It should be self-evident that a just and moral political regime can only exist in the long term if a sufficiently large number of people actually believe in it. Original Article: “Both Theory and Praxis: Rothbard’s Plan for Laissez-Faire Activism“. This Audio Mises Wire is generously sponsored by Christopher Condon. Narrated by Millian Quinteros. You Might Also Like How Historians Changed the Meaning of...

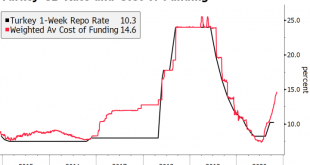

Read More »Turkey Central Bank Preview

We expect the Turkish central bank (CBRT) to deliver a substantial rate hike at Thursday’s meeting but not as aggressive as consensus. Bloomberg’s median expectation is for a 475 bp hike. Our call is for a somewhat less aggressive move (perhaps around 400 bp) because the recent price action is likely to afford the new CBRT administration the confidence not to have to surprise on the upside. We think this makes sense. A large enough move to reaffirm the change of...

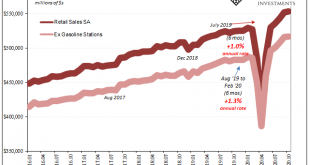

Read More »Extending the Summer Slowdown

A big splurge in September, and then not much more in October. While it would be consistent for many to focus on the former, instead there is much about the latter which, for once, is feeding growing concerns. Retail sales, American consumer spending on goods, has been the one (outside of economically insignificant housing) bright spot since summer. If it succumbs to the slowdown every other economic account is displaying, that could only mean it really has been...

Read More »Media Celebrates after Trump’s Pro-Gold Fed Nominee Gets Blocked

It was only after he entered politics that President Donald Trump began to fully grasp the bias, dishonesty, and fakeness that runs throughout the so-called mainstream media. But gold bugs and sound money advocates have long known to distrust the reporting of establishment news sources. Journalists’ anti-gold and anti-Trump biases converged this week as the Senate took up President Trump’s nomination of Judy Shelton to the Federal Reserve Board. Shelton, a fierce...

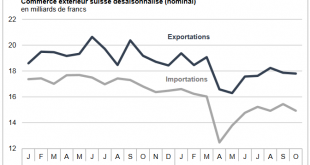

Read More »Swiss Trade Balance October 2020: foreign trade falters

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

Read More »FX Daily, November 19: Surging Virus Saps Risk Appetites

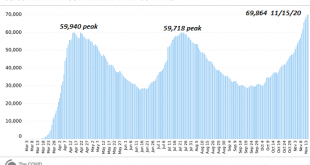

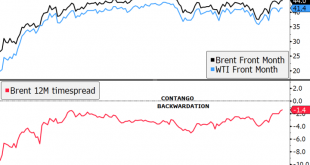

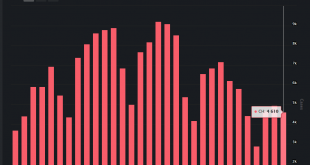

Swiss Franc The Euro is stable by 0.00% to 1.0796 EUR/CHF and USD/CHF, November 19(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that the New York City was closing the schools to contain the virus sent stocks reeling in late North American dealings yesterday and spurred some profit-taking in the Asia Pacific and Europe. Equities in the Asia Pacific region were mostly lower, though China, South Korea, and...

Read More »U.S. Healthcare Is Unraveling

The confidence that there will always be facilities and professionals to care for us is no longer realistic. I’ve covered the systemic problems of U.S. healthcare for over a decade, and as a result I’ve attracted numerous healthcare professionals as correspondents. I’ve been corresponding with some for almost 15 years, and this correspondence has given me a sobering education in the realities of our fully financialized (and thus hollowed-out) healthcare system....

Read More »Dollar Weakness Continues Ahead of US Retail Sales Data

The dollar continues to soften October retail sales will be the US data highlight; Fed manufacturing surveys for November have started to roll out; Republican Senator Alexander opposes Judy Shelton’s nomination to the Fed Newswires reported (again) that a Brexit deal is at hand; Hungary and Poland will veto the EU budget and recovery fund; ECB signaled that they are focused on asset purchases and long-term funding for the next round of stimulus; Hungary is expected...

Read More »Covid, November 19: Swiss ICU numbers reach new peak as infection rate moderates

Deaths because of and with Covid19 Over the last 48 hours, Switzerland’s Federal Office of Public Health (FOPH) reported a further 227 deaths among laboratory-confirmed Covid-19 cases, bringing the death toll to 1,654 since summer and 3,385 since the beginning of the year. Total Covid-19 deaths in Switzerland since the beginning of the pandemic have now reached 3,696 of which 3,385 were laboratory confirmed infections. Hospitalisations The are currently 543 Covid-19...

Read More »FX Daily, November 18: Balancing Pandemic Surge with Optimism about Vaccine

Swiss Franc The Euro has fallen by 0.01% to 1.0806 EUR/CHF and USD/CHF, November 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org