The pandemic has created major challenges at ports delivering goods around the world. Copyright 2021 The Associated Press. All Rights Reserved Swiss economic experts expect a significant economic slowdown as supply chain bottlenecks, inflation and pandemic restrictions persist in many parts of the world. On Thursday, the State Secretariat for Economic Affairs (SECO) announcedExternal link that the economic expert group has lowered the growth forecast for Switzerland...

Read More »Natural and Neutral Rates of Interest in Theory and Policy Formulation

Interest has a title role in many pre-Keynesian writings as it does in Keynes’s own General Theory of Employment, Interest, and Money (1936). Eugen Böhm-Bawerk’s Capital and Interest (1889), Knut Wicksell’s Interest and Prices (1898), and Gustav Cassel’s The Nature and Necessity of Interest (1903) readily come to mind. The essays in F.A. Hayek’s Profits, Interest, and Investment (1939), which both predate and postdate Keynes’s book, focus on the critical role that...

Read More »Swiss National Bank, Banque de France and BIS conclude successful cross-border wholesale CBDC experiment

Central bank digital currencies (CBDCs) can be used effectively for international settlements between financial institutions, as shown in the newest wholesale CBDC experiment concluded by the Swiss National Bank (SNB), the Banque de France (BdF) and the Bank for International Settlements (BIS). The recently completed Project Jura explored settling foreign exchange (FX) transactions in euro and Swiss franc wholesale CBDCs as well as issuing, transferring and redeeming...

Read More »A Global JOLT(s) In July

The Bureau Labor Statistics reported today another huge month for Job Openings (JO). According to their methodology (which I still believe is flawed, but that’s not our focus this time), the level for October 2021 (JOLTS updates are for one month further back than payrolls) was a blistering 11.03 million. It wasn’t a record high, though, as that was set back in July. Yes, the number remains upward in the stratosphere, but it has been in the same general area of it...

Read More »“Digitales Notenbankgeld – und nun? (CBDC—What Next?),” FuW, 2021

Finanz und Wirtschaft, December 8, 2021. PDF. I draw some conclusions from the CEPR eBook on CBDC, namely: Banks will change, whatever happens to CBDC. The main risk of retail CBDC is not bank disintermediation. CBDC may not be the best option even if it has net benefits. It should be for parliaments and voters, not central banks, to decide about the introduction of CBDC. [embedded content] You Might Also Like...

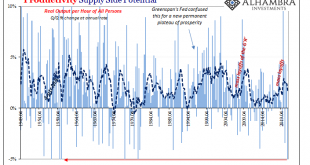

Read More »The Productive Use Of Awful Q3 Productivity Estimates Highlights Even More ‘Growth Scare’ Potential

What was it that old Iowa cornfield movie said? If you build it, he will come. Well, this isn’t quite that, rather something more along the lines of: if you reopen it, some will come back to work. Not nearly as snappy, far less likely to sell anyone movie tickets, yet this other tagline might contribute much to our understanding of “growth scare” and its affect on the US labor market. This topic deserves a much deeper dive than I am going to give it (for now). What...

Read More »Weekly Market Pulse: Discounting The Future

The economic news recently has been better than expected and in most cases just pretty darn good. That isn’t true on a global basis as Europe continues to experience a pretty sluggish recovery from COVID. And China is busy shooting itself in the foot as Xi pursues the re-Maoing of Chinese society, damn the economic costs. But here in the US, the rebound from the Q3 slowdown is in full bloom. Just last week we had pending home sales, ADP employment, both ISM reports,...

Read More »SNB-Vize Fritz Zurbrügg tritt Ende Juli 2022 zurück

Fritz Zurbrügg (links) tritt Ende Juli 2022 zurück. Andréa M. Maechler (rechts) dürfte ihm als Direktorin des III. ins II. Departement folgen. (Bild: PD) Fritz Zurbrügg leitete zunächst das III. Departement (Finanzmärkte, Operatives Bankgeschäft und Informatik) der Schweizerischen Nationalbank. Seit Juli 2015 führt er als Vizepräsident des Direktoriums das II. Departement (Finanzstabilität, Bargeld, Finanzen und Risiken). Seine Tätigkeit bei der SNB stand im Zeichen...

Read More »Swiss trade union demands shorter work week

© Keystone / Gaetan Bally Switzerland’s largest trade union issued a statement on Saturday demanding a “massive reduction” of working hours with full wage compensation for lower and income earners. “Nowhere in Europe do people work as hard as in Switzerland. At present, employees work an average of 41.7 hours per week in a full-time job,” the union noted in a statement after its 66 delegates met in the Swiss capital, Bern. While the number of hours worked has...

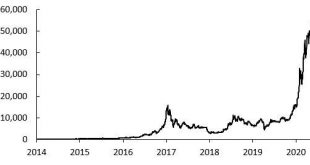

Read More »Bitcoin Isn’t Any More Dangerous than the Euro

Major representatives of the European Central Bank—including ECB president Christine Lagarde—continue to warn against bitcoin. In a recent article, addressed to the inflation-adverse German audience, the ECB representative Klaus Masuch together with the former ECB chief economist Otmar Issing has stressed five risks of bitcoin: a lack of intrinsic value, risks to financial market stability, the use in financing organized crime, high energy consumption, and the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org