I attended a panel discussion on private blockchains in banking at UBS in NYC last night. There were two overarching misconceptions that appeared to permeate the discussions: Counterparties can be trusted, hence you can build reliable systems with trusted parties, and; Capital markets are, and always will be predicated upon the legacy, highly centralized hub and spoke model that we know today. Basically, the influential gatekeepers that control access to a centralized, authoritative exchange. Referring to the picture above, there’s a group of lawyers on the right and technologists and bankers on the left. It’s interesting in that the technologists (an executive from R3C3V) said that blockchain tech will NOT be disruptive to the financial industry, but instead will be gradual in nature, and the representative from the banking industry agreed. The lawyers (Sullivan & Cromwell, the ex-general counsel of the Swiss National Bank, etc.) said that blockchain technology lowers the cost and increases the transparency of intermediation, thereby allowing more people to participate in the transfer of value. [embedded content] This is interesting for if the guy(s) on the right are correct, then the guys on the left are wrong.

Topics:

Reggie Middleton considers the following as important: B+, Bank of America, Bear Stearns, Bitcoin, Capital Markets, Counterparties, creditors, ETC, Featured, Federal Reserve, JPMorgan Chase, Lehman, newsletter, notional value, OTC, OTC Derivatives, recovery, Swiss National Bank, Tabb, Transparency, zerohedge

This could be interesting, too:

investrends.ch writes Welche Rolle spielen gehebelte Produkte beim jüngsten Einbruch der Krypto-Währungen?

investrends.ch writes «Die Nerven liegen derzeit blank»

investrends.ch writes Bitcoin fällt unter 90 000 US-Dollar

investrends.ch writes Bitcoin zieht deutlich an

I attended a panel discussion on private blockchains in banking at UBS in NYC last night. There were two overarching misconceptions that appeared to permeate the discussions:

-

Counterparties can be trusted, hence you can build reliable systems with trusted parties, and;

-

Capital markets are, and always will be predicated upon the legacy, highly centralized hub and spoke model that we know today. Basically, the influential gatekeepers that control access to a centralized, authoritative exchange.

Referring to the picture above, there’s a group of lawyers on the right and technologists and bankers on the left. It’s interesting in that the technologists (an executive from R3C3V) said that blockchain tech will NOT be disruptive to the financial industry, but instead will be gradual in nature, and the representative from the banking industry agreed. The lawyers (Sullivan & Cromwell, the ex-general counsel of the Swiss National Bank, etc.) said that blockchain technology lowers the cost and increases the transparency of intermediation, thereby allowing more people to participate in the transfer of value.

This is interesting for if the guy(s) on the right are correct, then the guys on the left are wrong. You see, the guys on the left ARE the intermediators, and they claim blockchain tech will not disrupt, meaning their revenues and profits will remain extant and by definition intermediation costs will remain high even if efficiencies are increased (the difference will be captured as added profit to the intermediators - the banks). If the guys on the right are correct, extreme disintermediation will be the soup du jour, and the intermediators revenue base will be distributed to the masses as cost savings.

Nowhere is this more prevalent than in the capital markets business, where P2P capital markets threatens to rear its hyper-efficient and transparent head. For over-the-counter (OTC) derivatives transactions, where much of the complexity of Lehman Brothers’ bankruptcy resolution was rooted, creditors’ recovery rate was below historical averages for failed firms comparable to Lehman. This is the source and cause of fear when dealing with untrusted parties. Before we go further, let’s define a “trusted party” for the sake of this discussion. As per Wikipedia:

In a social context, trust has several connotations Definitions of trusttypically refer to a situation characterized by the following aspects: One party (trustor) is willing to rely on the actions of another party (trustee); the situation is directed to the future. In addition, the trustor (voluntarily or forcedly) abandons control over the actions performed by the trustee. As a consequence, the trustor is uncertain about the outcome of the other's actions; they can only develop and evaluate expectations. The uncertainty involves the risk of failure or harm to the trustor if the trustee will not behave as desired. Vladimir Ilych Lenine expresses this idea with the sentence “Trust is good, control is better”.

