Schon einmal vom eNaira gehört? Die meisten Menschen würden mit Nein antworten. Selbst in der Crypto Community ist der Cryptocoin kaum bekannt. Doch der eNaira ist ein Cryptocoin, auf den jeder ein Auge werfen sollte, denn er ist einer der ersten staatlichen Cryptocoins des Marktes. Crypto News: Nigerias staatlicher Cryptocoin bisher kein Erfolg Nigerias Regierung hatte den eNaira vor wenigen Monaten als CBDC (Central Bank Digital Currency) gelaunched und damit eine...

Read More »FOMC Goes With Unemployment Rate While This Huge Number Happens To Far More Relevant Economic Data

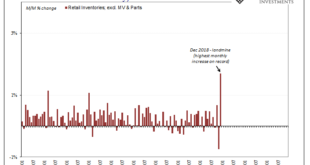

The first time I can consciously remember using the term landmine was probably here in February 2019. I had described the same process play out several times before, I had just never applied that term. There was all sorts of market chaos in the final two months of 2018, including a full-on stock market correction, believe it or not, leaving the inflation and recovery narrative in near complete tatters. All that was missing by then was the economic data to confirm...

Read More »Should Investors Fear Fed Rate Hikes?

The prospect of Federal Reserve rate hikes continues to rattle Wall Street and cloud the outlook for precious metals. On Wednesday, the central bank strongly signaled it will raise its benchmark Fed funds rate for the first time in three years – likely at its March policy meeting. Policymakers noted that inflation is running “well above” target and also claimed a “strong labor market” justifies a degree of monetary tightening. “There’s quite a bit of room to raise...

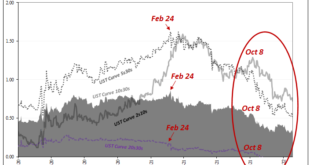

Read More »After Today’s FOMC, Yield Curve Is Already As Flat As It Was In Mar ’18 **Without A Single Rate Hike Yet**

It’s not hard to reason why there continues to be this conflict of interest (rates). On the one hand, impacting the short end of the yield curve, the unemployment rate has taken a tight grip on the FOMC’s limited imagination. The rate hikes are coming and the markets like all mainstream commentary agree that as it stands there’s nothing on the horizon to stop Jay Powell’s hawkishness. And yet, on the other hand, growth and inflation expectations, the long end could...

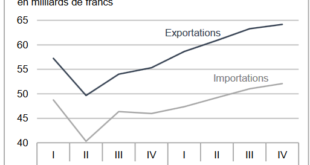

Read More »After pandemic slump, Swiss exports boomed in 2021

[caption id="attachment_858217" align="alignleft" width="400"] Exporting, or perhaps importing, on the Rhine in Basel. © Keystone / Gaetan Bally[/caption] Swiss exports climbed to record levels in 2021, with chemicals and pharma driving much of the growth. Watches, especially luxury ones, also had a good year. Exports came to a total value of CHF259.5 billion ($284.5 billion) in 2021, marking a 15.2% increase on the pandemic year 2020 and a 7% increase on...

Read More »Behind Klaus Schwab, the World Economic Forum, and the Great Reset: Part 1

Bob starts a series looking into Klaus Schwab, founder of the World Economic Forum and, along with Prince Charles, proponent of the “Great Reset.” Mentioned in the Episode and Other Links of Interest: Klaus Schwab and Prince Charles promoting the “Great Reset” The World Economic Forum’s page on the Great Reset An example of a session from the WEF’s Davos Agenda 2021 conference The WEF’s bio for its founder, Klaus Schwab Schwab’s books The Fourth Industrial...

Read More »Swiss National Bank proposes reactivation of sectoral countercyclical capital buffer at 2.5%

After consultation with the Swiss Financial Market Supervisory Authority (FINMA), the Swiss National Bank has submitted a proposal to the Federal Council requesting that the sectoral countercyclical capital buffer (CCyB) be reactivated. The buffer is to be set at 2.5% of risk-weighted exposures secured by residential property in Switzerland (cf. appendix). The SNB’s proposal envisages a deadline for compliance with the increased CCyB requirements of 30 September...

Read More »Rückläufige US-Erdölvorräte lassen Ölpreise steigen

Die Vereinigten Staaten weisen sinkende Ölreserven auf. Dies führt zu einem Druck auf die Preise. Trotz eines Anstiegs der Rohölvorräte im jüngsten EIA-Bericht sind die kommerziellen Erdölvorräte in den USA in den meisten Wochen der letzten anderthalb Jahre zurückgegangen und liegen unter dem saisonalen Durchschnitt der letzten fünf Jahre und sogar unter dem Fünfjahresdurchschnitt vor der Pandemie. Der kontinuierliche Rückgang der US-amerikanischen Erdölvorräte im...

Read More »Swiss Trade Balance Year 2021: exports climb to one record level

We do not like Purchasing Power or Real Effective Exchange Rate (REER) as measurement for currencies. For us, the trade balance decides if a currency is overvalued. Only the trade balance can express productivity gains, while the REER assumes constant productivity in comparison to trade partners. Who has read Michael Pettis, knows that a rising trade surplus may also be caused by a higher savings rate while the trade partners decided to spend more. This is partially...

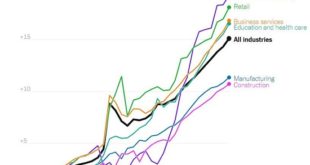

Read More »Inflation Winners and Losers

The clear winners in inflation are those who require little from global supply chains, the frugal, and those who own their own labor, skills and enterprises. As the case for systemic inflation builds, the question arises: who wins and who loses in an up-cycle of inflation? The general view is that inflation is bad for almost everyone, but this ignores the big winners in an inflationary cycle. As I’ve explained here and in my new book Global Crisis, National Renewal,...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org