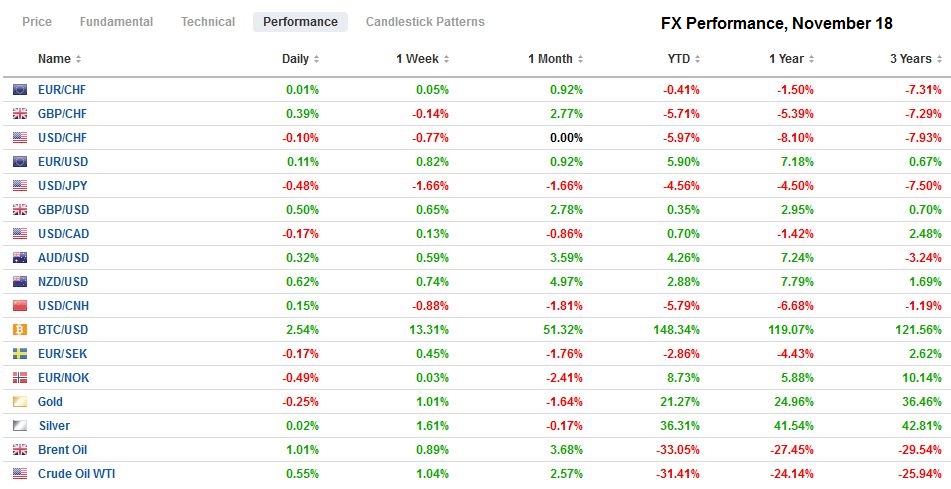

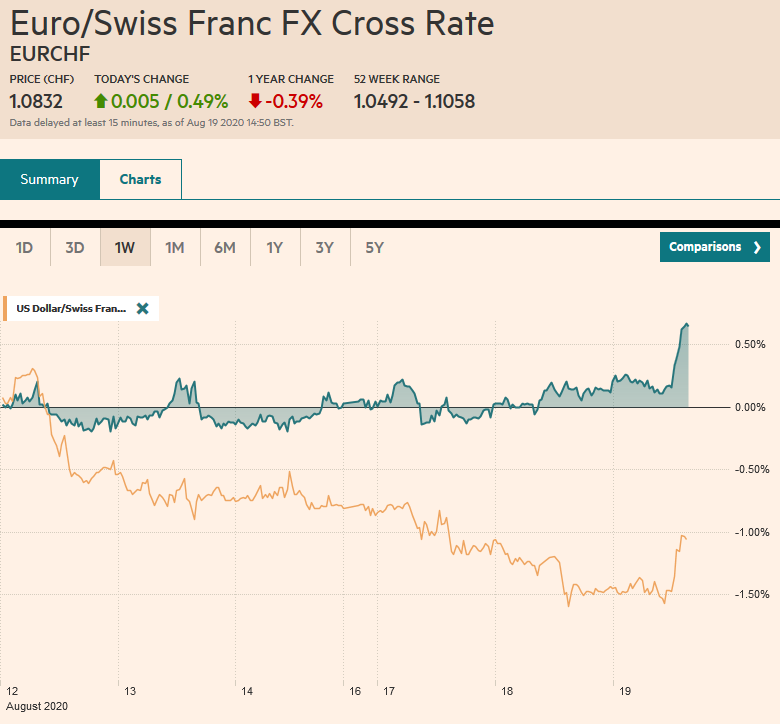

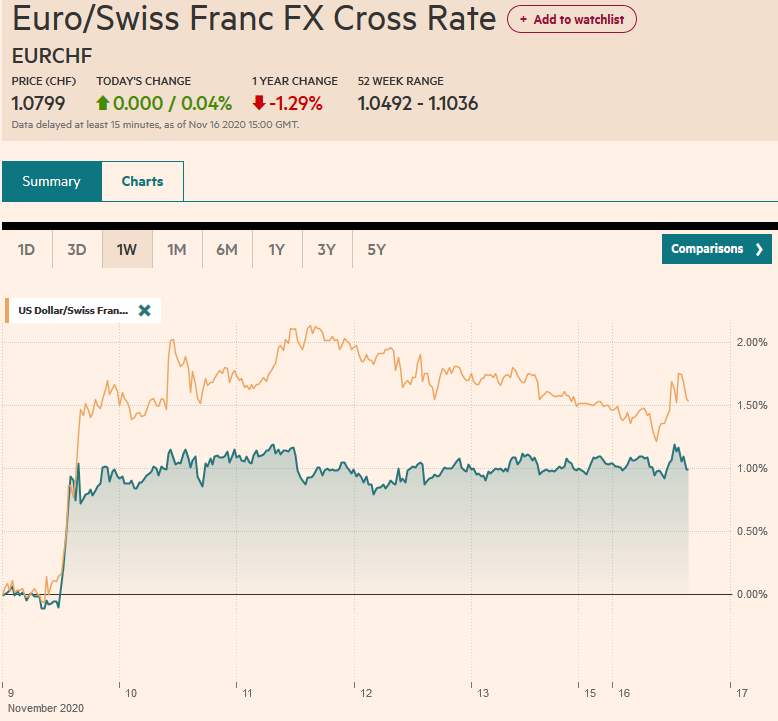

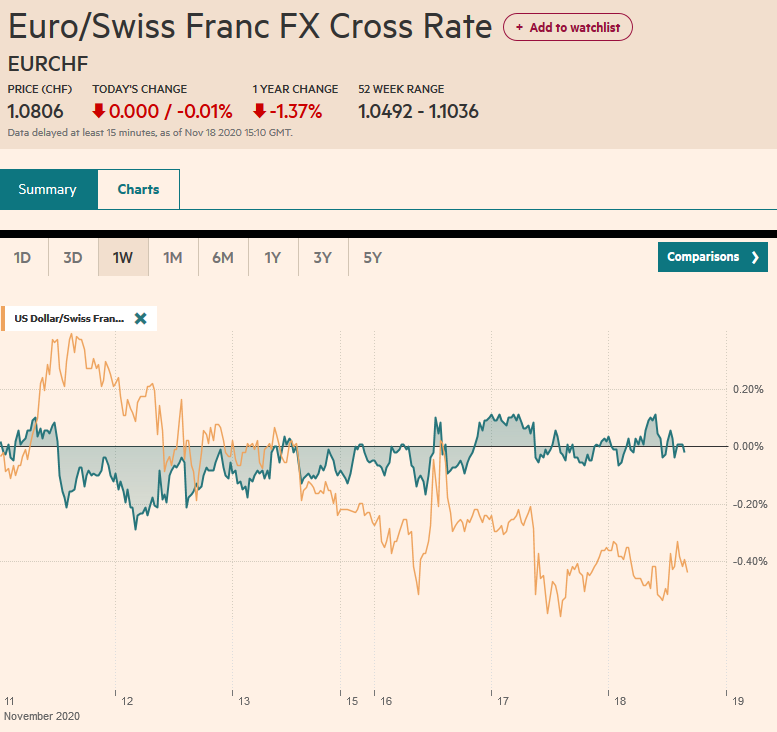

Swiss Franc The Euro has fallen by 0.01% to 1.0806 EUR/CHF and USD/CHF, November 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates Overview: News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600 continues to gyrate within Monday’s range. US shares are trading little changed, with a small upward bias in the NASDAQ futures. Benchmark 10-year bond yields are softer, with new low prints seen in Italy, Portugal, and Greece today. The US 10-year is little changed near 0.86%. The dollar is heavy,

Topics:

Marc Chandler considers the following as important: $CNY, 4.) Marc to Market, 4) FX Trends, China, Currency Movement, Featured, Japan, newsletter, South Korea, trade, U.K., USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Swiss FrancThe Euro has fallen by 0.01% to 1.0806 |

EUR/CHF and USD/CHF, November 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge |

