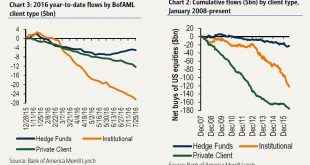

BofA’s Michael Hartnett points out something amusing, not to mention diabolical: following the rate cuts by the BoE & RBA this week, “global central banks have now cut rates 666 times since Lehman.” One would think this attempt by central banks to push everyone into risk assets, certainly the Swiss National Bank which as we showed yesterday has increased its US equity holdings by 50% in the first half of 2016 … …...

Read More »Emerging Markets: What has Changed

India’s upper house approved the creation of a Good and Services Tax (GST) The Polish government softened its stance on the proposed Swiss franc loan conversion plan Support for South Africa’s ruling African National Congress (ANC) appears to have fallen below 60% for the first time ever Brazil’s Senate impeachment committee recommended putting President Rousseff on trial In the EM equity space as measured by MSCI,...

Read More »Massive Majority Of Europeans Disapprove Of EU Handling Of Refugee Crisis

When the history books are finally written, I believe the tone-deaf handling of the refugee crisis by EU bureaucrats will be seen as one of the primary catalysts in the ultimate disintegration of the European Union. Although I knew many millions across the eurozone were irate about how the refugee crisis was being handled, I had no idea how irate they were until I read the results of a recent survey by the Pew...

Read More »Investing in Gold in 2016: Global Paradigm Shifts in Politics and Markets

Crumbling Stability In the past few months, we have witnessed a series of defining events in modern political history, with Britain’s vote to exit the EU, (several) terror attacks in France and Germany, as well as the recent attempted military coup in Europe’s backyard, Turkey. Uncertainty over Europe’s political stability and the future of the EU keeps growing. These worries are quite valid, as geopolitical...

Read More »Deflation Is Always Good for the Economy

“Experts” Assert that Inflation is an Agent of Economic Growth For most experts, deflation, which they define as a general decline in prices of goods and services, is bad news since it generates expectations for a further decline in prices. As a result, they hold, consumers postpone their buying of goods at present since they expect to buy these goods at lower prices in the future. This weakens the overall flow of...

Read More »Credit Suisse dropped from index as european markets feel pressure after bank stress tests

Investec Switzerland. SMI The Swiss Market Index is set to close slightly higher this week, outperforming global equities thanks to defensive heavyweights such as Nestlé and Novartis. Click to enlarge. Pessimism hit European shares at the beginning of the week as sliding oil prices and bank stress test results helped revive concerns over the strength of the recovery and stability of the financial...

Read More »Statistics on tourist accommodation in June and in the first half of 2016: Overnight stays decline in first half-year and in June

05.08.2016 09:15 – FSO, Tourism (0353-1607-30) Statistics on tourist accommodation in June and in the first half of 2016 Overnight stays decline in first half-year and in June Neuchâtel, 05.08.2016 (FSO) – The hotel sector registered 16.8 million overnight stays in Switzerland during the first sixth months of 2016. This represents a decrease of 1.2% (-199,000 overnight stays) compared with the same period a year...

Read More »FX Daily, August 04: The BOE Owns Today, but Tomorrow is a Different Story

Swiss Franc The Swiss Franc appreciated today against the euro. Given that the Bank of England started monetary easing, this slight appreciation is unexpectedly weak – reason was probably intervention. The SNB intervention level should be around 1 billion francs. Numbers revealed in next week’s sight deposits. Click to enlarge. Bank of England The Bank of England owns today, though tomorrow will be about the US...

Read More »“Mystery” Buyer Revealed: Swiss National Bank’s US Stock Holdings Rose 50 percent In First Half, To Record $62BN

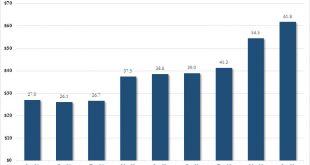

In a month, quarter and year, in which many have scratched their heads trying to answer just who is buying stocks, as both retail and smart money investors have been aggressively selling… Click to enlarge. … yesterday we got the answer. In the second quarter, the Swiss National Bank added $7.3 billion to its US equity portfolio, and according to its just filed 13-F, is now long a record $61.8 billion in US stocks, up...

Read More »Jailing Banksters Will Not Resolve the Economic Crisis

Meet the Scapegoats Last week, an Irish court sentenced three prominent banksters for their roles in the 2008 financial crisis. Judge Martin Nolan, who pronounced judgment, said that the bansksters had committed “a very serious crime.” He continued: “The public is entitled to rely on the probity of blue chip firms. If we can’t rely on the probity of these banks we lose all hope or trust in institutions.”* Meet the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org