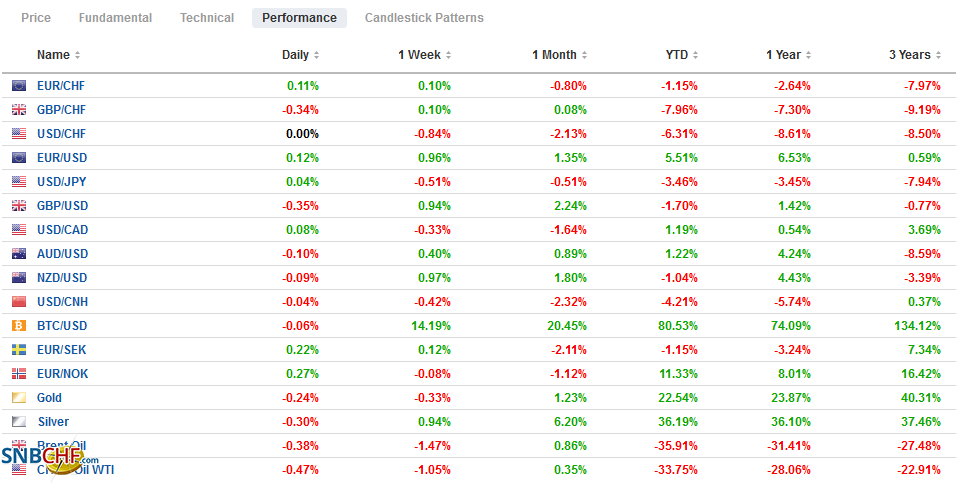

Swiss Franc The Euro has fallen by 0.06% to 1.071 EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: The US dollar is finishing the week on a soft note, falling against all the major currencies. On the week, it is off by at least one percent against most of them, with the Australian and Canadian dollars and Japanese yen, laggards, rising 0.5%-0.75%. Emerging market currencies are largely participating, as well. The JP Morgan Emerging Market Currency Index up almost 1% this week. Turkey, where the central bank disappointed participants by not hiking the one-week repo rate yesterday but hiked the arguably more relevant late loan window by150 bp to14.75%, was not enough to prevent

Topics:

Marc Chandler considers the following as important: $CNY, 4) FX Trends, 4.) Marc to Market, 6a.) GoldMoney's Alasdair Macleod, Currency Movement, Featured, newsletter, PMI, USD

This could be interesting, too:

RIA Team writes The Importance of Emergency Funds in Retirement Planning

Nachrichten Ticker - www.finanzen.ch writes Gesetzesvorschlag in Arizona: Wird Bitcoin bald zur Staatsreserve?

Nachrichten Ticker - www.finanzen.ch writes So bewegen sich Bitcoin & Co. heute

Nachrichten Ticker - www.finanzen.ch writes Aktueller Marktbericht zu Bitcoin & Co.

Swiss FrancThe Euro has fallen by 0.06% to 1.071 |

EUR/CHF and USD/CHF, October 23(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: The US dollar is finishing the week on a soft note, falling against all the major currencies. On the week, it is off by at least one percent against most of them, with the Australian and Canadian dollars and Japanese yen, laggards, rising 0.5%-0.75%. Emerging market currencies are largely participating, as well. The JP Morgan Emerging Market Currency Index up almost 1% this week. Turkey, where the central bank disappointed participants by not hiking the one-week repo rate yesterday but hiked the arguably more relevant late loan window by150 bp to14.75%, was not enough to prevent the currency from falling to record lows, leaving the dollar knocking on TRY8.0. The large equity markets were mixed in the Asia Pacific region. The big winner this week was Hong Kong, where the Hang Seng rose more than 2%. In Europe, the Dow Jones Stoxx 600 is poised to snap a four-day fall. The 0.8% gain near midday reduces the week’s decline to around 1%. The S&P 500 will come into today’s session, threatening to end a three-week advance, nursing a nearly 0.9% loss. The US 10 year yield is firm near 0.85%. It has risen for the last six sessions and is slightly higher today. European yields are mostly softer, led by a 3 bp decline in Italy. Note that the S&P will announce the conclusion of its rating review after the markets close today. The current BBB rating is one notch above Moody’s and Fitch. It has a negative outlook. Gold was holding above $1900 after a brief dip below it yesterday. December WTI is little changed around $40.60, a loss of about 1.3% this week. |