FX RatesOverview: News that Tokyo will go to its highest alert as it faces a rising contagion snapped a 12-day rally in the Nikkei, but most bourses in the Asia Pacific region excluding Japan advanced, though Chinese equities were mixed. European equities are narrowly mixed as the Dow Jones Stoxx 600 continues to gyrate within Monday’s range. US shares are trading little changed, with a small upward bias in the NASDAQ futures. Benchmark 10-year bond yields are softer, with new low prints seen in Italy, Portugal, and Greece today. The US 10-year is little changed near 0.86%. The dollar is heavy, and for the first time since the Pfizer announcement, it is trading back below JPY104. The euro remains firm but below $1.19. The Scandis and Antipodean currencies are doing best. Most emerging market currencies are also firm. The main exceptions are the Turkish lira, where domestic accounts continue to reportedly sell into gains spurred by foreign short-covering, ostensibly expecting a smaller rate hike tomorrow than offshore participants, and the Thai baht, where the central bank is threatening action to curb its strength. Gold and the December WTI contract ae little changed and remain confined to the ranges seen on Monday (~$1865-$1899 and $40.15-$42.10, respectively. Pfizer’s vaccine has passed a key safety check, and it will seek emergency use authorization. AstraZeneca’s vaccine is expected in the coming days or weeks, according to reports. |

FX Performance, November 18 |

Asia Pacific

Japan’s October trade surplus was nearly three times larger than what economists had forecast at around JPY873 bln (~$8.4 bln) as exports were stronger and imports weaker than anticipated. The export slump slowed for the fifth consecutive month, off 0.2% from a year ago, compared with expectations for a 4.5% contraction. Imports were off 13.3%. Economists had projected a greater recovery after September’s 17.4% year-over-year decline. The claim that China’s large trade surplus means that it is not aiding global growth rings hollow in Japan. Its exports to China are up more than 10% year-over-year, while its exports are down 2.5% to the US and 2.6% to Europe. Note that Japan has reported an average trade deficit of JPY43.45 bln a month this year through October compared with an average deficit of JPY142 bln in the first 10 months of 2019.

Several Asian countries are showing increasing concern about their currencies appreciation. We cited Thailand, where the central bank is explicit and is expected to announce new measures at the end of the week. The South Korean won’s appreciation is raising concern in Seoul. The South Korean’s won’s 4.5% appreciation against the dollar this year may overstate its strength given the importance of intraregional trade. Asia is the destination of nearly two-thirds of South Korea’s exports. The recently signed trade agreement (RCEP) will only reinforce this. The won has depreciated against the Chinese yuan (~1.6%) and is flat against the Japanese yen and Taiwanese Dollar. Still, in recent weeks officials have cautioned against rapid won gains. The current account surplus is growing, and the September surplus was the largest in two years. Foreign asset managers have been buyers of Korean bonds this year to the tune of around $50 bln. Foreign investors had been selling South Korean equities in the first three quarters (~$24 bln), but this quarter has turned net buyers (~$4.5 bln). South Korea’s reserves have risen by about $17.7 bln, and some of that gain reflects valuation changes. The KRW1100 level has psychological significance, and the dollar had not traded below it since the middle of 2018 when it bottomed near KRW1054. A retest would seem a reasonable forecast for the middle of next year, but the median forecast in the Bloomberg survey is for the dollar to still be above KRW1100 at the end of next year (KRW1108.50).

The US Treasury created its own foreign exchange model that can be used to calculate the appropriate countervailing duty in dumping cases. We worried that it would set a precedent for other countries to devise their own models. Apparently, earlier this month, the Treasury Department did away with all pretense. It informed the Commerce Department that is responsible for setting the countervailing duties that the yuan was undervalued by 5%. It did not bother with its newly minted model. The lack of transparency makes it difficult to precisely know how China manages a modest pace of yuan appreciation with limited growth in reserves, a large and growing current account surplus, capital inflows, and what appears to be restrained outflows. It is complicated by Chinese exporters able to hold on to their hard currency earnings and by financial engineering. On the other hand, China’s balance of payments shows elevated errors and omissions, suggesting savings overcoming the capital controls. In recent years, the errors and omissions have as large if not larger than the basic balance (current account plus net foreign direct investment).

