There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality). Bathed in the unearned glow of the Great “Moderation”, central banking’s greatest thinkers untroubled by no longer thinking about finance or money began to presume they had figured out a way to manipulate “confidence” to such a degree that it would allow them some substantial degree of control over the entire business cycle. Down as well as up. Ben

Topics:

Jeffrey P. Snider considers the following as important: 5.) Alhambra Investments, Alan Greenspan, Business cycle, consumer spending, currencies, economy, EuroDollar, eurodollar system, expectations policy, Featured, Federal Reserve, Federal Reserve/Monetary Policy, jay powell, Markets, newsletter, QE, Recession, recovery, Retail sales

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| There is a lot of evidence which shows some basis for expectations-based monetary policy. Much of what becomes a recession or worse is due to the psychological impacts upon businesses (who invest and hire) as well as workers being consumers (who earn and then spend). Once the snowball of macro contraction begins rolling downhill, rational prudence dictates some degree of caution on all parts (pro-cyclicality).

Bathed in the unearned glow of the Great “Moderation”, central banking’s greatest thinkers untroubled by no longer thinking about finance or money began to presume they had figured out a way to manipulate “confidence” to such a degree that it would allow them some substantial degree of control over the entire business cycle. Down as well as up. Ben Bernanke, among others, swallowed this view hook, line, and sinker (along with the adoration and attention it necessarily brought them). After all, he said, look at the nineties and 2000’s (before August 2007, obviously). With the tiny dot-com recession (why don’t stock crashes by themselves create depressions anymore?) the lone economic blemish in that 16-year span between 1991 and 2007, policymakers were riding high as to their emotional exploitation scheme. |

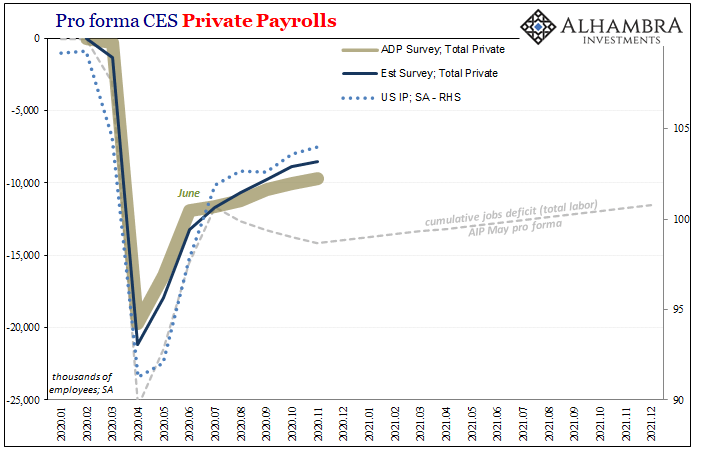

Pro forma CES Private Payrolls, 2020-2021 |

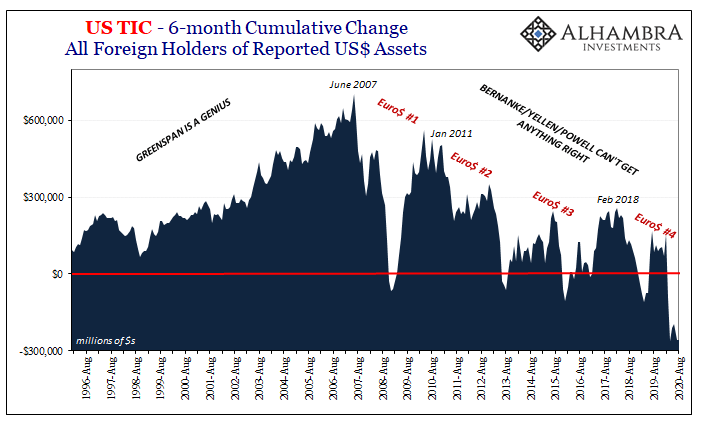

August 2007, however, should have awoken deep skepticism; maybe it hadn’t been pop psychology which had produced the near-unbroken “moderation” of the long prior span. Perhaps Federal Reserve officials, in particular, should have paid much closer attention to not just what Salomon Brothers had been up to at the start of it, more importantly why these “brothers” were doing these things and the potentially grave implications of everyone else in the money dealer family doing much the same.

