Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom. To interrupt now what has already proved to be a seriously impaired rebound should get people thinking more realistically about 2021. Once again, we’re witness to how the need for yet more “stimulus” is being proven – and what that might say about the effectiveness of what’s already been done. That much is universal globally from China to Europe to the US (which we’ll get to in a minute). Beyond this synchronized shortfall there’s reason to

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Consumer Confidence, currencies, economy, Europe, Featured, Federal Reserve/Monetary Policy, Fiscal spending, fiscal stimulus, inflation, jobless claims, Markets, newsletter, QE, stimulus

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Europeans are growing more downbeat again. While ostensibly many are more worried about a new set of restrictions due to (even more overreactions about) COVID, that’s only part of the problem. The bigger factor, economically speaking, is that Europe’s economy has barely moved, or at most not moved near enough, off the bottom.

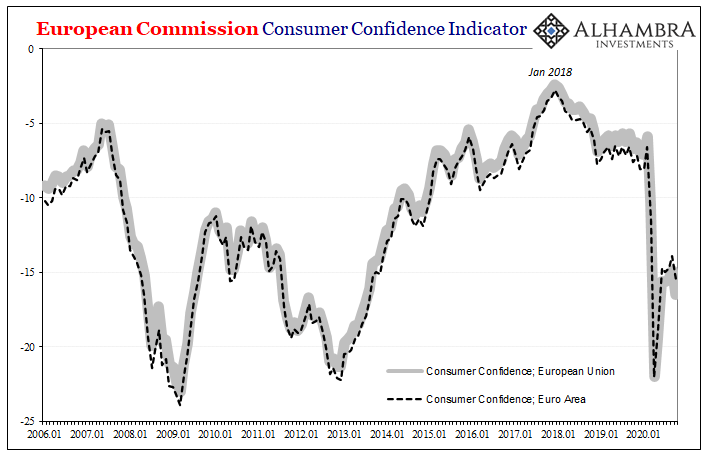

To interrupt now what has already proved to be a seriously impaired rebound should get people thinking more realistically about 2021. Once again, we’re witness to how the need for yet more “stimulus” is being proven – and what that might say about the effectiveness of what’s already been done. That much is universal globally from China to Europe to the US (which we’ll get to in a minute). Beyond this synchronized shortfall there’s reason to key in on Europe’s plight; maybe first, but never an outlier. While it may seem like ancient history, the European economy (Germany, in particular) had started out and remained at the forefront of the quick-developing globally synchronized downturn that spread worldwide right at the outset of 2018 when inflation was, like today, reportedly set to take off. |

European Commision Consumer Confidence Indicator, 2006-2020 |

| In other words, watch Europe for what it might mean elsewhere not too far down the road. The Europeans being China’s best marginal customer during the downturn, it certainly helps explain Xi Jinping’s expected emphasis upon “dual circulation” for the foreseeable future for the Chinese economy, which really means unbacked hope for help from China’s rather than Europe’s consumers.

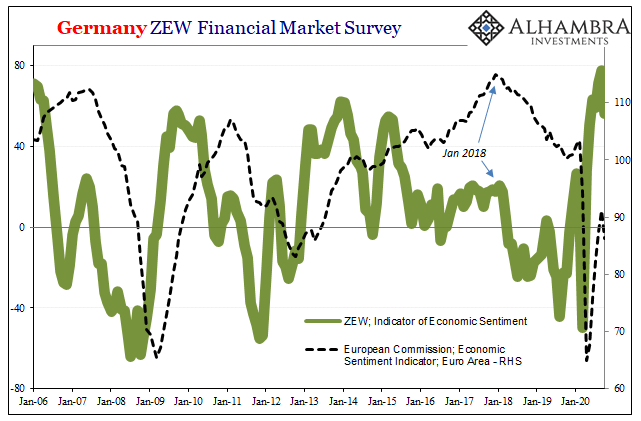

To the latter, the European Commission reported today a sharp drop during October in consumer sentiment in both the European Union as well as the smaller Euro Area bloc. As you can see below, consumers in Europe haven’t exactly been thinking economically happy thoughts much lately anyway. After 6 months of constant “stimulus” and talk about much more of it, and how there can be only more of it, “somehow” European consumers aren’t much into these ideas. Instead, they appear to perceive Europe’s economy right now more like the 2012 or 2008 recessions than a robust rebound of the German business sector’s more globally spaced imagination (even the ZEW faltered in October). |

