The Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank, the Sveriges Riksbank and the Swiss National Bank, together with the Bank for International Settlements (BIS), have created a group to share experiences as they assess the potential cases for central bank digital currency (CBDC) in their home jurisdictions. The group will assess CBDC use cases; economic, functional and technical design choices, including cross-border...

Read More »FX Daily, January 21: New Respiratory Illness Saps Risk-Taking Appetites

Swiss Franc The Euro has risen by 0.05% to 1.0743 EUR/CHF and USD/CHF, January 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The spread of a new respiratory illness in China has spurred a wave of profit-taking in equities and risk assets more generally. All of the markets in the Asia Pacific region tumbled, with Hong Kong hit the hardest (-2.8%) after posting a key reversal yesterday. The sell-off continued...

Read More »USD/CHF consolidates in a range, below 0.9700 handle

USD/CHF consolidates Friday’s goodish intraday positive move. The prevalent cautious mood seemed to have capped the upside. The USD/CHF pair was seen oscillating in a narrow trading band below the 0.9700 mark on Monday and consolidated the previous session’s goodish positive move. A combination of supporting factors helped the pair to gain some follow-through positive traction for the second consecutive session on Friday and build on the previous session’s modest...

Read More »Davos 2020: What to watch for at this year’s World Economic Forum

This year, as the WEF marks its 50th anniversary, a new urgency hangs over the Alpine town. (Keystone / Gian Ehrenzeller) World leaders, chief executives, thinkers and celebrities are gathering in the Swiss mountain town of Davos for the World Economic Forum’s annual meeting. The event, which begins on Tuesday, has earned a reputation for high-altitude pontificating as the global elite gather to pitch their takes on topics picked by WEF founder Klaus Schwab, from...

Read More »China Enters 2020 Still (Intent On) Managing Its Decline

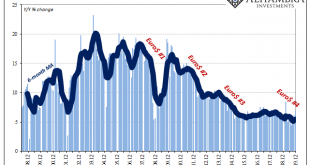

Chinese Industrial Production accelerated further in December 2019, rising 6.9% year-over-year according to today’s estimates from China’s National Bureau of Statistics (NBS). That was a full percentage point above consensus. IP had bottomed out right in August at a record low 4.4%, and then, just as this wave of renewed optimism swept the world, it has rebounded alongside it. Rather than suggest the global economy is picking up, or ended last year in a “good...

Read More »The ‘Great Replacement’ In Switzerland

Authored by Guillaume Durocher via The Unz Review, After the article on the Great Replacement in Belgium, I present you the following translation of an article by Polémia on the situation in Switzerland. The Swiss situation is unique, if only because of the country’s objective excellence and exceptional quality of life, and the extraordinary practice of direct democracy. Thus we have the rather rare situation of citizens actually being allowed to vote on whether and...

Read More »FX Daily, January 20: Stocks Stall while the Dollar Remains Bid

Swiss Franc The Euro has risen by 0.05% to 1.0737 EUR/CHF and USD/CHF, January 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The new week is off to a quiet start as the US celebrates Martin Luther King’s birthday, and investors look for a fresh focus. Hong Kong and Indian markets were suffered modest declines while most of the other large Asia Pacific markets edged higher. European stocks are trading a...

Read More »CHF appears well placed to extend its advance in the near-term – MUFG

Analysts at MUFG Bank, point out that the Swiss franc has strengthened alongside the price of gold, perhaps reflecting debasement fears. They argue market participants are also questioning Swiss National Bank’s appetite for maintaining negative rates and intervening to dampen CHF strength. Key Quotes: “Market participants are also questioning whether the SNB will still has the same appetite to continue intervening in the FX market to dampen CHF strength. It follows...

Read More »Zentralbank – SNB nach fünf Jahren Negativszinsen unter Druck

Die Schweizer Fahne weht vor dem Sitz der Schweizerischen Nationalbank (SNB) in Bern (26.4.2019). Bild: Bloomberg Fünf Jahre nach der turbulenten Abkehr der Schweiz von der Euro-Anbindung regt sich zunehmend Widerstand gegen die von den Währungshütern stattdessen ausgerufene ultra-lockere Geldpolitik. Seit die Schweizerische Nationalbank (SNB) am 15. Januar 2015 die zuvor mehrere Jahre durchgesetzte Euro-Kursuntergrenze von 1,20 Franken abrupt kippte, setzt die...

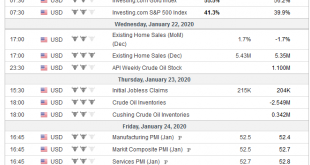

Read More »FX Weekly Preview: Central Bank Meetings Featured

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion. The focus shifts elsewhere in the week ahead,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org