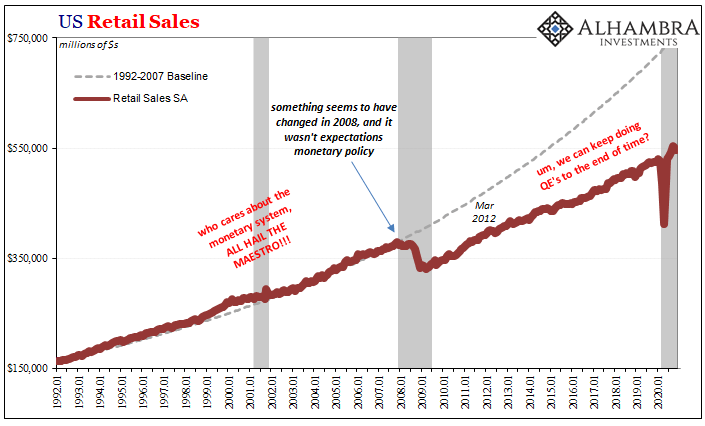

In other words, what if the monetary system had drastically changed (which Greenspan’s crew knew) and its unappreciated, decidedly immoderate ascent had been responsible for those particular 16 years? What good might monetary policy be with no money to offer attempting instead to manipulate happy thoughts throughout an economy recoiling in the wake of widespread, obvious (to any honest person operating outside the close central bank orbit) money shortages? Subprime mortgages nothing, this pretty much sums up the Great “Recession” as well as what didn’t follow it. Now 2020. The year of COVID, no doubt, but no less monetarily dry. Officials are thumping their chests about how well they must’ve performed given the lack of another Lehman, but like the original Lehman (which I still have more to say here) they’ve got it all wrong. But this part Federal Reserve Chairman Powell has right, warning Congress at the end of last month:

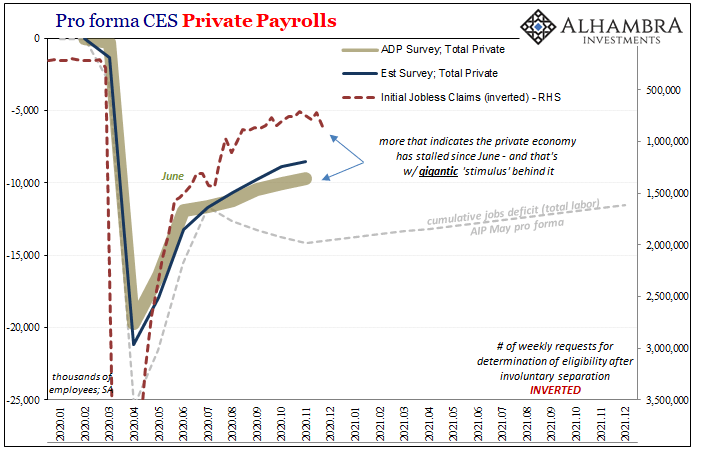

Again, the brief sparkle of truth underlying the expectations nonsense. This year, Powell’s Fed has tried Japan-style QE, Japan-style inflation targeting, and even Japan-surpassing lies about “digital money printing.” All of it with the same Japan-like goal in mind: making people “confident that it is safe to re-engage in a broad range of activities.” Uh oh. |

