Reliance on fossil fuels is putting the planet under increasing pressure. Keystone / Larry W. Smith The latest United Nations Human Development Report has found that countries, including Switzerland, still struggle to achieve high levels of human development without straining the planet. My specialty is telling stories, and decoding what happens in Switzerland and the world from accumulated data and statistics. An expatriate in Switzerland for several years, I...

Read More »It Should Shock Us That There’s Any Consumer Price Inflation at All

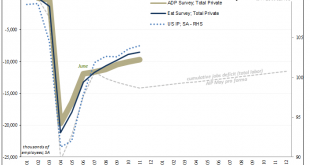

Thanks to lockdowns, high unemployment, and general uncertainty and fear over covid-19, the personal saving rate in the United States in October was 13.6 percent, the highest since the mid-1970s. This is down from April’s rate of 33.7 percent, which was the highest saving rate recorded since the Second World War. Moreover, among those who received “stimulus” checks under the CARES Act, only 15 percent of those surveyed in a National Bureau of Economic Research (NBER)...

Read More »Consumers, Too; (Un)Confident To Re-engage

There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”,...

Read More »Krankenzusatzversicherer: FINMA sieht umfassenden Handlungsbedarf bei Leistungsabrechnungen

Die Eidgenössische Finanzmarktaufsicht FINMA stellt aufgrund ihrer jüngsten Analysen fest, dass Rechnungen im Bereich der Krankenzusatzversicherung häufig intransparent sind und zum Teil unbegründet hoch oder ungerechtfertigt scheinen. Die FINMA erwartet von den Versicherern ein wirksameres Controlling, um solchen Missständen zu begegnen. Zudem fordert die FINMA die Versicherer auf, die Verträge mit den Leistungserbringern zu überprüfen und wo nötig zu verbessern....

Read More »Fed Recommits to Misleading the Public About Inflation

Did the Federal Reserve just usher in the next phase of the U.S. dollar’s decline? On Wednesday, the central bank recommitted to leaving its benchmark interest rate near zero for the foreseeable future. Fed officials also vowed to keep pumping cash into financial markets. Following Fed chairman Jerome Powell’s remarks, the wavering U.S. Dollar Index turned down – hitting a fresh new low for the year. Gold gained modestly on the day while silver got a bigger boost to...

Read More »Switzerland Construction prices fell by 0.2 percent in October 2020

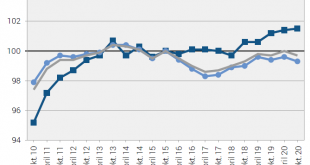

17.12.2020 – The construction price index recorded a decline of 0.2% between April and October 2020, reaching 99.7 points (October 2015 = 100). This result reflects a decline in building prices and a slight growth in civil engineering prices. Year on year, construction prices remained stable. These are some of the findings from the Federal Statistical Office (FSO). Development of the construction price index in Switzerland, October 2020 - Click to enlarge...

Read More »What Did Hamper Growth ‘In A Few Months’

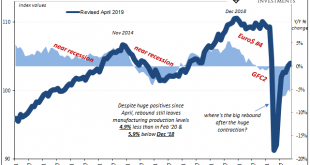

Over here, on the other side of that ocean, the US economy can only dream of the low levels Chinese industry has been putting up this late into 2020. At least those in the East are back positive year-over-year. Here in America, manufacturing and industry can’t even manage anything like a plus sign. Summer slowdown extends in Industrial Production. According to the Federal Reserve, the outfit which has kept tabs on this economic sector for more than a century, the...

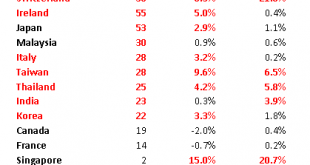

Read More »Some Thoughts on the Latest Treasury FX Report

The US Treasury’s latest “Macroeconomic and Foreign Exchange Policies of Major Trading Partners of the United States” report named Switzerland and Vietnam as currency manipulators. Both countries came under scrutiny in the last report and so this week’s announcement was only surprising in that it was made by a lame duck administration that will be gone in a month. RECENT DEVELOPMENTS This is the first Treasury FX report since January. In previous administrations, the...

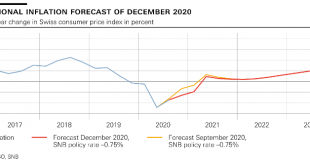

Read More »Monetary policy assessment of 17 December 2020

Swiss National Bank maintains expansionary monetary policy The coronavirus pandemic is continuing to have a strong adverse effect on the economy. Against this difficult backdrop, the SNB is maintaining its expansionary monetary policy with a view to stabilising economic activity and price developments. The SNB is keeping the SNB policy rate and interest on sight deposits at the SNB at −0.75%. In light of the highly valued Swiss franc, the SNB remains willing to...

Read More »Wieso (Teil-)Lockdowns nicht gerechtfertigt sind – Einer Kurz-Analyse der Zahlen.

Täglich werden wir von den Medien mit Behauptungen und Schocknachrichten in die kollektive Schockstarre getrieben. Heute schauen wir uns die Zahlen zu den Ansteckungsorten an (Quelle: blick.ch): Von diesen 65’000 Personen gaben 71 Prozent, also über 46’000 Personen, den vermuteten Ansteckungsort an. Familienmitglied 29,6 Prozent Unbekannt 29,5 Prozent Anderer Kontakt 16,7 Prozent Arbeit 11 Prozent Privatfest 3,9 Prozent Bar/Restaurant 2,8 Prozent Medizinisches und...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org