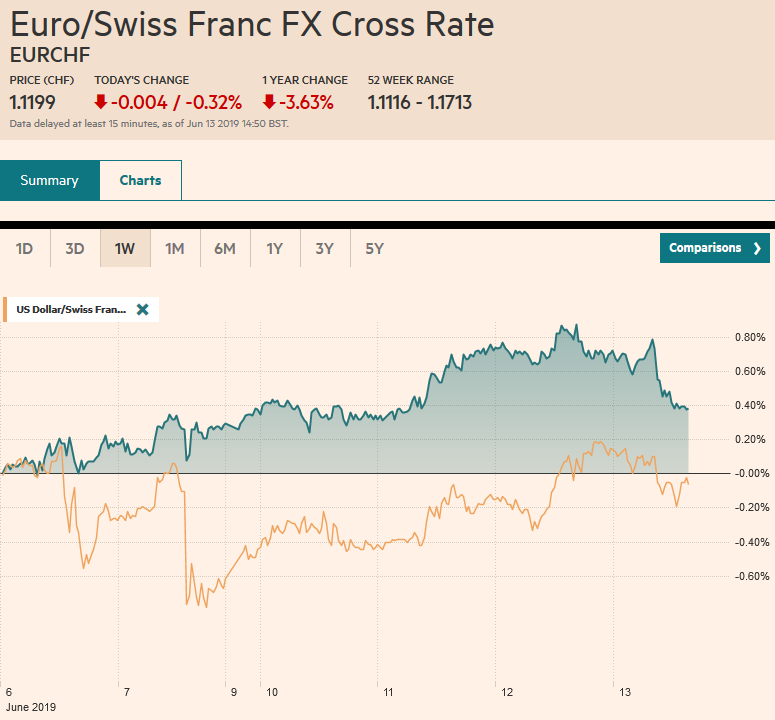

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, Eurozone Industrial Production, Featured, Germany, Germany Consumer Price Index, HKMA, newsletter, Oil, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.32% at 1.1199 |

EUR/CHF and USD/CHF, June 13(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: After roiling the markets by threatening escalating tariffs on Mexico, US President Trump has threatened China that if Xi does not meet him and return to the positions that the US claims it had previously, he will through on imposing tariffs to the remaining goods the US buys from China that have not already been penalized. Yesterday as the euro, which the US President noted was undervalued, was approaching two-and-a-half month highs, he knocked it to its lowest level since last week’s jobs disappointing by threatening to impose sanctions to block the proposed Russian gas pipeline to Germany. Meanwhile, demonstrations against the extradition bill in Hong Kong were sufficiently disruptive to stall the lawmakers, and Hang Seng shares slipped, and rates jumped. Regionals equity markets generally eased, though China and Singapore managed to eke out minor gains. European stocks are posting modest gains, shrugging off new of two oil tankers were attacked in the Gulf, which saw oil prices jump (Brent to ~$62 from ~$60 and WTI to $53 from nearly $51). US shares are also trading firmer. The broad rally in global bonds continues. The 10-year benchmark yield in Australia, Sweden, Spain, and Greece are making lows. The dollar is mixed in the foreign exchange market. The Antipodean currencies, sterling, and the Swedish krona are lower, while the Swiss franc’s 0.25% gain is leading the advancing currencies. |

Asia Pacific

The market was not impressed with the Australian employment report and boosted the chances the central bank cuts rates again next month after reducing the cash rate at the start of the month for the first time in three years. The derivative markets suggest the odds of a cut have risen to nearly 2/3 from less than 1/2 yesterday. To be sure, the employment data was not weak. Australia created 42.3k jobs, almost three times more than the Bloomberg survey suggested, and the April series was revised to 43.1k from the initial estimate of 26.4k. It is true that the jobs were mostly part-time positions. Full-time posts added 2.4k, while the April loss was cut to less than a thousand from 6.7k. The participation rate ticked up to 66.0% from a revised 65.9%, but the unemployment rate was steady at 5.2%. The RBA meets next on July 2. Australia’s two-year yield is poised to fall through 1%. It has fallen by about 30 bp over the past month, the most among the major countries after the US 32 bp decline.

Hong Kong demonstrations appeared to intensify, and the clash with officials continued. The unrest seems broader than the Umbrella Movement, which was mainly students. The process to approve the extradition bill has stalled. Hong Kong shares fell 1.7% yesterday and slipped less than 0.1% today. Today’s loss, among the smallest in the region, after the US S&P 500 posted its second consecutive decline, does not require much of a fundamental explanation. Interbank lending rates jumped (one and three-month rates are the highest since 2008, around 2.63% and 2.56% respectively). Some of the pressures are seasonal, but some may reflect investor nervousness. The money market pressure increased the cost of being short the Hong Kong dollar. Recall in late May, Hong Kong Monetary Authority intervened to defend the peg near HKD7.85. Yesterday, the dollar fell to around HKD7.816, its lowest for the year before consolidating today.

The dollar slipped to a new low for the week against the yen, just below JPY108.20. For the third session, the dollar has made lower lows and lower highs, but it has not gone anywhere, and the greenback is little changed on the week. There are $1.2 bln in options struck between about JPY107.95 and JPY108, which may offer some downside protection before they expire in the US morning. The top side may be similarly blocked by $1.3 bln in expiring options set between JPY108.65 and JPY108.75. The Australian dollar closed below its 20-day moving average yesterday for the first time this month and remains under pressure today, falling to nearly $0.6900. The low from the second half of last month, $0.6865 is the next target on a break of the $0.6900. The Chinese yuan eased slightly. The dollar finished the mainland session above CNY6.92 for the first time since Monday.

