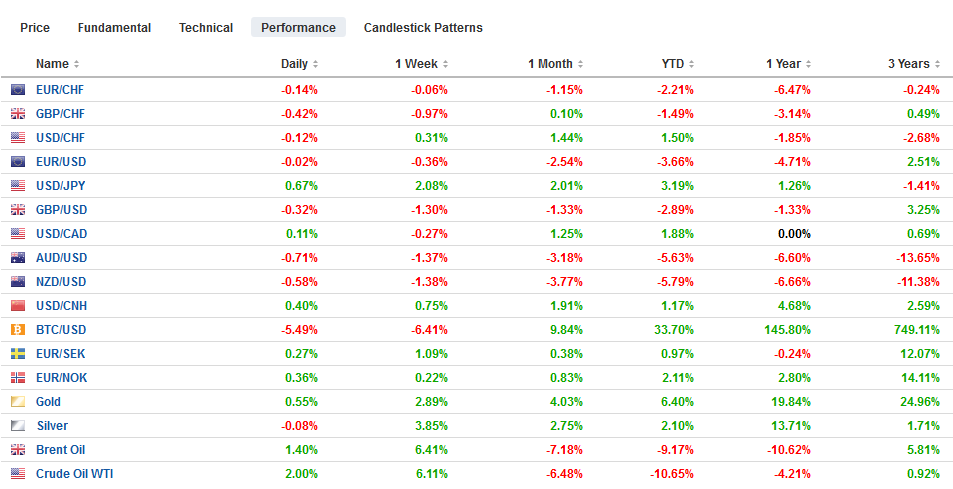

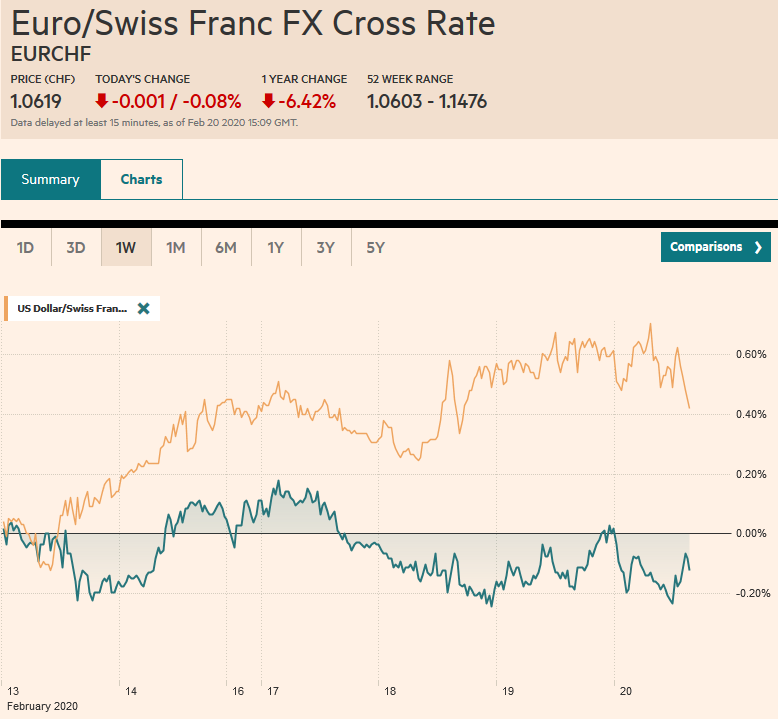

Swiss Franc The Euro has fallen by 0.08% to 1.0619 EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The increase of Covid-19 cases in South Korea and Japan, coupled with China’s changing reverting back to its previous methodology of calculation, dropping clinically-diagnosed cases have again weakened risk appetites and sent the dollar broadly higher. Fears of a Japanese recession are sapping the yen’s role as a safe haven, and this helps explain why Japanese equities did react as positively to the weaker yen than is often the case. Small gains were recorded in Japanese and Australian equities, while the Shanghai Composite rose 1.8% and the Shenzhen Composite rallied a little

Topics:

Marc Chandler considers the following as important: 4.) Marc to Market, 4) FX Trends, Australia, Currency Movement, Featured, newsletter, South Korea, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.08% to 1.0619 |

