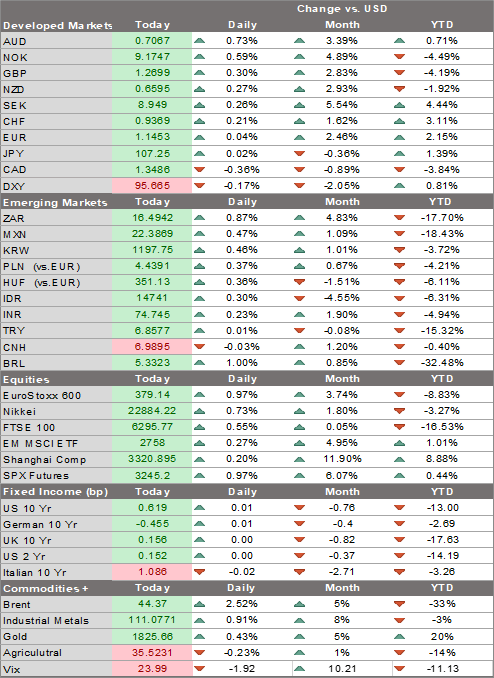

Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new .4 trln package as a basis for these negotiations Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win; today is a quiet day in the US Colombia is expected to cut rates 25 bp to 1.75%; Mexico cut rates 25 bp to 4.25% yesterday, as expected; we got two surprise hikes in EMEA yesterday Some UK Tory MPs are looking for ways to block new restrictive measures; UK public sector borrowing came in slightly lower than expected; eurozone M3 growth slowed in August FTSE

Topics:

Win Thin considers the following as important: 5.) Brown Brothers Harriman, 5) Global Macro, Articles, Daily News, Featured, newsletter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

- Markets are digesting the rising infection rates across Europe; the dollar is taking another stab at the upside

- Speculation is picking up that a compromise on a stimulus package could be reached; reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations

- Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win; today is a quiet day in the US

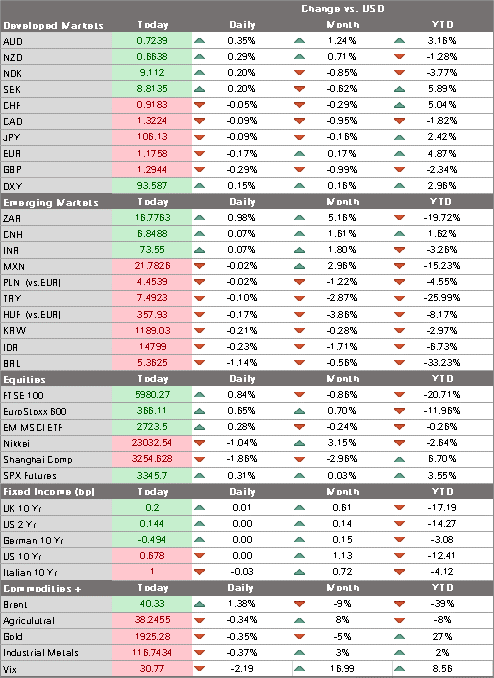

- Colombia is expected to cut rates 25 bp to 1.75%; Mexico cut rates 25 bp to 4.25% yesterday, as expected; we got two surprise hikes in EMEA yesterday

- Some UK Tory MPs are looking for ways to block new restrictive measures; UK public sector borrowing came in slightly lower than expected; eurozone M3 growth slowed in August

- FTSE Russell said it would include China in its flagship World Government Bond Index