The dollar has broken back below JPY104 for the first time since Pfizer’s announcement on November 9. Nearby chart support may be seen near JPY103.75, but this month’s low is closer to JPY103.20. Both the Japanese Prime Minister and the BOJ Governor expressed concern about volatility when the dollar broke below JPY104. After reversing lower from $0.7340 yesterday, the Australian dollar found support in the domestic market near $0.7270. It is back within spitting distance of yesterday’s high, which is also the high from November 9. Surpassing it will target the year’s high set on September 1, near $0.7415. The PBOC set the dollar’s reference rate at CNY6.5593, a little stronger than the Bloomberg survey’s average forecast. The dollar traded down to nearly CNY6.54, a fresh two-year low. The latest move extends the yuan’s gains this year to 6.3%. Its 10-year bond yield is at a new high for the year (~3.31%).

EuropeWhile some reports played up the possibility of a UK-EU deal next week, Ramsden, the Deputy Governor of the Bank of England, suggested that the market were pricing in “about a 20%, maybe a 20%-30% chance of no deal.” |

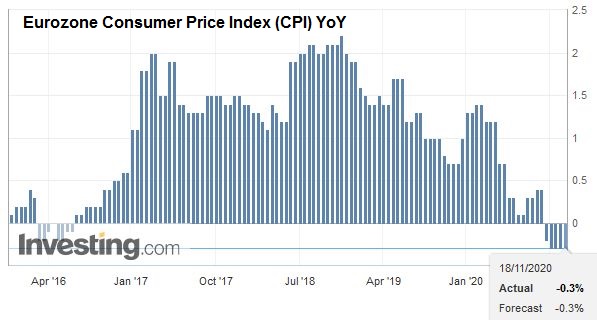

Eurozone Consumer Price Index (CPI) YoY, October 2020(see more posts on Eurozone Consumer Price Index (CPI) YoY, October 2020, ) Source: investing.com - Click to enlarge |

| Talks are ongoing, and the EU’s chief negotiator Barnier is expected to brief the EU on the progress on Thursday or Friday. The UK’s Johnson may have another call with EC President von der Leyen before the weekend. |

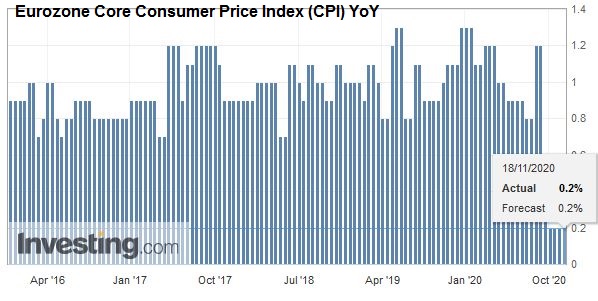

Eurozone Core Consumer Price Index (CPI) YoY, October 2020(see more posts on Eurozone Core Consumer Price Index, ) Source: investing.com - Click to enlarge |

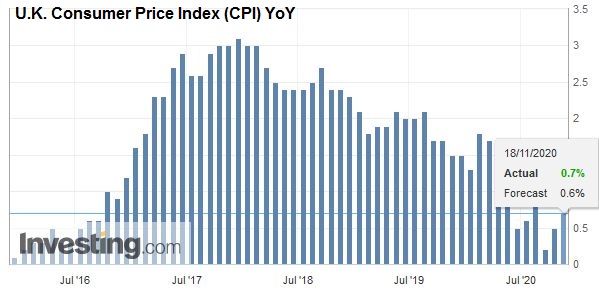

| The UK’s October inflation readings were firmer than economists expected. The preferred measure of CPI, which includes owner-occupied housing costs (which, incidentally, the ECB is reportedly considering including it in its CPI calculations), rose 0.9% from a year ago. Economists had expected an unchanged pace at 0.7%. The core CPI was also firmer at 1.5%, up from 1.3%. It is the highest since July. It finished 2019 at 1.4%. Deflationary pressures are abating quicker than economists assumed among producer price inputs, while deflation in output prices seems to be mostly due to past declines in energy prices. |

