Blockchain technology is yielding tremendous innovation and value creation for consumers and businesses around the world. As the technology becomes more mainstream, companies need scalable, secure, and sustainable infrastructure on which to grow their businesses and support their networks. Google Cloud believes it can play an important role in this evolution. Building on their existing work with blockchain developers, exchanges, and other companies in this space,...

Read More »Covid: weekly cases and hospitalisations fall further as Switzerland drops nearly all measures

This week, 118,555 new Covid-19 cases were reported in Switzerland, down 25% from the 157,683 cases reported a week earlier. The reported number of Covid-19 patients hospitalised also fell 20% from 492 to 392 across the week. Photo by Polina Tankilevitch on Pexels.comCovid-19 deaths were also down. Across the week, 61 Covid-19 related deaths were reported, a figure 13% lower than the 70 reported the week before. In addition, the number of Covid-19 patients in...

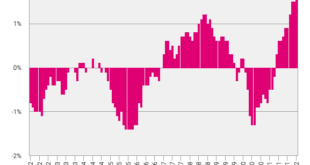

Read More »Consumer prices increased by 0.2% in January

Swiss consumer price inflation increased in January, data from the Federal Statistical Office showed on Friday. Consumer prices rose 1.6 percent in January, following a 1.5 percent increase each in December and November. Economists had forecast inflation to remain unchanged at 1.5 percent. On a monthly basis, consumer prices grew 0.2 percent in January, after a 0.1 percent fall in the previous month. Prices for hotel accommodation and second-hand cars increased in...

Read More »Money and Savings Are Not the Same Thing

In the National Income and Product Accounts (NIPA), savings are established as the difference between disposable money income and monetary outlays. Disposable income is defined as the summation of all personal money income less tax payments to the government. Personal income includes wages and salaries, transfer payments, income from interest and dividends, and rental income. The NIPA framework is based on the Keynesian view that spending by one individual becomes...

Read More »Bitcoin-Spenden an Freedom Convoy auf Blacklist

In Kanada hat Premiere Minister Trudeau eine Art Notfallsituation im Zusammenhang mit Trucker-Protesten ausgerufen. Diese Maßnahme erlaubt es der Regierung Bankkonten ohne Gerichtsbeschluss zu beschlagnahmen. Doch wie versucht die kanadische Regierung an die Bitcoin-Spenden an die Trucker des Freedom Convoys zu kommen? Bitcoin News: Bitcoin-Spenden an Freedom Convoy auf Blacklist Ohne die Keys für Bitcoin-Wallets, kommt die Regierung zwar nicht an die gespendeten...

Read More »Glencore sets aside $1.5bn to settle UK, US and Brazil probes

Glencore says that the market is deteriorating for lead smelters with no active mine. (Image of Sudbury nickel smelter.) Courtesy of Glencore. Glencore expects to resolve bribery and corruption investigations in the UK, US and Brazil this year and has set aside $1.5 billion (CHF1.4 billion) to cover potential fines and costs. Neil Hume, Financial Times News of the provision came as the London-listed miner and commodity trader announced record earnings on the...

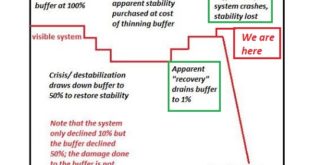

Read More »How Empires Die

When the state / empire loses the ability to recognize and solve core problems of security and fairness, it will be replaced by another arrangement that is more adaptable and adept at solving problems. From a systems perspective, nation-states and empires arise when they are superior solutions to security compared to whatever arrangement they replace: feudalism, warlords, tribal confederations, etc. States and empires fail when they are no longer the solution, they...

Read More »How Not to Think About Gold

Monetary Metals has been covering gold and silver markets for over ten years. Throughout that time, there’s been no shortage of new and old commentators talking about the drivers of gold and silver prices. Unfortunately, the vast majority of this analysis is just plain wrong. Whether it’s a company trying to sell you something, or a big investment bank. Gold and silver defy conventional commodity analysis. And plotting the gold price against the money supply, or...

Read More »SNB Jordan: Strong Swiss Franc limits Swiss inflation

SNBs Jordan Strong CHF limits swiss inflation See no sign swiss wage price cycle Inflation stubbornly above 2% would lead to policy tightening Difficult to say whether global rates have turned, much still depend on economic development CHF has remained stable in real terms Asked about real estate prices, Jordan says monetary policy aims primarily at price stability The SNB is not investing in crypto currencies The USDCHF has moved to new session lows (higher CHF)...

Read More »LP-Skitag

Am Samstag, 26. Februar 2022 ist es wieder so weit. Die LP führt ihren jährlichen Skitag im – bei fast jeder Abstimmung freiheitlichen – Hoch Ybrig durch. Treffpunkt 09:00 an der Talstation Laucheren (also an der Talstation mit Sesselbahn). Wir hoffen auf gutes Wetter und tolle Pistenverhältnisse und freuen uns auf euer zahlreiches Erscheinen.

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org