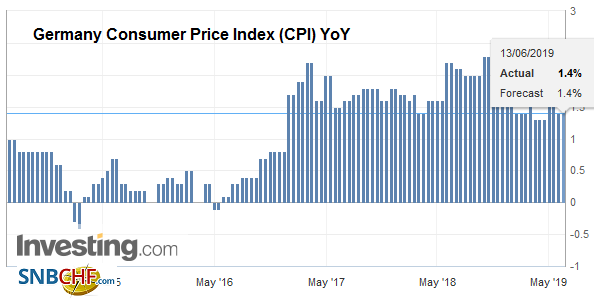

EuropeThe US Administration has been critical of Germany on several issues, with the gas pipeline with Russia being yesterday’s catalyst. The Trump Administration, which puts an emphasis on economic rivalry over ideological differences. In addition to the pipeline, defense spending and trade are also controversial. A 25% tariff on US auto imports continues to be threatened later this year. As part of his broadside, Trump threatened to shift (by a symbolic and not substantive amount) some US troops from Germany to Poland. If the US did not have a surplus of liquid natural gas, would the Trump Administration emphasize security issues? Lastly, note that the US opposition to the pipeline, the extradition bill in Hong Kong, and the harder line on China enjoys bipartisan support in the US. |

Germany Consumer Price Index (CPI) YoY, June 2019(see more posts on Germany Consumer Price Index, ) Source: investing.com - Click to enlarge |

| The contest for a new Tory leader in the UK takes a big step today. Conservative MPs will vote from the 10 candidates seeking the mantle of leadership. Each candidate received the support of at least eight MPs. Today’s vote will eliminate the one that got the least votes and any candidate that did not at least double their support (16 votes). Several candidates may be eliminated today. |

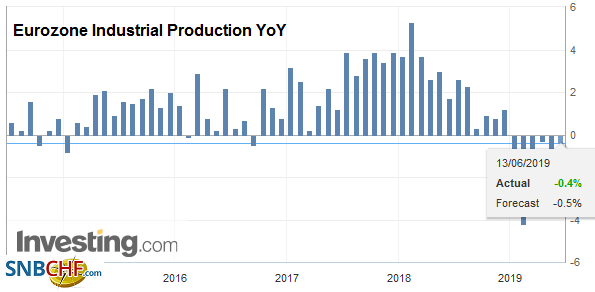

Eurozone Industrial Production YoY, April 2019(see more posts on Eurozone Industrial Production, ) Source: investing.com - Click to enlarge |

The euro posted an outside down day yesterday by trading on both sides of Tuesday’s range and finishing below Tuesday’s lows. It is consolidating today in less than a fifth of a cent range, and the region’s industrial production report was in line with expectations (-0.5%), posting the second consecutive decline. The $1.1275 level that has held (so far) is a (50%) retracement of the euro rally from the low made last week around the ECB meeting (almost $1.12). While there are no close by option strikes that will be cut today, note that tomorrow options for 4.2 bln euros at $1.13 will expire. Sterling is trading a little heavier but has held above the week’s low set Monday near $1.2650. It looks stuck between $1.2630, where a GBP254 mln option is set to expire and $1.2700, were another GBP666 mln option rolls off today.

America

The North American economic calendar is light today. US import prices may draw more attention than usual as economists and investors scrutinize the data for signs of how producers are responding to US economic nationalism. In particular, the question is whether Chinese exports are lowering prices to maintain market share in the US. Remember the tariff is on the imported price, but by the time imported good is bought by the end-user, there are several locally incurred costs (e.g., shipping, insuring, storing, and marketing) that could raise the final price by more than 50%.

While many observers accept Trump’s claim that because the US runs a large trade deficit with China that it enjoys “escalation dominance” in the tariff battle. It sounds intuitively right, but it may be another case of Americans playing checkers while China plays chess. China is not merely raising tariffs on US goods, which is the focus of many Americans. Instead, mostly unnoted, is China is cutting tariffs on goods from other countries, putting the US producers at a disadvantage in a different way, while at the same time, finding alternatives to the US. In addition, other countries, including Canada, are taking advantage of the less hospitable environment in the US for foreign (including Chinese) students and scientists and trying to attract the “human capital.”

The soft US CPI figures on the heels of the disappointing employment data have reinforced confidence that next week the FOMC will prepare the ground for a rate cut in July, which has been fully discounted now by the August fed funds futures contract. The July meeting concludes on July 31. The Dollar Index recorded a big outside up day yesterday but has not seen follow-through buying, leaving it just below 97.00. The pre-jobs data high was 97.15, and a move above there lifts the near-term tone. The US dollar tested the (38.2%) retracement of this month’s decline against the Canadian dollar yesterday (~CAD1.3355). It held yesterday and remains intact today. Initial support is seen around CAD1.3285-CAD1.3300. The Mexican peso continues to consolidate after dodging Trump’s tariff threat. The risks increase around the middle of next month after 45 days pass from the agreement, which if there is not sufficient progress, Mexico could be forced to escalate its efforts further and possibly accept the US demand that those seeking asylum do so in Mexico first. Mexico, in turn, would have to seek assistance from other key countries in the region, including Guatemala and Brazil.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Eurozone Industrial Production,Featured,Germany,Germany Consumer Price Index,HKMA,newsletter,OIL