Aktiendepots bei Schweizer Banken befinden sich auf Rekordniveau (Bild: shutterstock) Ende 2019 erreichte der Wertschriftenbestand in den Depots der Schweizer Banken laut den neuesten Daten der Schweizerischen Nationalbank SNB einen neuen Rekordstand von 6,72 Bio. Fr. Die Zunahme belief sich auf fast eine Bio. Franken. Genau waren es 961 Mrd. Fr. bzw. 16,7%. Dieses aussergewöhnliche Wachstum ist vor allem den haussierenden Aktienmärkten zu verdanken. So schnellte...

Read More »Unions say anti-EU initiative is bad for workers

Unions are worried the vote would weaken protection for workers in Switzerland. (Keystone / Peter Klaunzer) Trade unions have come out against the initiative to scrap the freedom of movement agreement with the European Union, saying a “yes” vote would be “an attack on all workers”. Accepting the right-wing proposal would lead to a situation whereby “collective agreements and wage checks would be replaced by an unfettered competition of all against all,” Swiss Trade...

Read More »Was It A Midpoint And Did We Already Pass Through It?

We certainly don’t have a crystal ball at the ready, and we can’t predict the future. The best we might hope is to entertain reasonable probabilities for it oftentimes derived from how we see the past. Which is just what statistics and econometrics attempt. Except, wherein they go wrong we don’t have to make their mistakes. For example, in the Fed’s main model ferbus there’s no way to input a global dollar shortage. Even if there was, to this statistical...

Read More »When Will We Admit Covid-19 Is Unstoppable and Global Depression Is Inevitable?

Given the exquisite precariousness of the global financial system and economy, hopes for a brief and mild downturn are wildly unrealistic. If we asked a panel of epidemiologists to imagine a virus optimized for rapid spread globally and high lethality, they’d likely include these characteristics: 1. Highly contagious, with an R0 of 3 or higher. 2. A novel virus, so there’s no immunity via previous exposure. 3. Those carrying the pathogen can infect others while...

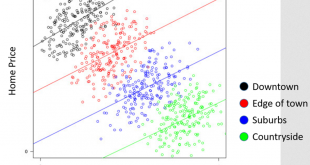

Read More »Tax Burdens, Per Capita Income, and Simpson’s Paradox

How many times have you heard that higher taxes mean greater social welfare and economic development? The statement is backed up by a touch of popular wisdom: “More taxes, more public services.” Almost incontestable empirical evidence is also cited: with very few exceptions, the richest countries’ tax rates are very high, whereas taxes in poor countries are relatively low. This article analyzes the statistical relationships that suggest that high tax burdens...

Read More »FX Daily, February 24: Stocks Slammed and Yields Drop as Virus Containment Fails

Swiss Franc The Euro has fallen by 0.15% to 1.0588 EUR/CHF and USD/CHF, February 24(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The ring of containment of Covid-19 has grown from China. The new frontline is Japan, South Korea, Italy, and Iran. A lockdown of around 50k people near Milan and Austria blocking trains from Italy is scaring investors. Asian markets fell, but South Korea bore the brunt with a...

Read More »USD/CHF Price Analysis: 200-day EMA questions pullback from 0.9770/75 support confluence

USD/CHF bounces off the short-term key support confluence comprising 21 and 50-day EMA as well as 38.2% Fibonacci retracement. 200-day EMA, 61.8% Fibonacci challenge buyers amid bullish MACD. USD/CHF registers 0.21% gains while taking the bids around 0.9805 during the early Monday. The pair recently reversed from 21/50-day EMA and 38.2% Fibonacci retracement of October 2019 to January 2020 declines. Also supporting the pullback are bullish signals from MACD. That...

Read More »Who wins and who loses because of negative interest rates?

The SNB’s monetary policy is geared to counteracting upward pressure on the Swiss franc against the Euro. (© Keystone / Ti-press / Alessandro Crinari) The Swiss National Bank’s negative interest rates, introduced five years ago, are having an increasingly significant economic and social impact. But despite criticism, the SNB does not want to remove them. It considers the measure necessary to stop the Swiss franc appreciating too much. Why were negative interest...

Read More »When It Comes to Raw Power, Few Have More of It Than Central Bankers

A common retort to the claim that in voluntary exchange both parties expect to become better off (or they wouldn’t do it) is that exchanges are seldom, if ever, a matter of horizontal, equal exchange of values. Instead, any such interaction between people is ultimately a matter of their exercising power over one another. The implication, and often explicitly stated conclusion, is that there is no voluntariness, that exploitation is always present, that one party...

Read More »FX Weekly Preview: Sources of Imbalance and the Pushback Against New Divergence

The US dollar’s surge alongside gold has eclipsed the equity market rally as the key development in the capital markets. Even the traditional seemingly safe-haven yen was no match for the greenback. The dollar appeared to have been rolling over in Q4 19, as the sentiment surveys in Europe improved, Japanese officials seemingly thought the economy could withstand a sales tax increase, and data suggested the Chinese economy was gaining some traction. However, 2020 has...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org