Summary:

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion. The focus shifts elsewhere in the week ahead, for which the US sees a relatively light calendar of economic reports in a holiday-shortened week. Then again, the recent employment, trade, inflation, and retail sales data offer valuable insight. The course is set, and the Fed seems inclined to look beyond the near-term economic fluctuations, ensuring that

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Bank of Japan, ECB, Featured, newsletter, Norges Bank

This could be interesting, too:

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion.

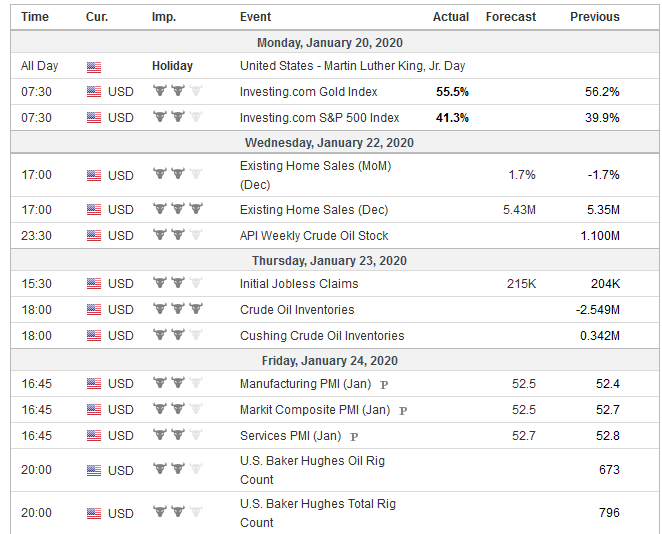

The focus shifts elsewhere in the week ahead, for which the US sees a relatively light calendar of economic reports in a holiday-shortened week. Then again, the recent employment, trade, inflation, and retail sales data offer valuable insight. The course is set, and the Fed seems inclined to look beyond the near-term economic fluctuations, ensuring that the meeting at the end of the month is as close to a non-event as an FOMC meeting and a Powell press conference can be.

There are four central bank meetings to note, and none are likely to do anything, so the words are more important than the actions. The Bank of Japan begins with Governor Kuroda holding at the conclusion of the two -day meeting on January 21. Under the yield-curve control initiative, it puts the deposit minus 10 bp and targets the 10-year yield at zero =/+ 20 bp. Global tensions have eased, and the yen has weakened to the lower end of where it has been in the past six months. Prime Minister Abe’s fiscal support (~$122 bln) and preparation for the Olympics may also help the BOJ's efforts to support the economy.

The BOJ will provide updated forecasts. In October, it anticipated growth of 0.7% in FY20 and 1.0% in FY21. Core inflation, which excludes the price of fresh food, was forecast to rise by 1.1% in FY20 and 1.5% in FY21. The forecast seems optimistic. The Bloomberg economists survey found median forecasts for 2020 growth at 0.5% and 0.7% in 2021. Japan has not reported core CPI above 1% since April 2015. The tax increase will the optics, but the BOJ and investors know better.

That said, deflation has been halted, and Japan, like many other countries, is experiencing low inflation. Core CPI has been above zero since the end of 2016. Policymakers and economists understood the tax increase would push economic activity in Q3 from Q4. The actions the government took were meant to ensure a quick rebound. Data from November suggests capex bounced back strongly and consumption slower. While the easing of US-China trade tensions helps lift uncertainty, quantitative targets may give American companies an edge, all else being equal.

The Bank of Canada’s decision is the next day, January 22. It is in a holding pattern. The real sector data has disappointed, even though employment in December recovered from the unexpected weakness in November. Firm inflation readings may be deterring the Bank of Canada from easing, and the government is promising fiscal support. The fact that the Federal Reserve is understood to be on hold also gives Bank of Canada officials some time, though last year's three cuts by the US did not induce a move by Canada.

Shortly before the outcome of the meeting is announced, Canada will report December CPI figures. The month-over-month pace declined in three of the four months through November by a cumulative 0.3 percentage points. In the same period in 2018, the cumulative decline in the four months through November was twice as much. The base effect seems behind the year-over-year rise of all the Canadian measures above 2%.

Also, most economists expect the current run of soft data is not a prelude to a more severe slowdown. About three-quarters of the economists in a recent Reuters survey expect the Bank of Canada to remain on hold into 2021. However, officials are more optimistic than private-sector economists. The former see growth accelerating from about 1.7% to a little more than 2.0% in 2020. Private economists, according to the Bloomberg survey, see the growth slipping to 1.6%, which would be the slowest pace in four years.

It may be helpful to review the status of the three drivers of the Canadian dollar: First, commodities and oil have rallied into the end of last year but have eased at the start of 2020. The price of oil (WTI) is off about 3.3%, while the CRB Index fell by almost 2%. Second, the Canadian dollar typically appears to do better when there are strong risk appetites, for which the S&P 500 is a rough proxy. Investors are willing to take on risk with the S&P 500, and its equivalent in Europe (Dow Jones Stoxx 600) is also setting new record highs. The MSCI Emerging Markets Index has rallied for seven consecutive weeks, the longest positive run since late 2017 and early 2018.

The US dominated the news stream at the start of 2020. The spasm in the US-Iran confrontation has quickly subsided. The much-heralded US-China Phase 1 trade deal has been signed. The US has completed the ratification process of the US Mexico Canada Free-Trade Agreement. The early signs from the economic entrails suggest the world’s largest economy continue to enjoy a record-long, even if not robust, expansion. The focus shifts elsewhere in the week ahead, for which the US sees a relatively light calendar of economic reports in a holiday-shortened week. Then again, the recent employment, trade, inflation, and retail sales data offer valuable insight. The course is set, and the Fed seems inclined to look beyond the near-term economic fluctuations, ensuring that

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Bank of Canada, Bank of Japan, ECB, Featured, newsletter, Norges Bank

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Tags: Bank of Canada,Bank of Japan,ECB,Featured,newsletter,Norges Bank