Our value trading platform, Veritaseum, enables absolute control, thus trust is not needed. This is known as a “zero trust transaction” - or a transaction wherein the performance of your counterparty is given and guaranteed whether you know them or not - their credit risk, balance sheet, ethics, liquidity and macro risks be damned. This is also the antithesis of a private blockchain solution where only “trusted” parties are allowed to participate. Hmmm… Here we go again, trust. What parties can truly be trusted (with trust being defined as above)? Certainly not banks, for “As a consequence, the trustor is uncertain about the outcome of the other's actions”. If you are uncertain about the outcome, then you only hope to trust, but cannot truly trust. Take Lehman Brothers’ failings for instance. I’m sure Lehman’s myriad counterparties went into the derivatives deals knowing “they can only develop and evaluate expectations”. The problem was that “The uncertainty involves the risk of failure or harm to the trustor if the trustee will not behave as desired.” Lehman did not behave as desired. It’s not just bankrupted banks either. Take the biggest (Lehman was the smallest of the big Wall Street banks) and the best and you still have actors that don’t “behave as desired”.

JPMorgan Chase Hacking Affects 76 Million Households ...

JPMorgan's 2014 Hack Tied to Largest Cyber Breach Ever ...

Inside the Fall of Bear Stearns - WSJ

Bank of America Pays $16.65 Billion in Justice Department Settlement for Financial Fraud

How Hackers Stole 200,000+ Citi Accounts Just By ...

I can go on. Don’t believe me?

APT-style Bank Robberies Increase With Metel, GCMAN ...

Feb 8, 2016 - APT-style bank robberies increase with Metel, GCMAN and Carbanak 2.0attacks. Encrypted configuration for Metel malware plugins. APT-style ...

Dozens of banks lose millions to cybercriminals attacks

Feb 8, 2016 - The Carbanak group has been performing acts on the Internet since 2013. It occasionally disappears and eventually comes back with a new ...

Carbanak 2.0: the billion-dollar bank heist is back | IT PRO

Feb 8, 2016 - Now its successor, Carbanak 2.0, is targeting the budgeting and accounting departments of companies beyond banks, and in one instance ...

An executive of R3C3V (blockchain tech company that’s creating a consortium of banks to run settlement products through private blockchains) wrote an opinionated article basically belittling the logic of using public blockchains for security settlement in the Tabb Forum. He quoted the European Commission’s Directive 98/26/EC as: “[T]o minimize systemic risk by ensuring that any payment deemed final according to the system rules is indeed final and irreversible, even in the event of insolvency proceedings.

He then went on to state that the possibility of a 51% style attack could allow a miner or pool of miners to reverse a transaction in the blockchain. Unfortunately, he failed to go into detail as to how difficult and expensive that would be without an economic majority - essentially requiring quantum computing power which currently does not exist. He also failed to note that if there was an economic majority than there is a majority consense that the change is appropriate, which makes it correct. There is much, much less probabilistic risk of this occurring than the risk of deploying and relying on a tech that has no where near the proven security, testing, use and seasoning as the extant bitcoin network.

Let’s look at a historic case involving Lehman to put this theory to the test….

