Air Force One carrying US President Donald Trump, landing at Zurich airport in 2018, the last time he came to WEF (Keystone / Walter Bieri) American secret service agents have been granted access to Zurich Airport’s control tower as they prepare for US President Donald Trump’s visit to the World Economic Forum (WEF) in Davos, the NZZ am Sonntag reports. WEFexternal link, which starts in the Swiss mountain resort on Monday, attracts wealthy, high-profile business and...

Read More »Luck and Taxes

“Luck egalitarianism” is a philosophical fad, and in the past I have had some characteristically unkind things to say about it. I’d like today to discuss a new argument that concerns luck and government. The economist Robert H. Frank says in Under the Influence, Because successful people often fail to appreciate the importance of seemingly minor random events in life, they tend to develop an exaggerated sense of entitlement to the enormous material rewards they...

Read More »California’s Anti-Self-Employment Law Is Already Crushing Freelancers

In 1971, Isaac Asimov wrote an extraordinary novel, The Gods Themselves, about a machine that generates unlimited energy for free, defying the fundamental economic principle known as scarcity. It is later learned that the Electron Pump is originating from a hole in space that connects parallel universes. Doomsday is nigh as it is discovered that galaxies will soon be destroyed and that the sun will metastasize into a supernova. The crux of the story is comparable to...

Read More »EM Preview for the Week Ahead

Market sentiment on EM remains positive after the Phase One trade deal was signed. Data out of China is also supportive for EM. Key forward-looking data this week are Taiwan export orders and Korea trade data for the first 20 days of January. The global liquidity story also remains beneficial for risk, with the ECB, Norges Bank, BOC, and BOJ all set to maintain steady rates this week. AMERICAS Mexico reports mid-January CPI Thursday, which is expected to rise 3.16%...

Read More »SNB can leverage its balance sheet if needed, Schlegel says

The Swiss National Bank (SNB) retains the ability to wage currency market interventions if necessary, Martin Schlegel, one of the SNB’s alternate governing board members, said on Wednesday, according to Bloomberg. Key quotes The balance sheet is the result of our monetary policy. That means that if we need to loosen monetary policy we still have the room to expand the balance sheet. There is no alternative to the SNB’s negative interest rate, currently at minus...

Read More »Investing in crypto the sound way!

Interview with Christian Zulliger I have long been fascinated by the far-reaching consequences and the great potential of the wave of new technologies and ideas that emerged with the crypto revolution. While most of us first came into contact with these concepts in 2017, this tectonic shift that is only just beginning has been in the making for nearly a decade. Now, we begin to see the basic ideas and tools take shape and give rise to endless exciting possibilities...

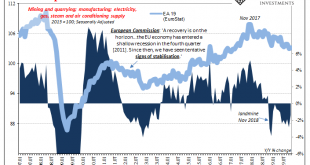

Read More »Germany, Maybe Europe: No Signs Of The Bottom

For anyone thinking the global economy is turning around, it’s not the kind of thing you want to hear. Germany has been Ground Zero for this globally synchronized downturn. That’s where it began, meaning first showed up, all the way back at the start of 2018. Ever since, the German economy has been pulling Europe down into the economic abyss along with it, being ahead of the curve in signaling what was to come for the whole rest of the global economy. The ECB, many...

Read More »The Prospects for a Sound-Money Revolt against the Dollar and Euro

In the last decade, the combination of virulent asset price inflation and low reported consumer price inflation crippled sound money as a political force in the US and globally. In the new decade, a different balance between monetary inflation’s “terrible twins” — asset inflation and goods inflation — will create an opportunity for that force to regain strength. Crucial, however, will be how sound money advocacy evolves in the world of ideas and its success in...

Read More »Hartnäckige Frankenstärke – Auf der Suche nach den mysteriösen Franken-Käufern

Der cash Insider ist unter @cashInsider auch auf Twitter aktiv. Lesen Sie börsentäglich von weiteren brandaktuellen Beobachtungen am Schweizer Aktienmarkt. +++ Am Morgen des 15. Januars 2015 waren die Devisenmärkten in Aufruhr. Dass die Schweizerische Nationalbank (SNB) das Ende des Euro-Mindestkurses von 1,20 Franken verkünden würde, hatten selbst erfahrenste Marktakteure nicht erwartet. Folglich wurde der Euro vorübergehend zu 80 Rappen gehandelt und auch der...

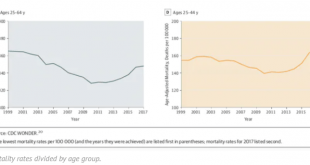

Read More »Inflation, But Only At The Morgue

Why is everyone so angry? How can socialism possibly be on such a rise, particularly among younger people around the world? Why are Americans suddenly dying off? According to one study, two-thirds of millennials are convinced they are doing worse when compared to their parents’ generation. Sixty-two percent say they are living paycheck to paycheck, with no savings and no way to get any (though they also tend to “overspend” when compared to other age groups). Worst of...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org