(I have been sick with pneumonia but am just about back. I expect to resume my commentary tomorrow. Here is my overdue monthly column for a Chinese paper. Thanks to everyone for their support.)Conspiracy theories have run amok. After several years of claiming countries were engaged in currency wars, or attempts to drive their currencies down to achieve export advantage, many reporters and analysts announced a volte-face. At the late February G20 meeting in Shanghai, a secret...

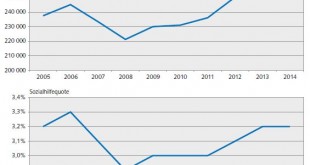

Read More »10 years of Swiss Social Assistance Statistics: Social assistance rate the same as 10 years ago

04.04.2016 11:00 - FSO, Social Assistance (0353-1603-30) 10 years of Swiss Social Assistance Statistics Social assistance rate the same as 10 years ago Neuchâtel, 04.04.2016 (BFS) – The Swiss Social Assistance Statistics cover ten years of observation with the latest data from 2014. The social assistance rate was 3.2% in 2005 and is the same today. Over the ten year period, observations from previous years have been confirmed, with children, foreign nationals, divorced persons and those...

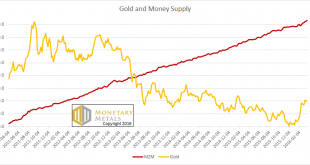

Read More »The Gold Money Supply Correlation Report, 3 Apr, 2016

There were some fireworks this week. Gold went up on Tuesday (it was a shortened week due to Easter Monday), from a low of $1,215 to $1,244 over the day, a move of over 2 percent. Silver moved from $15.02 to $15.44, almost 3 percent. What happened on Tuesday to drive this move down in the dollar? (We always use italics when referring to gold going up or down, because it is really the dollar going down or up). Janet Yellen happened, that’s what. Our Federal Reserve Chair spoke to the...

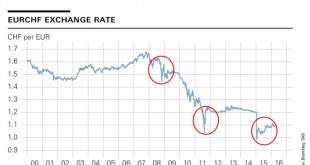

Read More »Investment policy in times of high foreign exchange reserves

The Money Market Event is the biggest feast of the Swiss National Bank and a selected list of money managers that work together with the central bank. It is initiated by important speeches and ended with a generous buffet dinner. In the first speech, Andrea Mächler addressed three points: The expansion of the SNB balances sheet as measure against the so-called “strong franc” in a historic perspective. How the SNB takes over currency risks from the private sector. Details on the balance...

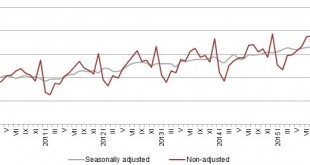

Read More »Retail trade turnover in February 2016: Swiss retail trade turnover falls by 0.9%

01.04.2016 09:15 - FSO, Economic Surveys (0353-1603-20) Retail trade turnover in February 2016 Swiss retail trade turnover falls by 0.9% Neuchâtel, 01.04.2016 (FSO) – Turnover in the retail sector fell by 0.9% in nominal terms in February 2016 compared with the previous year. Seasonally adjusted, nominal turnover fell by 0.4% compared with the previous month. These are provisional findings from the Federal Statistical Office (FSO). Real turnover in the retail sector also adjusted for...

Read More »February Swiss Retail Sales -0.3% YoY(Real), Core Retail Sales +0.3%

01.04.2016 09:15 – FSO, Economic Surveys (0353-1603-20) In several press release Swiss Statistics focuses on nominal data:But the data adjusted for inflation is more important: Real retail sales (adjusted for holidays) -0.3% YoY Real “Core retail sales” (excluding service stations) +0.3% YoY Retail trade turnover in February 2016 Swiss retail trade turnover falls by 0.9% Neuchâtel, 01.04.2016 (FSO) – Turnover in the retail sector fell by...

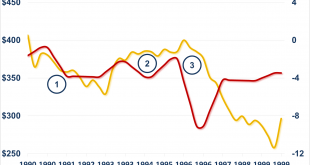

Read More »The Voldemort Effect: Gold Price and Gold Sales

Gold market analysts have for many years puzzled over the unusual behaviour of the gold market during the 1990s, specifically the bizarrely flat gold price from 1993 to 1996 in the face of sustained selling pressure from central banks and gold miners hedging their production. To-date no one has been able to identify the hidden source of demand that was obviously supporting the gold market during that period. In addition, conventional justifications that accelerated sales by central banks...

Read More »With Wall Street Bitten by the Blockchain Bug, How Do We Admit the Truth About the Technology’s Disruptive Potential?

I attended a panel discussion on private blockchains in banking at UBS in NYC last night. There were two overarching misconceptions that appeared to permeate the discussions: Counterparties can be trusted, hence you can build reliable systems with trusted parties, and; Capital markets are, and always will be predicated upon the legacy, highly centralized hub and spoke model that we know today. Basically, the influential gatekeepers that control access to a centralized, authoritative...

Read More »Families and Generations Survey 2013: Relationships: Where the heart is: Relationships and marriages popular

31.03.2016 09:15 - FSO, Demography and Migration (0353-1603-10) Families and Generations Survey 2013: Relationships Where the heart is: Relationships and marriages popular Neuchâtel, 31.03.2016 (FSO) – More than three quarters of men and women aged between 18 and 80 are in a relationship and most of these live together with their partner. Marriage still remains common with four fifths of all people who live with a partner of the opposite sex being married. These are some of the findings of...

Read More »OPEC’s Doha Dilemma: 3mb/d US lock in?

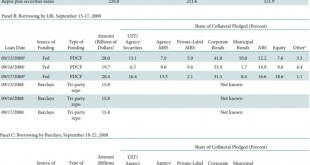

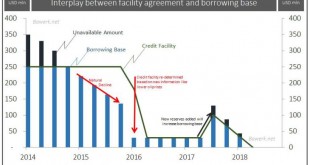

Bawerk shows that more than 3 mb/d of American oil production was helped by US$55.5bn in credit facilities, by excessive debt. This production is now at risk and the debt may not be repaid. The big OPEC players are playing against US shale oil and some smaller OPEC members that have higher costs. Another month, another flight to Hamad international airport for 17th April after initial agreement to hold ‘upstream horses’ in February 2016. While it’s no doubt great fun getting back...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org