Swiss Franc The Euro has risen by 0.02% to 1.061 EUR/CHF and USD/CHF, February 21(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft..com - Click to enlarge FX Rates Overview: The spread of Covid-19 outside of China and early signs of the economic consequences again emerged to weigh on investor sentiment. Poor Japanese and Australian preliminary February PMI reports and some trade indications from South Korea saw most Asia Pacific equities sell-off. ...

Read More »Kauf von Gladstone Commercial – Mit Immobilien Geld verdienen (REIT) ??

Ich nutze einen kleinen Rücksetzer, um die Position von Gladstone Commercial weiter auszubauen. Insgesamt verdopple ich meine Anteile von 250 auf 500 Stück. Hier geht’s übrigens zum letzten Aktien Kauf Alphabet. . Kauf von Gladstone Commercial Das Investment von 250 Gladstone Commercial Aktien hat mich 5‘463.99 USD gekostet. Die damaligen Käufe konnte ich deutlich günstiger erwerben, allerdings sehe ich da langfristig weniger ein Problem. Gladstone Commercial...

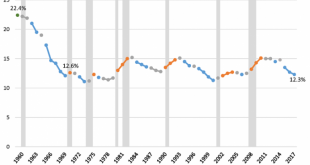

Read More »The labels that show how much more international retailers charge Swiss

To simplify labelling, many international retailers put recommended retail prices (RRP) for multiple nations on the same label, like the one below. The Swiss retail price premium laid bare. Labels such as these show how much more Swiss customers are being charged compared to customers in other countries. The label above, from an item of clothing sold in Switzerland, shows how much more Swiss customers are charged. The RRP for Switzerland is the highest. The Swiss...

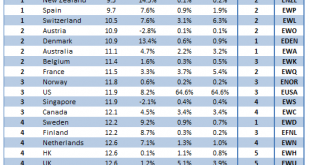

Read More »DM Equity Allocation Model For Q1 2020

Developed equity markets remain near the highs despite mounting concerns about the impact of the coronavirus MSCI World made a new all-time high last week near 2435 and is up 2.5% YTD Our 1-rated grouping (outperformers) for Q1 2020 consists of Ireland, Israel, New Zealand, Spain, and Switzerland Our 5-rated grouping (underperformers) for Q1 2020 consists of the Italy, Germany, Portugal, Japan, and Greece Since our last update on November 19, our proprietary DM...

Read More »Dollar Firm as Risk-Off Sentiment Picks Up Again

Negative news on the coronavirus has kept risk appetite subdued across the board; the dollar rally continues During the North American session, we will get some more clues to the state of the US economy; FOMC minutes were largely as expected UK January retail sales came in firm; ECB releases the account of its January 23 meeting Australia reported firm January jobs data; China commercial banks cut lending rates; Indonesia cut rates 25 bp to 4.75%, as expected The...

Read More »Is Free Market Economics Too “Ideological”?

Free market economics is often ignorantly dismissed for being “ideological” rather than scientific. It probably sounds smart to the economically illiterate, but it is decidedly not. It doesn’t mean nearly what most people assume it does. The word “free” in free market economics is not used as a normative value judgment but indicates an economy that is unaffected by exogenous (from the outside) factors. “Free” therefore means that it is the market economy in and by...

Read More »USD/CHF New York Price Analysis: Dollar eases from session highs, trades below 0.9830 vs. Swiss franc

USD/CHF prints another 2020 high and retraces down in the New York session. Bears are challenging the 0.9830 level. USD/CHF daily chart After hitting yet again a new 2020 high, USD/CHF is easing from session highs. The spot is trading below the 200-day simple moving averages suggesting an overall bearish momentum in the long term. USD/CHF daily chart(see more posts on USD/CHF, ) - Click to enlarge USD/CHF four-hour chart Dollar/Swiss is trading in a rising...

Read More »New Swiss aid budget proposes more funds but for fewer countries

. The Swiss government wants to set aside CHF11.25 billion ($11.43 billion) in development aid for the 2021-2024 period. The governing Federal Council adopted its Strategy for International Cooperation on Wednesday after opening it up for public consultation. It will still have to be approved by parliament. The amount proposed is CHF140 million more than the current aid budget and will cost Swiss taxpayers less than one Swiss franc (CHF0.80) per inhabitant per day....

Read More »Why It’s so Hard to Escape America’s “Anti-Poverty” Programs

One of the most common debates that has occurred in the United States for the past six decades is the discussion of the poverty rate. As the narrative goes, the US has an unusually high poverty rate compared to equivalent nations in the OECD (Organisation for Economic Co-operation and Development). Although it’s true that the measure of poverty is flawed, especially when compared cross-nationally, this piece addresses the reasons why the poverty rate in the US in...

Read More »FX Daily, February 20: Covid-19 Hits Yen and Korean Won

Swiss Franc The Euro has fallen by 0.08% to 1.0619 EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The increase of Covid-19 cases in South Korea and Japan, coupled with China’s changing reverting back to its previous methodology of calculation, dropping clinically-diagnosed cases have again weakened risk appetites and sent the dollar broadly higher. Fears of a Japanese recession...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org