FX Performance, October 23 |

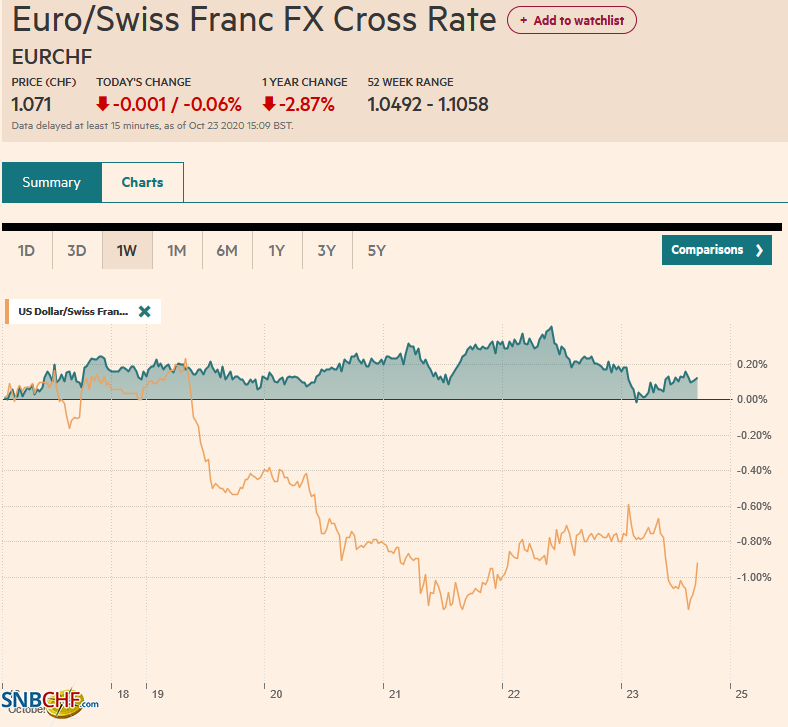

Asia PacificJapan reported September CPI was unchanged from a year ago after a 0.2% in the 12-months through August. Core prices, which exclude fresh food, ticked up to -0.3% from -0.4%. The preliminary October PMI showed a pattern that was experienced by others as well. Manufacturing is faring better than services as the virus continues to threaten. In Japan, the manufacturing PMI rose to 48.0 from 47.7, while the service PMI slipped to 46.6 from 46.9. The composite edged up to 46.7 from 46.6. The BOJ meets next week. It may lower its assessment a little but is not expected to take fresh steps. |

Japan Manufacturing Purchasing Managers Index (PMI), October 2020(see more posts on Japan Manufacturing PMI, ) Source: investing.com - Click to enlarge |

Australia is an exception to the pattern. Its manufacturing PMI slipped to 54.2 from 55.4. The services component rose to 53.8 from 50.8 and lifted the composite to 53.6 from 51.1. The Reserve Bank of Australia meets on November 2, and official comments have been guided to the market to look for fresh measures. However, it is not immediately clear whether it is ready to move or wait until the December 1 meeting.

Yesterday SWIFT reported that the Chinese yuan’s share on its payments network stood at 1.97% in September, up marginally from August. To put it in perspective, consider that the five-year average is 1.87%, and the two-year average is 1.90%. We suggest a new phase in the yuan’s internationalization is unfolding, and it is not about the use of the yuan. It is the integration of Chinese capital markets into global benchmarks and combined with market-opening measures and other access issues, and what many investors see as favorable macro considerations, including attractive rates and an expanding economy, is drawing international interest.

The attempt to push the dollar back above JPY105 failed in Tokyo, and this sent it back to almost JPY104.50. The low for the week was set on Wednesday near JPY104.35. The JPY104 area is defended by options, and one for about $500 mln expires today. The dollar finished around JPY105.40 last week. Near $0.7150, the Australian dollar is at a six-day high in the European morning. It is recovering from a test on the $0.7000-area earlier this week (~$0.7020 was low). Initial resistance is seen near the $0.7160-$0.7180 area. An option at the upper end of that range for almost A$830 mln rolls off today. The PBOC set the dollar’s reference rate at CNY6.6703, which was a little weaker than anticipated. Neither reducing the reserve requirements for forward foreign exchange contracts to zero nor the signaled increase of outbound institutional investment quotas offered much resistance to the yuan’s appreciation. It rose in four sessions this week. The move is not large (the dollar fell by about 0.4% this week), but it has been consistent. In fact, the yuan has fallen in only three weeks since the end of H1.