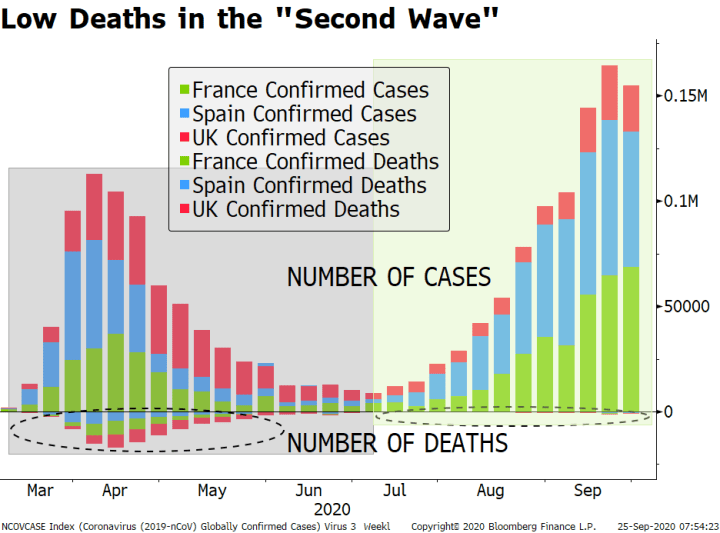

| Markets are digesting the rising infection rates across Europe. France and the UK are seeing record daily infection rates while the number of hospitalizations are increasing as well (especially in Spain). The good news is that deaths are nowhere near the first wave of the pandemic. The bad news is that limited lockdowns and self-imposed lockdowns will still have a chilling effect on economic activity. The September flash PMIs across Europe are already reflecting this. However, Europe successfully crushed the curve in the first wave and we are confident that it can be done for this second wave, albeit at the cost of slower growth in Q4 and perhaps even Q1. US virus numbers are also rising again, but we never crushed the curve in the first place and so the US is starting from an already weakened position. With stimulus running out, we continue to believe that the US economy will underperform in Q4.

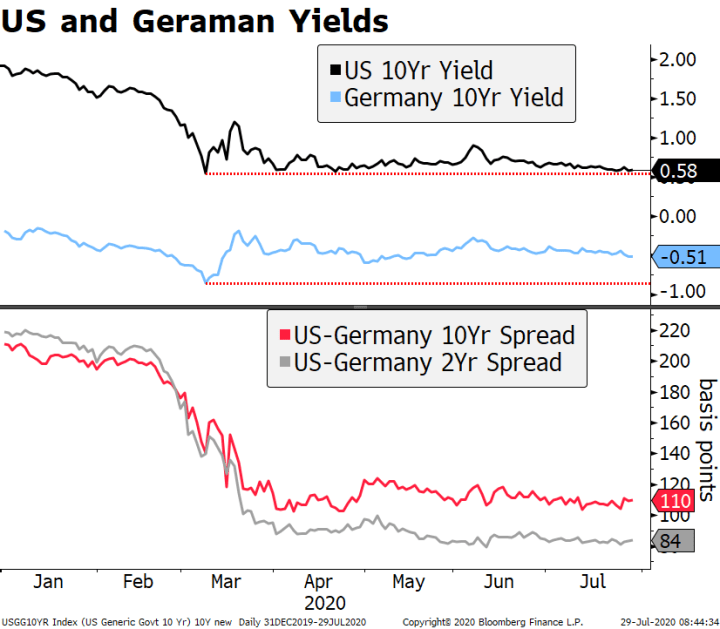

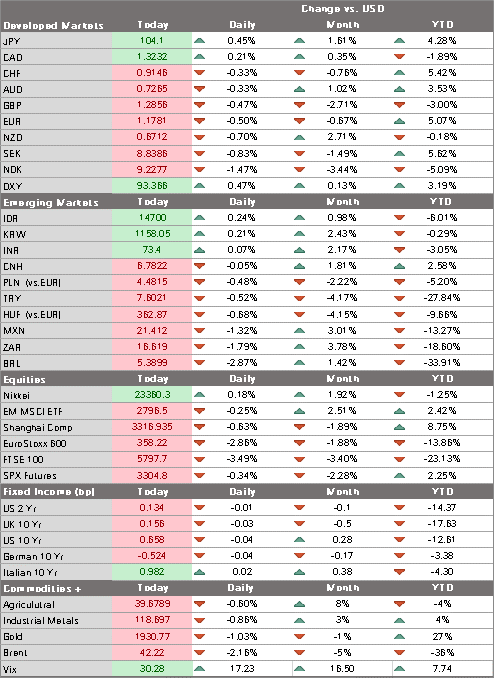

The dollar is taking another stab at the upside. DXY traded yesterday at the highest level since July 24 before ending the day basically flat. It has resumed its climb today but has yet to take out yesterday’s high near 94.594. The next retracement objectives from the June-September drop come in near 94.774 (50%) and 95.489 (62%). Similar objectives for the euro come in near $1.16 and $1.15. Cable is still finding support around the 200-day moving average near $1.2720 but a break below sets up a test of the June 29 low near $1.2250. We continue to view this dollar move as a positioning adjustment rather than a trend change. The broad-based weak dollar trend should eventually resume as we remain negative on the dollar due to the now-familiar combination of an ultra-dovish Fed and softening US economic data. |