Germany ZEW Financial Market Survey, 2006-2020 |

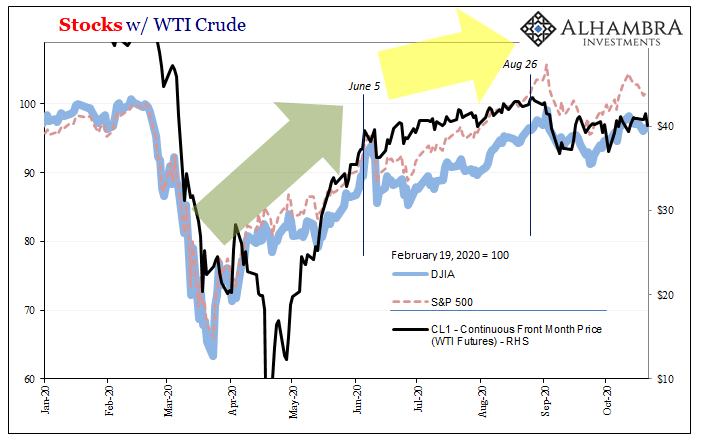

| In this sense, there is some disconnect between perceptions, as there is, I believe, about the US economy – at least according to media reports and interpretations stoked by the same deference to that lovely conventional word. As noted yesterday, though, not even the stock market is so certain any longer about the potentially positive effects of even more “stimulus.”

The need for it, of that there is no doubt anywhere anymore. Like oil, equities have retired the original “V” narrative because, well, like European consumers it is absolutely clear the global system didn’t achieve nearly as much as it “should” have during the summer months of gigantic positives. |

Stocks w/ WTI Crude, 2020 |

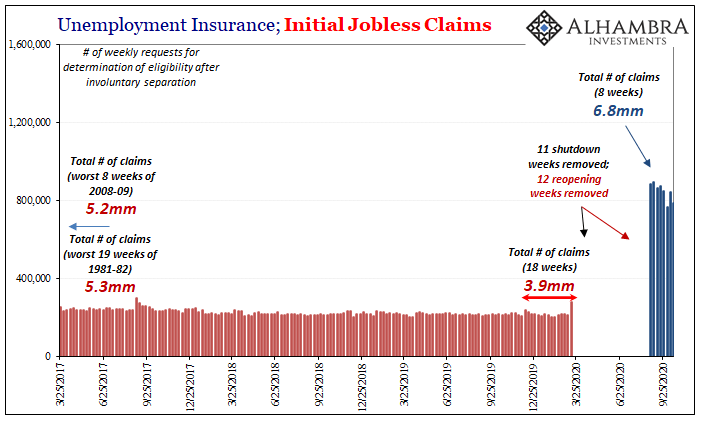

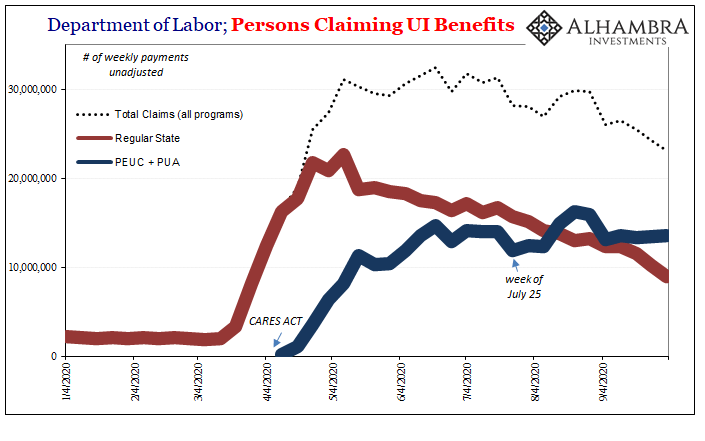

| The Fed playing its role in the puppet show, the labor market continues to crack under severe strain. But here again there’s the conditions for misinterpretation.

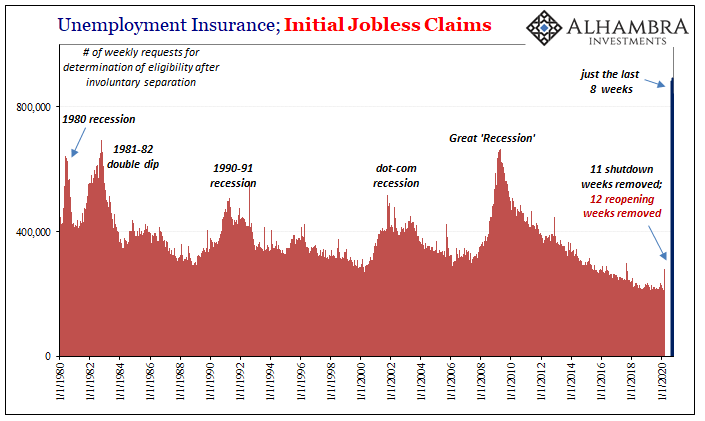

The big minus continues to be what jobless claims represent – and that’s a labor market still in big trouble when it should have emerged out from trouble weeks if not months ago. However, initial claims continue to fall which can leave the exact opposite impression. These, for example, with California finally catching up its numbers, dropped below 800,000 last week (though not for the first time; revised claims for two weeks before had been less). When you look at the presumed improvement since the beginning of this thing, an astronomical peak of 6.9 million during the week (just the one) of March 28, compared to 6.9 million down to 787,000 it sure seems like an enormously significant if not hugely robust improvement. But it’s not. |

Unemployment Insurance; Initial Jobless Claims, 2017-2020 |

| That is making the wrong comparison. To show you what I mean, I’ve removed (above) not just the 11 shutdown weeks from March to May, I’ve further removed the first 12 weeks of the reopening phase (which were awful). That leaves only the last eight weeks (up to and including last week) during which nearly 7 million former American workers filed for benefits payments from their state government.