EUR/CHF and USD/CHF, February 20(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The increase of Covid-19 cases in South Korea and Japan, coupled with China’s changing reverting back to its previous methodology of calculation, dropping clinically-diagnosed cases have again weakened risk appetites and sent the dollar broadly higher. Fears of a Japanese recession are sapping the yen’s role as a safe haven, and this helps explain why Japanese equities did react as positively to the weaker yen than is often the case. Small gains were recorded in Japanese and Australian equities, while the Shanghai Composite rose 1.8% and the Shenzhen Composite rallied a little more than 2%. However, most bourses were lower. Europe’s Dow Jones Stoxx 600 has been alternating between gains and losses for the past five sessions. As yesterday saw an advance, today’s seeing losses to extend the sawtooth pattern into a sixth session. Consumer discretionary and information service sectors are the biggest drags (~0.5%), while industrials (~0.6%) and healthcare (0.2%) are the strongest sectors. US shares are paring yesterday’s gains after yesterday’s gap higher to new record highs in the NASDAQ and the S&P 500. Benchmark bond yields are narrowly mixed in Europe, leaving the 10-year German Bund near minus 42 bp to approach a three-month low. The US 10-year yield is hovering around 1.55%. The dollar’s gains have accelerated, and only the Swiss franc among the majors is resisting. The JP Morgan Emerging Market Currency Index is off for its fourth consecutive session, the longest losing streak of the year. Gold is consolidating above $1600, and April WTI initially extended yesterday’s rally to poke above $54 a barrel for the first time this month, after beginning last week below $50. |

FX Performance, February 20 |

Asia Pacific

The yen dropped like a rock yesterday after Tokyo got the ball rolling. The dollar reached its highest level in nine months near JPY111.60, after finishing in Tokyo near JPY110.25. It is pushed above JPY112 in Europe. The ties to China, exposure to the coronavirus, compounded by Japan’s own domestic challenges (e.g., the sales tax increase last October) is bolstering fears that the world’s third-largest economy is likely contracting for the second consecutive quarter. In industry news, there are reports that Nissan may have to curb domestic output unless shipments of parts from China resume shortly. South Korea’s KOSPI (~-0.6%) and the won (~-1.2%) are among the poorest performers today. Traced to a religious cult, the number of Covid-19 cases in South Korea doubled. In South Korea, 2.5 mln people are being encouraged to stay at home.

China’s Loan Prime Rate, set by survey on the 20th of each month, eased in line with expectations. The one-year rate fell 10 bp to 4.05%, while the 5-year rate slipped five basis points to 4.75%. Indonesia also delivered the anticipated 25 bp rate cut of its key seven-day reverse repo rate to 4.75%. Elsewhere, Taiwan’s January export orders tumbled 12.8%, nearly twice the decline economists forecast. In December, export orders rose by 0.9%.

The Australian dollar was sold to new 10-year lows following the January employment report, but we suspect that it was more about the broader developments that the jobs data itself. The unemployment rate did tick up to 5.3% from 5.1% but reflected partly the increase in the participation rate (61.1% vs. 61.0%). Full-time jobs surged by 46.2k. This is the most since last March. It contrasts with the 12-month moving average that is closer to 12k. Part-time positions fell by nearly 33k. Perhaps the most troubling part of the report was the 0.4% decline in hours worked. The takeaway is that the market boosted the likelihood of a rate cut around the middle of the year.

The PBOC set the dollar’s reference rate above CNY7.0 for the second consecutive session, and the dollar rose to a marginal new high for the year (~CNY7.0260). The offshore yuan is weaker. Against it, the dollar briefly traded above CNH7.04. The PBOC does not appear to be engineering the yuan’s decline. The dollar is approaching last year’s high against the yen set in May near JPY112.40. The yen is such a creature of range-trading that when it is trending, it is often moving from one range to another. The new range may be JPY110-JPY115. However, the approaching fiscal year-end may make it difficult to establish the boundaries of the range, which often have to be discovered. The combination of risk-off, contagion, economic disruption fears, and some disappointment with the employment report sent the Australian dollar to new decade-lows (~$0.6620). There does not appear to be meaningful nearby chart support, and the downside momentum appears strong.

