Der SMI ist heute morgen teilweise über 6% abgesackt. (Bild: Shutterstock.com/Pavel Ignatov) Die Aktienmärkte erlebten heute erneut einen schwarzen Tag mit Rekordverlusten: Der SMI stürzte um -9,64% auf 8270 Punkte ab, der Euro STOXX 50 um sage und schreibe -12,4% und der DAX tauchte ebenfalls zweistellig um -12,24%. Der Dow Jones lag kurz nach 18 Uhr mit -9,3% ebenfalls im tiefroten Bereich. Bereits am Morgen hatten die Börsen mit einem Kurssturz auf das...

Read More »How will we judge multinationals when the epidemic is over?

Employees at the greatest risk are those who don’t have the luxury to work from home. (Keystone / Matteo Bazzi) Our regular analysis of what the biggest global companies in Switzerland are up to. This week: responsible business in an epidemic, child labour on coffee farms, and Responsible Business debate. What has made multinational companies in Switzerland so successful is exactly what is making them particularly vulnerable in a global epidemic. In the Financial...

Read More »Coronavirus: youngest death so far brings Swiss death toll to four

Binningen – source: Wikipedia The coronavirus has claimed its fourth victim in Switzerland. A 54 year old man died yesterday in Binningen hospital in the canton of Basel-Landschaft, according to the Federal Office of Public Health (FOPH). The man attended an evangelical church gathering of 2,000 people held between 17 and 24 February 2020 in the French city of Mulhouse. Several other cases of infection have been linked to the same gathering. The man, who had been in...

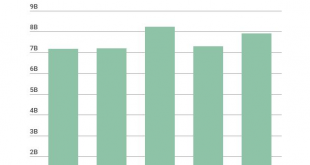

Read More »The CDC’s Budget Is Larger Now Than Under Obama

This is how the budget process in Washington begins. Step one: the president submits his budget to Congress. Step two: Congress puts the president’s budget in a drawer somewhere and forgets about it. Step three: Congress passes a budget it likes instead. This reality, however, has been conveniently ignored in recent weeks. Some pundits and politicians have claimed that Donald Trump “gutted the CDC.” Trump has been busy “slashing the government agencies” that combat...

Read More »Dollar Firms, Equities Sink Ahead of ECB Decision as US Fails to Deliver

President Trump spoke to the nation last night and did little to calm markets; reports suggest that the Democrats are working on a bill Fed easing expectations are intensifying The ECB decision will be out at 845 AM ET; over the past 17 ECB decision days, the euro has finished lower in 11 of them Reports suggest the Bank of Japan is “likely to strengthen stimulus” next week; Australia announced details of its AUD17.6 bln stimulus plan The dollar is broadly firmer...

Read More »USD/CHF Price Analysis: Extends run-up beyond 10-day SMA

USD/CHF holds onto recovery gains from 23.6% Fibonacci retracement level. 50% of Fibonacci retracement, January month low on the bulls’ radars. Sellers can take entry below 0.9320. USD/CHF adds 0.22% to its previous recovery, currently crossing 10-day SMA, while trading near 0.9460 during the early Friday. The pair manages to remain positive beyond 23.6% Fibonacci retracement of its fall from November 2019. As a result, buyers can aim for further upside beyond a...

Read More »Coronavirus: too late to close Swiss borders

Switzerland’s government and health officials presented a coronavirus update yesterday. Key elements of the presentation are set out below. [embedded content]The full coronavirus press update can be viewed above in German. Closing borders is now pointless Patrick Mathys, who is leading the coronavirus response at the Federal Office of Public Health (FOPH), said epidemiologically that closing the borders would achieve nothing and would not slow the spread of the...

Read More »New trade barriers could hamper the supply of masks and medicines

IT IS BAD enough when individuals stockpile pasta and toilet paper. It is worse when governments put a protective ring around medical equipment. As the covid-19 pandemic leads to a rush for medical gear, the World Health Organisation (WHO) has warned that supplies of respirators and medical masks will not keep up with demand, and soon global stocks of gowns and goggles will be insufficient too. Some governments are erecting trade barriers to safeguard their...

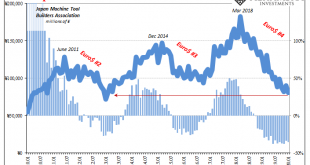

Read More »What Happens When Central Banks Buy Stocks (ETFs)? Well, We Already Know

Can we please dispense with all notions that monetary policy works? Specifically balance sheet expansion via any scale asset purchase programs. Nowhere has that been more apparent than Japan. Go back and reread all the promised benefits from BoJ’s Big Bang QQE that were confidently written in 2013. The biggest bazooka ever conceived has fallen short in every conceivable way. Starting with the fact QQE remains ongoing approaching its seventh birthday. Over here in...

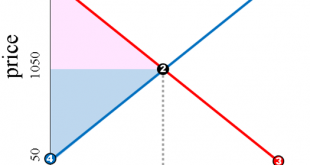

Read More »Why Medicare for All Would Require Huge Tax Increases

Medicare for All is listed as the top priority of Democratic presidential candidate Bernie Sanders. He describes it as a single-payer system that is “free at the point of service” as there will be no premiums, deductibles, copays, or surprise bills. It will cover more services (dental, hearing, vision, long-term care, substance abuse treatment, etc.) than what the present Medicare system covers. It will also stop the “pharmaceutical industry from ripping off the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org