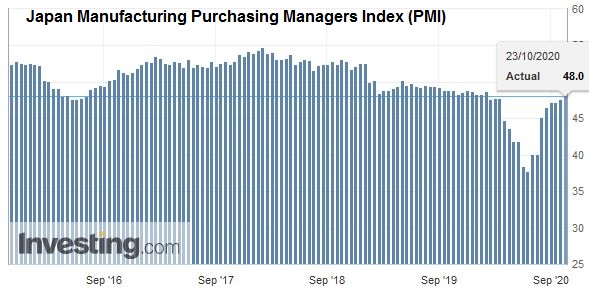

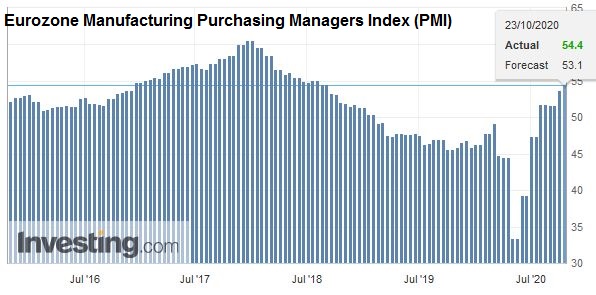

EuropeWith the virus ravaging Europe, it may be early to talk about a new divergence emerging, but that is clearly the risk and reflected in the preliminary PMI readings. Germany’s manufacturing PMI rose to 58.0 from 56.4, which was better than expected. France’s slipped to 51.0 from 51.2, as anticipated. The service sector is contracting. Germany’s fell to 48.9 from 50.6 and was a larger decline than expected. The same is true of France, where the services were already struggling in September. The French services PMI dropped from 47.5 to 46.5, which was also weaker than anticipated. The German composite slipped (54.5 from 54.7), while the French composite fell to 47.3 from 48.5. In the aggregate report, the services PMI fell for the third consecutive month, and the composite fell below the 50 boom/bust level for the first time since June (49.4). The takeaway is that although the ECB is unlikely to move next week, the downside risks officials warned of are materializing. Lagarde’s message will be colored dovish. |

Eurozone Services Purchasing Managers Index (PMI), October 2020(see more posts on Eurozone Services PMI, ) Source: investing.com - Click to enlarge |

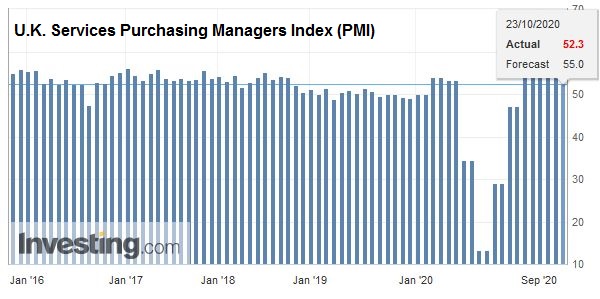

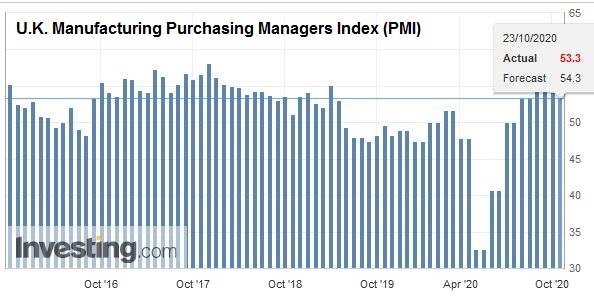

| While the UK reported stronger than expected September retail sales, the October PMI reflected softer economic activity as new social restrictions bite. Gasoline prices did not make much of a difference in September. With them, retail sales rose 1.5% and 1.6% without. The median in the Bloomberg survey was anticipating a 0.2% and a 0.5% increase, respectively. Home improvement and gardening products were particularly strong. Groceries ticked up, while clothing purchases fell. |

Eurozone Manufacturing Purchasing Managers Index (PMI), October 2020(see more posts on Eurozone Manufacturing PMI, ) Source: investing.com - Click to enlarge |

| Online sales accounted for 27.5% of the total compared with a little more than 20% in February. The new social restrictions may impact consumption this month. Yesterday, the Chancellor of the Exchequer boosted government support to ailing business, including making the wage subsidies more generous and new grants for businesses. |

