While Forex banks, traders, and other institutions are being blamed for market rigging, the Swiss National Bank can publish reports about its own market rigging, but instead of being a scandal, it’s economic data. That’s because the vast majority don’t understand how the Forex markets work. It’s not insulting – it’s a fact. Currently there are hundreds of pending litigation cases against a plethora of Forex banks, traders, and other institutions – but none against a central bank....

Read More »Latin America – Seven Ugly Sisters in Deep Political Trouble

Get beyond endless Latin American headlines burning column inches and you come to far broader strategic conclusion: The seven ‘ugly Latino sisters’, namely Brazil, Venezuela, Ecuador, Bolivia, Colombia, Mexico and Argentina are all deep political trouble from collapsed benchmark prices. It’s merely a case of who’s in more advanced states of political decay where left leaning governments’ can’t hang on much longer vs. those trying to buy a bit of time with more ‘centrist’ positions. In...

Read More »Great Graphic: Another Look at the Canadian Dollar

We have been looking for a bottom in the US dollar against the Canadian dollar. It is been difficult, but now it appears that the technicals are turning. This Great Graphic, from Bloomberg, shows that the US dollar is moving above a trend line down off the January 20 high just below CAD1.47. The downtrend line connects the late February high and the mid-March high. It intersects today near CAD1.3200. The 20-day moving average, the green line, also caught the February and mid-March...

Read More »Is that Buzzing Sound Helicopter Money?

Helicopter money is the rage. Central banks are talking about it. Economists are debating it. The media is rife with coverage. While it sounds important, it is not precisely clear what helicopter money means. It appears to have originated with Milton Friedman. In 1969, he wrote: "Let us suppose now that one day a helicopter flies over this community and drops an additional $1,000 in bills from the sky, which is, of course, hastily collected by members of the community. Let us...

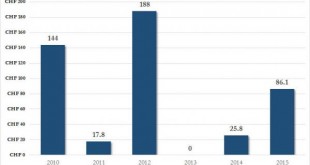

Read More »Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

By now it is common knowledge that when it comes to massive, taxpayer-backed hedge funds, few are quite as big as the Swiss National Bank, whose roughly $100 billion in equity holdings have been extensively profiled on these pages, including its woefully investments in Valeant and the spike in its buying of AAPL stock at its all time high. But while the SNB's stock holdings are updated every quarter courtesy of its informative SEC-filed 13F (we wish the Fed would also disclose the equities...

Read More »Dollar Continues To Recoup Recent Losses

A few short hours stand in the way of the long holiday weekend for many. The capital markets are retracing the recent moves. This means equities and commodities are lower. It means bonds are firmer and the dollar stronger. The markets response to the ECB and FOMC recent meetings was to extend trend moves. However, this entire week has been the counter. The foreign exchange market illustrates this point. The euro is recording a lower high for the first consecutive session and a...

Read More »Bankruptcy Statistics 2015: Increase in the number of bankruptcies

24.03.2016 09:15 - FSO, Economic structure and analyses (0353-1602-90) Bankruptcy Statistics 2015 Increase in the number of bankruptcies Neuchâtel, 24.03.2016 (FSO) – The number of bankruptcy proceedings opened in 2015 rose to 13,016 cases, a 9.9% increase compared with 2014. The Lake Geneva region was particularly affected by this trend. Overall, this upsurge is due mainly to bankruptcies of persons registered in the Commercial Registry. Over the same period the number of debt collection...

Read More »ECB, Corporate Bonds, and Credibility

The euro's rallied shortly after the ECB announced numerous monetary measures that in their totality were more than expected. Many saw this as proof that monetary policy had lost its effectiveness, and central banks have lost credibility. Recall summer of 2012. The market anticipated another round of asset purchases by the Federal Reserve. The euro rallied from about $1.2050 in late July to $1.30 on September 13 when Bernanke announced the open-ended QE3. The euro peaked two days...

Read More »Great Graphic: Brexit Fears Boost Sterling Put Buying

The UK referendum is three months away. Three-month options are a common benchmark for various market segments; from speculators, to fund managers to corporations. Events over the past week have raised the risks that the UK votes to leave the EU. The market has responded forcefully today, and even if you only follow the spot market, what is happening in the options market is significant. First, three-month volatility has jumped 2.6 percentage points to 14.5%. It appears to be the...

Read More »Great Graphic: 10-Year Break-Evens and Oil

Until last September, the Federal Reserve seems to play down the market-based measures of inflation expectations, preferring the surveys that showed views were anchored. At the September 2015 FOMC meeting where the Fed had been expected to tighten until the August turmoil, officials cited among other considerations, the decline in market-based measures of inflation expectations. There are many problems with using the spread between conventional Treasuries and the inflation-linked...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org