Low Death in the "Second Wave", 2020 |

AMERICAS

Speculation is picking up that a compromise on a stimulus package could be reached. We still think it’s a long shot but hope springs eternal. Treasury Secretary Mnuchin will reportedly resume talks with House Speaker Pelosi after telling the Senate Banking Committee yesterday that a targeted relief package is still needed. Pelosi also expressed hope that negotiations would begin again soon but we do not expect her to give much ground.

Indeed, reports suggest House Democrats are working on a new $2.4 trln package as a basis for these negotiations. It could be passed next week and a senior Democratic leader thought that the compromise on the stopgap funding bill might provide an opening for a compromise. That remains to be seen. Senate Republicans were unable to fully coalesce around its original $1 trln package, forcing them to eventually pass a “skinny” bill worth $500 bln or so. It remains to be seen how much they can truly offer but it’s clear to us that the divide remains very, very wide.

Reports suggest Fed Governor Lael Brainard is a top candidate for Treasury Secretary if Biden were to win. Brainard would become the first woman to hold the post and would be a much more conventional choice than Elizabeth Warren. She was previously Undersecretary for International Affairs and she wouldn’t be the first to jump from that post to head up Treasury, as Larry Summers and Timothy Geithner did. Nor would she be the first to jump from the Fed to become Treasury Secretary, as Timothy Geithner did. Regardless, she comes with a wealth of experience but does not come with any Wall Street baggage that progressives might object to. Of course, the point is moot if Biden doesn’t win.

Today is a quiet day in the US. Williams is the only Fed speaker. August durable goods orders are the only data to be reported and are expected to rise 1.4% m/m vs. 11.4% in July. Weekly jobless claims yesterday support our view that the labor market is stalling out. Consensus for the September jobs report is currently 865k, nearly half of the 1.371 mln gain in August and sequentially smaller every month.

Colombia central bank is expected to cut rates 25 bp to 1.75%. At its last meeting August 31, the bank cut 25 bp but said that further cuts will be data-dependent. Since then, inflation has come in at 1.88% in August, the lowest since November 2013 and below the 2-4% target, while real sector data has been weak. Add in lower oil price and there is a strong case for another cut this week, especially with the peso remaining relatively firm.

Banco de Mexico cut rates 25 bp to 4.25% yesterday, as expected. The decision was unanimous and the bank noted downside risks to the economy prevail. As such, we believe the easing cycle can continue, perhaps into early 2021. Most look for only one more cut to 4.0% in Q4 but we think the weak economy will generate more easing than that despite rising price pressures.

EUROPE/MIDDLE EAST/AFRICA

Some UK MPs from the ruling conservative party are looking for ways to block new restrictive measures. Reports claim that as much as 40 Tory MPs want parliament to have a say in new pandemic-related policies. Separately, Chancellor Sunak’s new support scheme was largely well received, but there was some confusion as to what constitutes a ‘viable job’. Some analysts have forecast that the scheme is likely to leave around 2.2 mln people moving from furlough to unemployment, leaving the jobless rate at 9%, more than double the current level.

UK public sector borrowing came in slightly lower than expected. Ex-banks, the August reading was GBP35.9 bln and compares to GBP15.4 bln in July and GBP5.4 bln a year ago. This pushed the debt to GDP ratio up to 101.9% from 100.1% in July and 80.1% a year ago. Yet despite the increased issuance, the UK yield curve remains low with parts of it still negative. That said, the curve is steeper now than it was three months ago and it likely causing some concerns for UK policymakers,