U.K. Services Purchasing Managers Index (PMI), October 2020(see more posts on U.K. Services PMI, ) Source: investing.com - Click to enlarge |

| The UK’s October manufacturing PMI fell to 53.3 from 54.1. It was a little better than feared. The services PMI was considerably weaker than forecast, dropping to 52.3 from 56.1. These combined to drive the composite down to 52.9 from 56.5. It is the lowest since June. The Bank of England meets on November 5, a few hours before the FOMC meeting concludes. It is widely expected to ease policy by boosting its Gilt purchases. There is some risk that it cuts the 10 bp base rate to zero. |

U.K. Manufacturing Purchasing Managers Index (PMI), October 2020 Source: investing.com - Click to enlarge |

The euro initially extended yesterday’s losses in Asia, but support near $1.1780 held, and it has returned to the $1.1855 area in the European morning. Note that a 2 bln euro option at $1.1800 expires today, and a one billion euro option at $1.1850 will also expire. The high for the month was set in the middle of the week, near $1.1880. Near the session highs, the euro is up about 1.1% for the week, which is the largest weekly gain since July. Sterling continues to consolidate within the large range seen on Wednesday as it rallied amid the signal that UK-EU trade talks were resuming. It reached a high then of almost $1.3170. It found support today near $1.3050. There are more than GBP1.1 bln in options struck in the $1.3090-$13100 range that expires today. Although it popped up to nearly $1.3115 in early European activity is has come back offered and is little changed in late morning dealings.

America

The US stimulus talks continue, but approval by the Senate remains a key unknown. In addition to the size of the package, there is several that object to elements, like federal funds for abortions, that makes it unlikely that there will be sufficient votes to join the Democratic Senators to pass the bill. In fact, perceptions that the numbers are not there are now beginning to discourage some Democrats in the House, all of who face re-election, from wanting to return to stop campaigning and return to Washington. The unexpectedly large drop in weekly initial jobless claims, reported yesterday, as California’s figures were updated, and the highest new home sales in 14 years, were cited by some to justify resistance to a large new spending package.

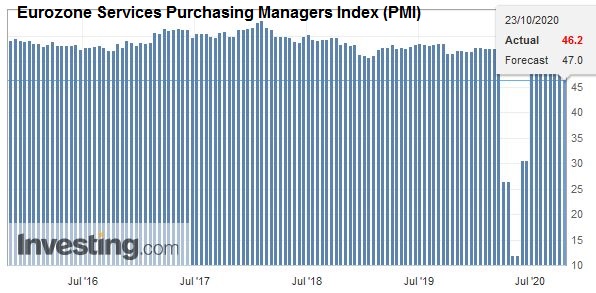

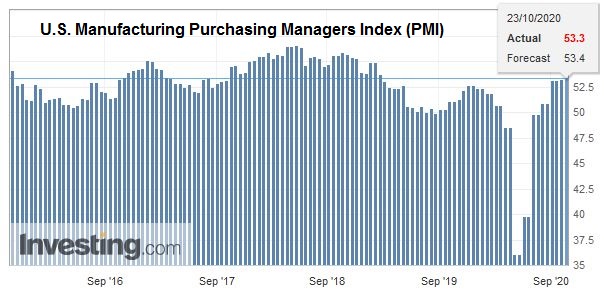

| Markit reports its preliminary PMI for the US today. Manufacturing is expected to have edged higher from 53.2 while services are expected to be steady at 54.6. The composite is unlikely to change much from the 54.3 reading in September. The US economy may prove to be more resilient than Europe’s in this fall surge of the virus, and earlier evidence that the European recovery was stronger is being shaken. |

U.S. Manufacturing Purchasing Managers Index (PMI), October 2020(see more posts on U.S. Manufacturing PMI, ) Source: investing.com - Click to enlarge |

However, it is giving the dollar little succor, even against the North American currencies. The Canadian dollar has edged about 0.6% higher this week (~CAD1.3110). It is the third week in the past four that it has advanced. The US dollar was near six-week lows in the middle of the week (~CAD1.3080). That is where it looks to be heading on its way to the early September low just below CAD1.30. There is an option expiring today for roughly $935 mln at CAD1.3080. The greenback is slipping below MXN21.00. It is falling for the fourth consecutive session and is off about 1% this week. The next target is last month’s low near MXN20.85.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,Currency Movement,Featured,newsletter,PMI