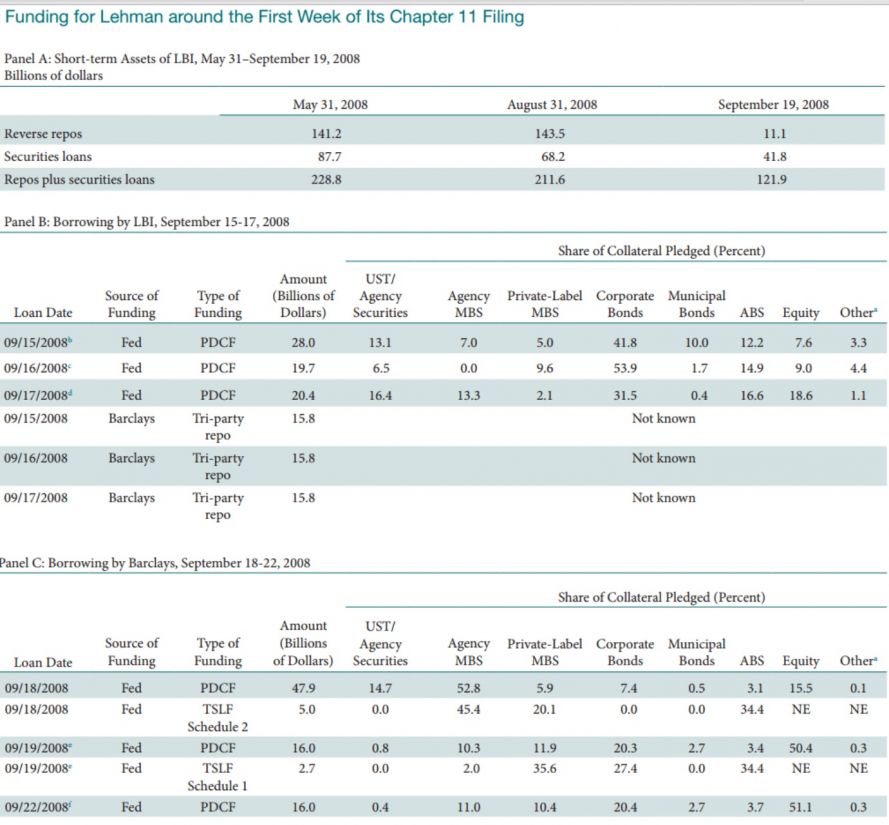

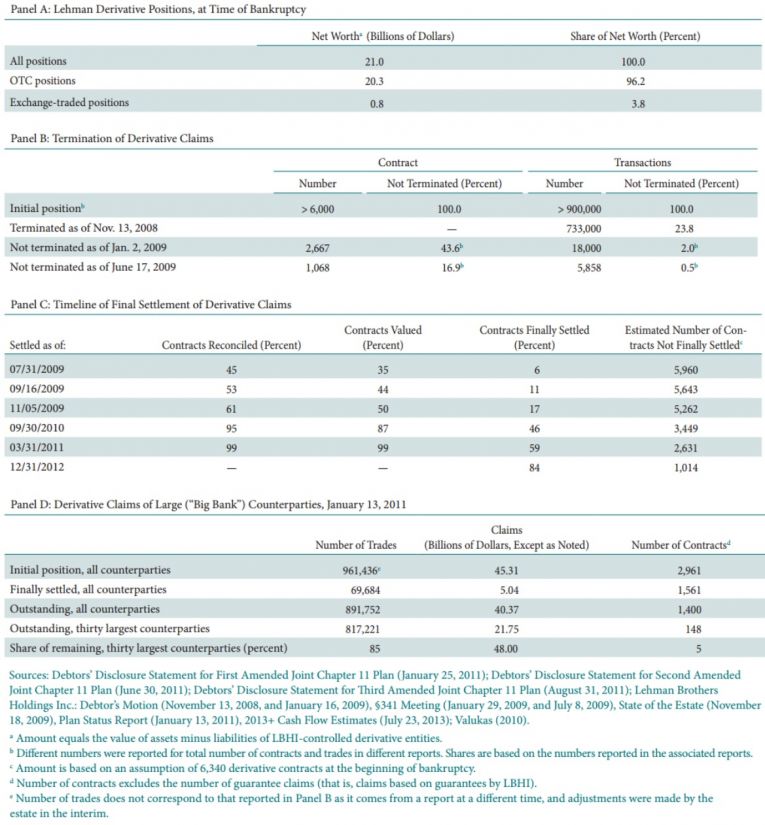

The settlement of OTC derivatives is a long and complex process. In the case of a chapter 11 bankruptcy, settlement occurs on different tracks for different groups of derivatives creditors. According to the NY Federal Reserve, “prior to bankruptcy, Lehman’s global derivatives position was estimated at $35 trillion in notional value, accounting for roughly 5 percent of derivatives transactions globally (Summer 2012). Its OTC derivatives positions represented 96 percent of the net worth of its derivatives-related entities.”

The settlement of Lehman’s OTC derivatives positions proceeded along three tracks.

There’s a statutory safe harbor that allows derivative contracts counterparties to bypass the automatic stay of debt put in place by a bankruptcy proceeding. As a result of this safe harbor, many of Lehman’s derivatives contracts were terminated early, This did not extend to the out of-the-money counterparties who were underwater in the trade and owed money to Lehman. They had no economic incentive to terminate their contracts. Even those that chose to terminate early had ambiguity since a mutually agreed upon termination value had to be reached. This is difficult in a litigious situation, and even more so from a fundamental perspective in an illiquid market with large positions such as those with big bank counterparties.

For OTC Derivatives Contracts That Were Terminated Early:

Out of more than 900,000 trades, 733,000 were automatically terminated by November 13, 2008 yet only 6 percent of ISDA contracts had been settled by July 2009, with this number rising slowly to 46 percent by September 2010. For the record and sake of comparison, Veritaseum claims to settle derivative transactions within 40 minutes - by hook or by crook.

OTC Derivatives Where Out-of-the-Money Counterparties Chose Not to Terminate Early

Those counterparties that owed Lehman money unsurprisingly chose not to terminate their contracts early, thereby avoiding paying the accrued losses on their out-of-the-money and/or underwater positions. This was a significant portion of the value of Lehman’s derivative positions, even though it paled in the actual number of contracts.