Pro forma CES Private Payrolls, 2020-2021 |

|

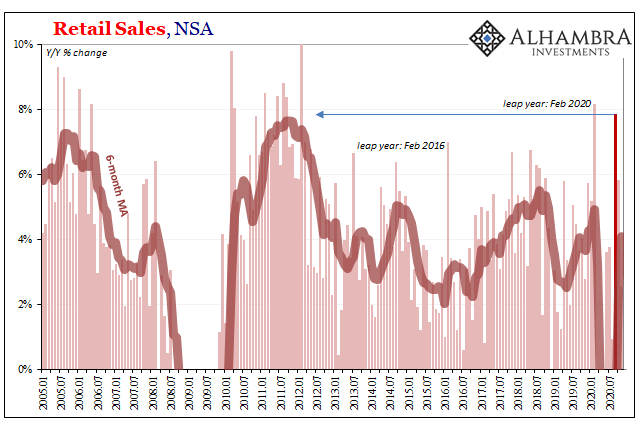

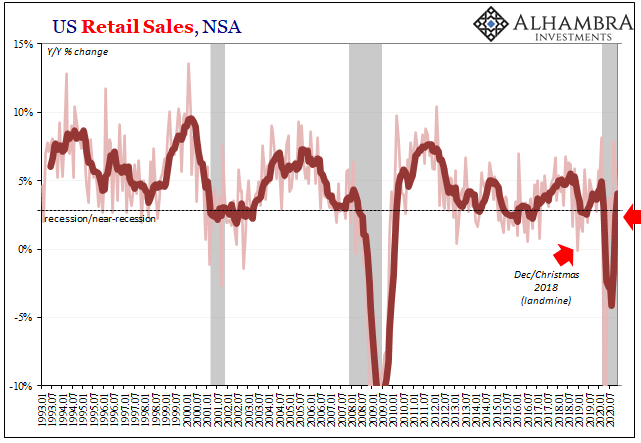

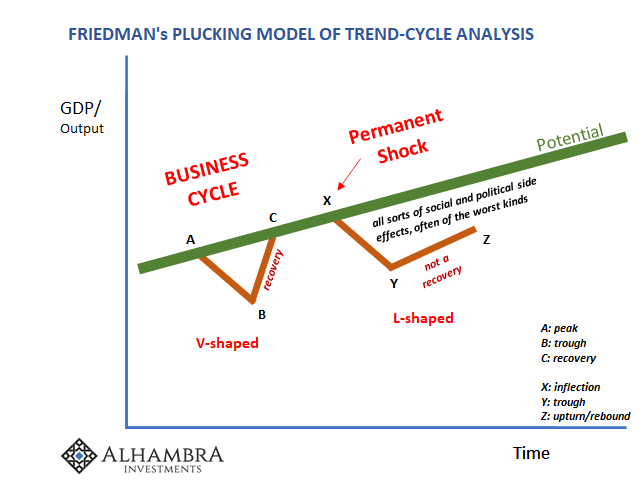

As we’ve catalogued for months now, the re-engaging part never even got halfway and now the rebound’s down to not yet nil but closing in again on nil. The labor market, most importantly, most of all.One of the very few indications otherwise had been US Retail Sales – and only for a brief time. In September, Americans apparently splurged and did so in a way that was, for once, at least plausibly consistent with the level of activity a “V”-shaped trajectory would feature. Overall sales growth had risen by the most in unadjusted terms (outside of leap year Februarys with their 29th day advantages) since before the 2012 (Euro$ #2) slowdown (the end of all recovery hopes). |

Retail Sales, NSA 2005-2020 |

| Was that a sign of things to come, an actual acceleration as consumers looked upon a resurgent labor market and, as Powell said, re-engaged in immoderate spending? Or, had it been merely the same outlier jump brought about artificially by some large government handouts and subsidizing stipends?As noted yesterday, the production side of the economy (which includes a healthy proportion of the unhealthy services side) has been unequivocal on which one; producers haven’t just been betting on the latter, they are actively suppressing their own activities having already been convinced of it. |

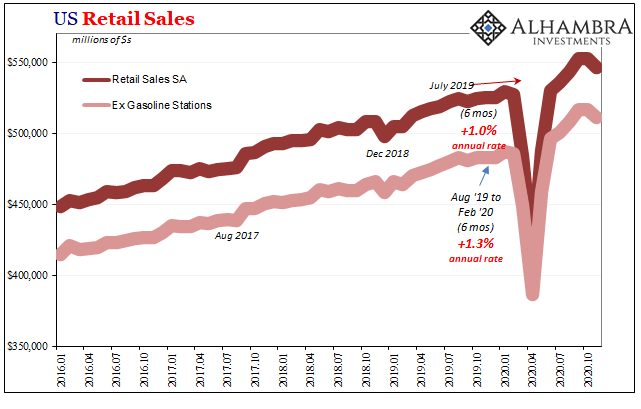

US Retail Sales, 2016-2020 |

| Now the updated spending figures for October and thus November (released today). Retail sales have declined, seasonally-adjusted, in both (October’s estimate was revised downward), with November’s, a key month for the all-important Christmas period circled on every single retailer’s calendar, coming in with a significant monthly negative at the worst time. |

US Retail Sales, NSA 1993-2020 |

|

In the unadjusted series, year-over-year total retail sales were up just 2.52%! That’s right back down into recession territory after having been in somewhat “V” shape for only the one month. Following a huge contraction earlier this year after which symmetry already proposes an equally huge rebound, massive stipends abound, QE all over the place, and yet there remains serious reluctance “to re-engage in a broad range of activities.”Powell, like most, will point to COVID and a second wave of non-economic factors beginning with unnecessary interruptions to the economy. Of course he will; he already has. Workers always suffer the most under the deflationary strain central banks never time; Keynes was exactly right about this, and the Federal Reserve’s entire history – including how wrong it was about the Great “Moderation” – a litany of tragic errors more than establishing what used to be common knowledge. |

US Retail Sales, 1992-2020 |

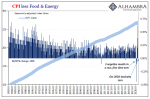

| The Great Inflation, like the Great Depression, only its most glaring.

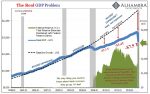

The Great “Recession” and its aftermath, what my co-host Emil Kalinowski wisely calls this Silent Depression, still ongoing, would be right at the top of this list if it hadn’t been for all that manipulation and squandered good faith wasted by the Greenspan “put” which doesn’t in reality exist. “To re-engage in a broad range of activities” will need more than vaccines and additional stipends, however enormous-sounding; it sure requires something other than QE. |

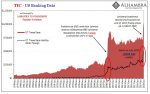

US TIC, 1996-2020 |

Friedman's Plucking Model of Trend-Cycle Analysis |

Tags: Alan Greenspan,Business Cycle,consumer spending,currencies,economy,EuroDollar,eurodollar system,expectations policy,Featured,Federal Reserve/Monetary Policy,federal-reserve,jay powell,Markets,newsletter,QE,recession,recovery,Retail sales