U.K. Consumer Price Index (CPI) YoY, October 2020(see more posts on U.K. Consumer Price Index =, ) Source: investing.com - Click to enlarge |

Strong demand is being seen for China’s euro-denominated bond offering. It is selling three-tranches (5, 10, and 15-year). After a 15-year absence, China returned to the euro market last year, and demand was very strong. Recall that China has a $6 bln USD-bond offering in October, and investors, including Americans, bought it.

The euro is firm. After finding support near $1.1850, it is near the upper end of yesterday’s range when it rose to around $1.1895. Recall that it had spiked to $1.1920 on the November 9 Pfizer announcement but came off sharply. For many players, it only makes sense to buy euros above $1.19 if one thinks that the $1.20 level will be overcome. While there is a soft dollar backdrop, the market may be cautious ahead of the ECB meeting next month. Separately, but not completely unrelated, 3-month Euribor, a benchmark funding rate, fell to new record lows today of -0.527%. Sterling is moving higher for the fourth consecutive session to approach $1.33. The high from November 9 was a little above $1.3310. A move above there targets $1.34, but the bigger target is the September 1 high, around $1.3480. Some demand appears to be coming from the cross as the euro eases to a four-day low below GBP0.8940, which is also where the 200-day moving average is found.

America

US October retail sales disappointed yesterday, rising by 0.3% instead of 0.5%, and the September gain was shaved to 1.6% from 1.9%. The core measure eked out a 0.1% gain, and the September series was revised to 0.9% from 1.4%. While consumption was soft, industrial output met expectations for a 1.1% increase, and manufacturing output rose 1%. September’s decline in manufacturing (-0.3%) was revised away, and instead, it rose by 0.1%. The gap between consumption and production may point to inventory accumulation. Today’s data highlight is the October housing starts. The housing market, broadly understood, has been a leading sector since the spring. Four Fed officials speak, and market participants are looking for clues into the central bank’s thinking amid speculation that next month it will lengthen the maturities of the Treasuries it is buying.

Canada reports October CPI figures today. The headline is expected to slip from 0.5% to 0.4%. However, the headline remains distorted by the earlier drop in oil prices. The central bank puts more weight on the core measures, and they are expected to remain steady between 1.5% and 1.9%. Mexico reports its latest weekly reserve figures. They trend higher.

Shelton failed to clear a procedural vote in the Senate yesterday, which just about dooms her candidacy. When it became clear that the votes were not there, Senate Majority Leader McConnell switched his vote, allowing him to later bring up the nomination. The Senate is not in session next week for the Thanksgiving holiday. A Democrat will replace a Republican (Arizona) at the end of the month, further narrowing the Republican majority. The nomination for the other vacancy is not nearly as controversial and will easily be approved. This may mean that Biden would get nominate a Fed governor in 2020. The terms of Powell as Chair and both vice-chairs (Clarida and Quarles) end in early 2022.

The US dollar initially ticked above yesterday’s high against the Canadian dollar and now has reversed course and taken out yesterday’s low to test the CAD1.3055 area. There is little in the way to block a return to CAD1.30, where a $1.1 bln option is set to expire today. That said, the intraday technicals are stretched, and there is scope for a bounce in the North American morning toward CAD1.3085. The greenback is a little lower against the Mexican peso but holding above the week’s low near MXN20.1550. Last week’s low was near MXN20.0340. Look for North American participants to sell into the dollar’s upticks being seen in late European morning turnover. Resistance is seen in the MXN20.28-MXN20.33 area.

Graphs and additional information on Swiss Franc by the snbchf team.

Tags: #USD,$CNY,China,Currency Movement,Featured,Japan,newsletter,South Korea,Trade,U.K.