As quoted from the NY Fed report on the topic:

”... by January 2, 2009, just 2,667 contracts (out of more than 6,000 contracts at the time of bankruptcy) and 18,000 derivatives trades remained outstanding, and by June 17, 2009, less than 17 percent of contracts and less than 1 percent of trades were not terminated (Panel B of Table 2). Assignment of claims moved slowly, partly because of market illiquidity and the balance sheet constraints of financial firms, and partly because the positions were less valuable. For example, some were uncollateralized, had weak credits, or involved long maturity instruments (LBHI, “§341 Meeting,” July 8, 2009). Nevertheless, the Lehman estate made good progress on collecting derivatives receivables, with cash collections increasing from less than $1 billion through November 7, 2008, to about $8 billion through November 6, 2009 (LBHI, “The State of the Estate,” November 18, 2009) and to about $11.5 billion through June 30, 2010 (LBHI, “The State of the Estate,” September 22, 2010). As of January 10, 2011, Lehman had issued notices to counterparties commencing ADR procedures in connection with 144 derivatives contracts and resolved fifty-two of these contracts, resulting in receipt of approximately $356 million (“Debtors’ Disclosure Statement for First Amended Joint Chapter 11 Plan,” January 25, 2011).”

From 2008 to 2011, take note of the progress. For the record and sake of comparison, Veritaseum claims to settle derivative transactions within 40 minutes - by hook or by crook.

OTC Derivatives Contracts with Big Bank Counterparties

Source: https://www.newyorkfed.org/medialibrary/media/research/epr/2014/1412flem.pdf

I have decreid for many years the concentration risk of global derivative exposure. Over 90% global derivative exposure is concentrated in just 6 banking institutions (out of tens of thousands of financial institutions). Concentration equals risk, which does not equal trust!

Again quoting from the NY Fed report:

“... the Lehman estate reported that, of the outstanding contracts, the share of the thirty big bank counterparties was 85 percent of the number of trades and 48 percent of derivatives contracts by dollar value, but only 5 percent of the number of contracts. Settlement of derivatives with big bank counterparties proved challenging owing to difficult legal and valuation issues (LBHI, “The State of the Estate,” September 22, 2010).”

For the record and sake of comparison, Veritaseum claims to settle derivative transactions within 40 minutes - by hook or by crook - and does so via mutually agreed upon smart contracts that execute automatically. Thus, there is no bickering over whether 2+2=4. Via smart contract, either it does, or it doesn’t. Now this does ring up a whole raft of other issues or concerns, particularly conflicts between the laws of math and the laws of the Southern District of NY, but hopefully you can see I’m coming from.

Additionally, quoting from the NY Fed report:

“Confirmation of the Joint Chapter 11 plan by the court on December 6, 2011, did not completely resolve the settlement of derivatives with big bank counterparties, as the Lehman estate had entered into settlement with only eight of thirteen major financial firms at the time. The slow progress of negotiations can be gauged by the fact that, in 2012, the estate settled only about 1,000 of the roughly 2,000 contracts open at the beginning of the year (LBHI, “2013+ Cash Flow Estimates,” July 23, 2013). This implies that an estimated 16 percent of contracts remained to be finally settled almost a year after confirmation of the liquidation plan (Panel C of Table 2). Nevertheless, sufficient progress was made such that the Lehman estate was able to make the first distribution to creditors on April 17, 2012.”

Keep in mind the Lehman liquidity event and bankruptcy took place in 2008. Four years after the fact, and the first payment was made to creditors in 2012. For the record and sake of comparison, Veritaseum claims to settle derivative transactions within 40 minutes - by hook or by crook - and does so via mutually agreed upon smart contracts that execute automatically.

This can get into a protracted debate on bankruptcy law, markets etc., and that is not my intention. What I do intend to to is bring to light the weaknesses inherent in the private blockchain argument. There is no such thing as a trustworthy party. You can trust a party, but parties can’t be trusted. The Lehman analysis above is a perfect example of what happens when a so-called “trusted party” bares the undeniable fact that no bank or financial entity can truly be trusted. If you think 30 days is a long time to settle a trade, try 4+ years and counting. This is what you face with private blockchains, and this is avoidable with zero trust chains, aka, the bitcoin blockchain.

Find out more about Peer-to-Peer capital markets., Download the "Pathogenic Finance" research report or view excerpts via video...

Full story here