Remember, the economy is supposed to be doing well on its way back to full recovery by now. Instead, this 6.8 million in jobless claims is, by far, worse than any other eight-week stretch in history before March 2020. It is substantially more labor market destruction than the worst two months of the Great “Recession.” That’s not what anyone had in mind for September and half of October, edging closer and closer to next year at what continues to be an absolutely alarming shortfall. |

Unemployment Insurance; Initial Jobless Claims, 1980-2020 |

|

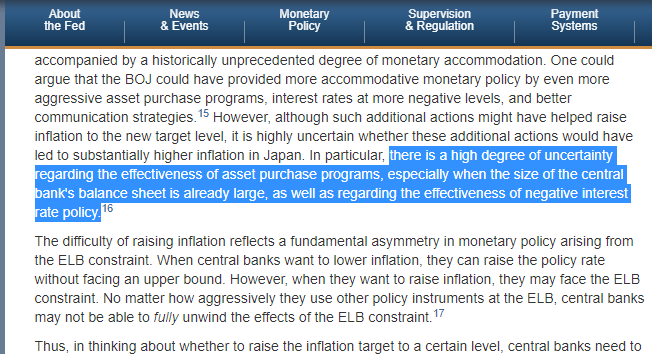

When you take out the prior 33 weeks, the last eight – which, yes, have been the best so far- in historical comparison these are way beyond ugly. Do people really not remember what it was like during the worst two months of 2009 in the US labor market? Of course they do. What’s different is, unbelievably, QE and federal spending. Ben Bernanke during that prior contraction appears today timid and uncertain, President Obama’s widely derided ARRA small and meek, given what Jay Powell and the current federal government are both projecting. Not doing, because QE doesn’t do much, feds spending a stipend not “stimulus”, but both leaving the impression – via a compliant, uncritical media – that this stuff is “ultra-accommodative.” Just don’t ask anyone how it works; and that includes the Fed. |

|

| I’ve written this many times before, and it bears repeating once again. Some have likened QE, in particular, to cocaine or speed or whatever sort of drug that drives its user into a manic-type state. That’s instead what those who think QE is money printing, or fed aid as “stimulus”, might be impressed with.

Closer to the truth, QE is anesthesia. It is designed to put you to sleep or at worst numb enough of your senses so that you don’t realize just how bad off you actually are. Only, in a medical setting there’s a doctor there who actually knows how to fix or cure your ailments; at least prevent your death right there on the spot. In monetary policy, Europe’s like America’s (or Japan’s), you’re in the operating room with gaping wounds thinking Jay Powell’s the attending surgeon when instead he’s only the anesthesiologist. |

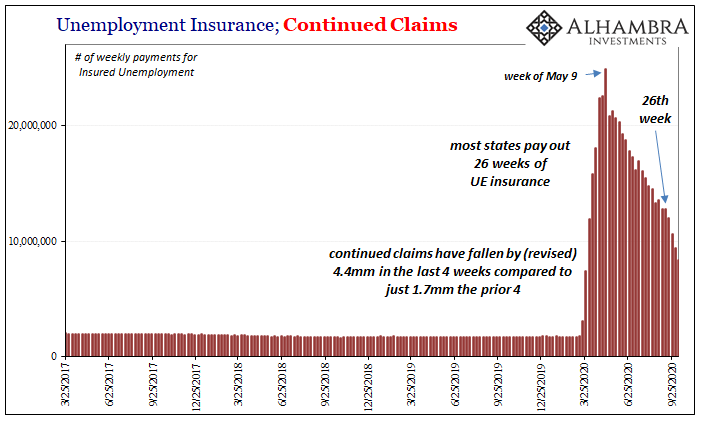

Unemployment Insurance, Continued Claims, 2017-2020 |

| Worse, he has no idea who the real doctor is or when – or if – the actual physician might show up.

But he’s going to give you the drug anyway because, in his view, it’s for your own good. But don’t you dare blame him for what comes next. Patient, heal thyself. |

Department of Labor; Persons Claiming UI Benefits, 2020 |

Tags: Consumer Confidence,currencies,economy,Europe,Featured,Federal Reserve/Monetary Policy,Fiscal spending,fiscal stimulus,inflation,jobless claims,Markets,newsletter,QE,stimulus