USD/CHF consolidates Friday’s goodish intraday positive move. The prevalent cautious mood seemed to have capped the upside. The USD/CHF pair was seen oscillating in a narrow trading band below the 0.9700 mark on Monday and consolidated the previous session’s goodish positive move. A combination of supporting factors helped the pair to gain some follow-through positive traction for the second consecutive session on Friday and build on the previous session’s modest recovery from multi-month lows. Bulls seemed reluctant amid cautious mood The latest optimism over the long-awaited US-China phase one trade deal remained supportive of the recent risk-on rally across the global financial markets and continued weighing on the Swiss franc’s perceived safe-haven status. On

Topics:

Haresh Menghani considers the following as important: 1.) FXStreet on SNB&CHF, 1) SNB and CHF, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- USD/CHF consolidates Friday’s goodish intraday positive move.

- The prevalent cautious mood seemed to have capped the upside.

| The USD/CHF pair was seen oscillating in a narrow trading band below the 0.9700 mark on Monday and consolidated the previous session’s goodish positive move.

A combination of supporting factors helped the pair to gain some follow-through positive traction for the second consecutive session on Friday and build on the previous session’s modest recovery from multi-month lows. Bulls seemed reluctant amid cautious moodThe latest optimism over the long-awaited US-China phase one trade deal remained supportive of the recent risk-on rally across the global financial markets and continued weighing on the Swiss franc’s perceived safe-haven status. On the other hand, the US dollar was underpinned by expectations that the US economy will continue to expand and reduced odds of any further interest rate cuts by the Fed, which provided an additional boost to the pair. The greenback managed to preserve its recent gains to monthly tops, albeit a slightly cautious mood – amid tensions in the Middle East and Libya – kept a lid on any further positive move amid relatively lighter turnover on the back of a holiday in the US. The US markets will remain closed on Monday in observance of Martin Luther King Day. Hence, the broader market risk sentiment might continue to play a key role in influencing the price action and produce some meaningful trading opportunities. |

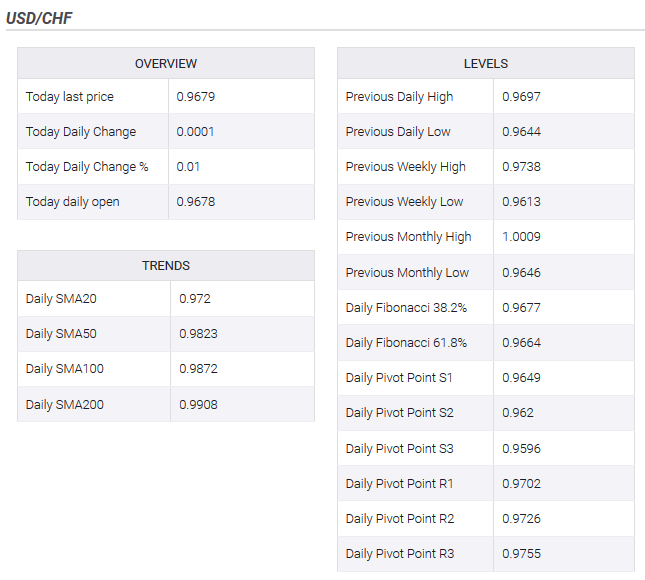

Technical levels to watch |

Tags: Featured,newsletter