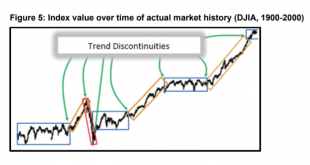

Income is the lifeblood of retirement. In Part 1, wisdom from the early chapters of Jim Otar’s new book about retiree income challenges is explored. A one-person revolutionary. In 2004, I discovered the work of Canadian-based planner and Chartered Market Technician Jim Otar. As a result of his work, I changed my approach to planning. Compared to conventional financial gurus, Jim’s research showcased how stock market cycles changed over time and negatively affected...

Read More »Swiss refiner breaks industry silence on sourcing gold from risky areas

The southeastern region of Madre de Dios in Peru is known for its illegal gold mining practices, but Chave insists PX Precinox does not source any of its precious metal from there. Copyright 2018 The Associated Press. All Rights Reserved. In a rare interview, PX Precinox CEO Philippe Chave defends his company’s record in Peru and says abandoning artisanal miners is not the way to achieve more sustainable and transparent mining practices. For years reports of...

Read More »It Just Isn’t Enough

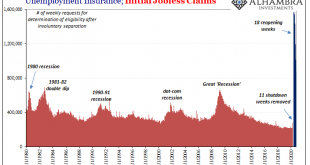

The Department of Labor attached a technical note to its weekly report on unemployment claims. The state of California has announced that it is suspending the processing of initial claims filed by (former) workers in that state. Government officials have decided to pause their efforts for two weeks so as to try and sort out what “might” be widespread fraud. The state is also using this time to get after a substantial backlog of previous initial claims yet to be...

Read More »The Second Act Will Be Worse Than the First: Lockdowns Are Not the Answer

In the first presidential “debate” (I use that word creatively), Joe Biden hinted that he would order a national lockdown in order to “defeat” the covid-19 virus, and there certainly seems to be a consensus in the media and among political elites that if there is another “outbreak” of covid, then the “shelter in place” order will be the law of the land. Many businesses certainly are making plans for such an order, this time not wanting to be caught unprepared as they...

Read More »What “Experts” Miss about Economic Inequality

That’s a question USA Today posed to three “policy experts on the left and the right” in this recent article. The responses, while unsurprising, were nevertheless disappointing. For libertarians, economic inequality itself is not problematic, as long as it is in the context of an unfettered market economy free of government privileges and interference. Of course, that’s not what we have. But instead of advocating for a more free economy to address inequality, the...

Read More »FX Daily, October 9: Animal Spirits Return

Swiss Franc The Euro has fallen by 0.10% to 1.0768 EUR/CHF and USD/CHF, October 09(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The on-again-off-again fiscal stimulus in the US is back on as the White House now supports a broad stimulus program, but not as big as the Democrats $2.2 trillion package. It is the narrative being cited as the rebuilding of risk appetites is the wobble earlier in the week. Chinese...

Read More »Central banks and BIS publish first central bank digital currency (CBDC) report laying out key requirements

Seven central banks and the BIS release a report assessing the feasibility of publicly available CBDCs in helping central banks deliver their public policy objectives. Report outlines foundational principles and core features of a CBDC, but does not give an opinion on whether to issue. Central banks to continue investigating CBDC feasibility without committing to issuance. A group of seven central banks together with the Bank for International Settlements (BIS) today...

Read More »Women 62 percent of doctors under 40 in Switzerland

© Kaspars Grinvalds | Dreamstime.com At the end of 2018, there were 23,000 doctors in Switzerland, according to a recently published study. Overall, 41% of these doctors were women. Among doctors aged 60-64, the percentage was 28%. However, 62% of doctors under 40 were women, a figure which partly reflects the higher numbers of women graduating from Swiss universities. In 2019, significantly more women than men were university graduates in the youngest age band in...

Read More »Most Everything Governments Do Should Be Regarded as “Corrupt”

Governments that redistribute wealth and regulate our daily lives are inherently corrupt. We cheapen the word “corruption” when we reserve it for just a few politicians who break the arbitrary rules. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. Original Article: “Most Everything Governments Do Should Be Regarded as ‘Corrupt’“. You Might Also Like The...

Read More »A Hard Rain Is Going to Fall

The status quo is about to discover that it can’t stop the hard rain or protect its fragile sandcastles. You’ll recognize A Hard Rain Is Going to Fall as a cleaned-up rendition of Bob Dylan’s classic “A Hard Rain’s a-Gonna Fall”. Since the world had just avoided a nuclear conflict in the Cuban Missile Crisis, commentators reckoned Dylan was referencing a nuclear rain. But he denied this connection in a radio interview, stating: “…it’s just a hard rain. It isn’t the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org