Europe

The UK’s economic data have improved since the election, and today’s January retail sales gains were consistent with this generalization. January retail sales rose by 0.9%, which was a little more than expected, and the December decline was revised to -0.5% from -0.6%. Excluding auto fuel, retail sales jumped 1.6%, twice the gain expected by the median forecast in the Bloomberg survey. The previous speculation of a rate cut has been pared. The implied yield of the December 2020 short-sterling futures contract has risen from less than 50 bp late January to about 63 bp today.

The EU-27 showed an impressive united front last year in negotiations of the withdrawal agreement with the UK. However, it is finding it more difficult to agree on a negotiating mandate for this year’s trade talks. The UK is insisting on an agreement with year, no delays. Many observers were skeptical a deal could be reached in such a short period, and now there are nearly two months less. Today’s EU leaders will continue to debate the seven-year budget.

The EMU reports the preliminary February PMI. We suggest there are asymmetrical risks. The market is more likely to respond to disappointing data than it is to an upside surprise. The sharp contraction of industrial production figures at the end of last year has undermined previous survey data that should a recovery was gaining traction.

The euro broke below $1.08 for the first time since 2017 yesterday and is straddling the area today. However, the push above $1.08 in early European turnover was greeted with new sales. The near-term technical potential extends to the old gap from the April 2017 French elections near $1.0740. The favorable retail sales report has done little to support sterling. The British pound has held just above this year’s low set on February 10, near $1.2870. Below there support is seen around $1.28.

America

Investors were buying the dip even before the US reported considerably stronger than expected housing starts and permits (highest permits since 2007) for January and a dramatic 0.5% rise in the headline and core PPI, the highest since October 2018. This dip-buying prior to the data was manifest in the S&P and NASDAQ gapping higher to new record levels yesterday. The gains will be pared in the early going today, though buying on dip strategies continues to be rewarded.

There are several economic reports today but are unlikely to be as supportive as yesterday’s data. The Philadelphia Fed survey is the second Fed survey for February. Recall the Empire State manufacturing survey jumped to 12.9 from 4.8. The Philly Fed is expected to have softened to 11 from 17. The weekly jobless claims, which cover the survey week for the February non-farm payrolls, are expected to have edged a little higher. However, the four-week average is likely to fall. The US also reports January leading economic indicators. It fell last August through October before popping up in November, only to fall anew in December. The rule of thumb has been three negative readings are a recession signal. The US economy began the new year on a strong note, and this is expected to be reflected in a 0.4% rise in the LEI, which would be the most since last July.

President Trump, who has often complained about the dollar’s strength, has been quiet in the face of its recent push higher. Some jawboning ought not to be surprising, though its direct effect may be limited. The market seems to agree with the US President that the Fed ought to be cutting interest rates. Fed officials have given little sign that this is under consideration, but the market is discounting about 35 bp of easing, and the 2-10-year yield curve is flattening. At about 13.5 bp, it is the least steep in roughly four months. The 10-year yield is slipping below the three-month bill rate.

The Canadian and Mexican economic calendars are light today, and both currencies are under some pressure. The US dollar initially approached CAD1.32 in Asia, to set a new low for the month, but as risk appetites were sapped, the greenback rebounded smartly to trade through yesterday’s highs (~CAD1.3260). An outside day is the making before the domestic markets open. The close is important, and a close above CAD1.3260 would strengthen the greenback’s technical tone. We had identified the Canadian dollar as the strongest from a technical perspective last week. Today’s losses offset the earlier gains, but with around a 0.2% decline for the week, the Canadian dollar is the best performing major behind the greenback. The US dollar traded at new highs for the week against the Mexican peso near MXN18.67. Nearby resistance is seen a little above MXN18.68. Speculative positions are near-record highs, and some carry plays (e.g., short yen long peso or short euro and long pesos) may have more staying power than those using the US dollar. A spike toward MXN18.80-MXN18.85 may see new peso buying emerge.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,Australia,Currency Movement,Featured,newsletter,South Korea