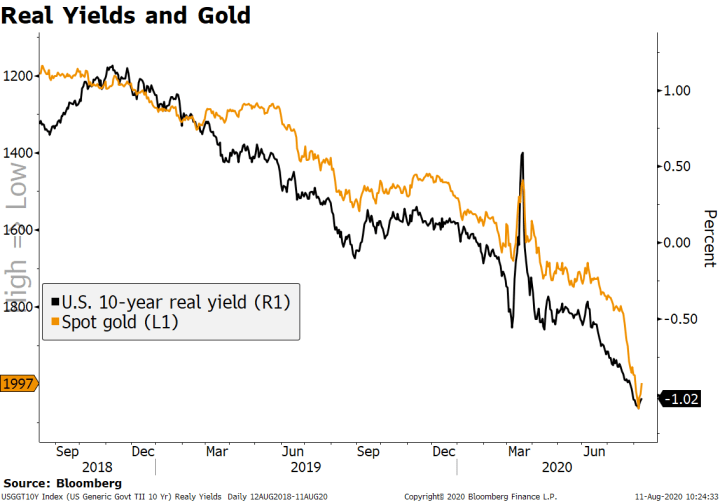

Eurozone M3 growth slowed in August. The gap a revised 10.1% (was 10.2%) in July. It was the first month of deceleration and while it’s too early to sound the alarm, we suspect the ECB will be keeping an eye on this in the months ahead. Its balance sheet continues to expand at a nice clip and liquidity remains plentiful, so much so that the take-up to its latest TLTRO was less than EUR200 bln. But the return of deflation is disconcerting. And with headwinds growing due to the second wave of the virus, we expect another expansion of its asset purchases this year.

We got a pair of surprise rate hikes in the region yesterday. Hungary surprised with a 15 bp emergency hike, coming just two days after a regularly scheduled meeting saw steady rates. It said the hike was “to prevent the current uncertain environment from causing an increase in inflation risks.” Then, Turkey’s central bank surprised with a 200 bp hike in the policy rate to 10.25%. Most were expecting steady rates and some (including us) were expecting a hike in the rates corridor. Strangely enough, the new policy rate is still below the average cost of funding near 10.65% and so it appears the bank will still rely on more stealth tightening to push that average up towards the new ceiling of 13.25%. Both moves were in response to a weak currency, but neither are expected to have much lasting impact if the risk-off environment continues.

| ASIA

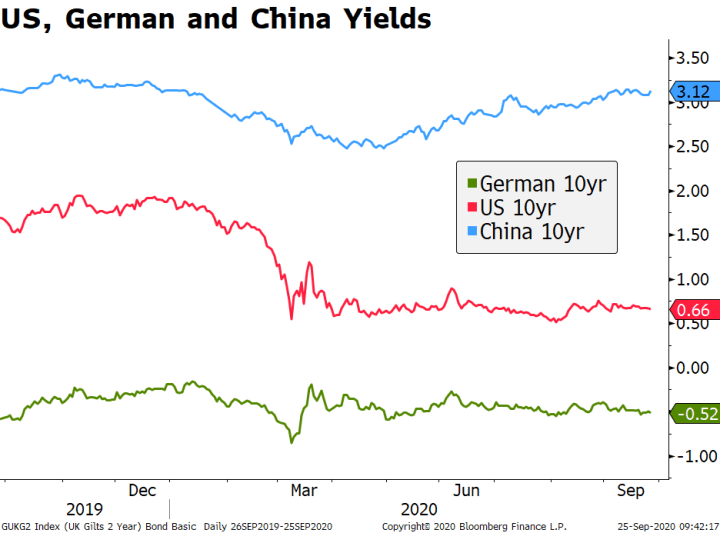

FTSE Russell said it would include China in its flagship World Government Bond Index. The decision comes a year after China was rejected, and will start in October 2021. FTSE Russell is the last of the three major bond indexers to include China, following in the footsteps of Bloomberg Barclays and JP Morgan Chase. When FTSE Russell rejected China a year ago, it cited the need for greater secondary market liquidity, as well as increased flexibility in FX execution and transaction settlement. Despite huge inflows in recent years, foreign investors only account for less than 3% of the $16 trln market. The inclusion in the index, which is fixed-rate, local currency, and investment grade sovereign bonds, implies huge inflows as benchmarking funds rebalance their holdings. |

US, German and China Yields, 2019-2020 |

Tags: Articles,Daily News,Featured,newsletter