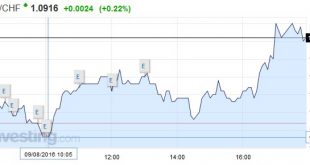

Swiss Franc The upwards tendency of the euro against CHF continues.The 100 day EMA of 1.0901 has passed. Click to enlarge. FX Rates In an otherwise uneventful foreign exchange market, sterling’s slide for its fifth consecutive session is the highlight. It was pushed below $1.30 for the first time since July 12. Initial resistance for the North American session is seen near $1.3020, while the $1.2960 area...

Read More »Bank of England QE and the Imaginary “Brexit Shock”

Mark Carney, Wrecking Ball For reasons we cannot even begin to fathom, Mark Carney is considered a “superstar” among central bankers. Presumably this was one of the reasons why the British government helped him to execute a well-timed exit from the Bank of Canada by hiring him to head the Bank of England (well-timed because he disappeared from Canada with its bubble economy seemingly still intact, leaving his...

Read More »Bernanke’s Advice: More Emphasis on Data, Less on Fed Guidance

Summary: Bernanke reviews the changes in the long-term dot plots. There as been a clear trend toward lower long-term growth, unemployment and Fed funds equilibrium. The full adjustment may not be over. Former Fed Chair Bernanke keeps a blog at Brookings. His latest post offers insight into how to think about Federal Reserve, and in particular, Fed officials’ understanding of the US economy. Bernanke’s...

Read More »The Great Silver Bubble

See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Bubble Conditions The price of gold was down about fifteen Federal Reserve Notes this week. The price of silver was down sixty-two copper-plated zinc pennies. Is the Federal Reserve Note a suitable instrument with which to measure gold? Can one really use debased pennies – which aren’t even made of the base metal copper...

Read More »Best Countries To Store Gold (How Did America, A Serial Defaulter, Make The Cut?)

Submitted by Peter Diekmeyer via SprottMoney.com, An era of slowing growth, falling corporate profits, record debt levels, and currency debauchment has many investors buying gold as a bet against global central banks. Holding that gold outside the banking system, and for some, outside one’s own country, are increasingly popular options. Canada, Switzerland, and four other countries have particularly attractive...

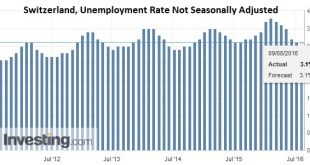

Read More »Switzerland: Situation on the labor market July 2016

Via Google Translate: Bern, 08.09.2016 – Registered unemployment in July 2016 – According to surveys conducted by the State Secretariat for Economic Affairs (SECO) were the end of July 2016 139’310 registered as unemployed at the regional employment centers (RAV), 183 more than last month. The unemployment rate remained at 3.1% in June. Compared to the previous month, unemployment increased by 5’556 persons (+ 4.2%)....

Read More »FX Daily, August 08: Stocks Up, Bonds Down, Dollar and Yen are Heavy

Swiss Franc Click to enlarge. FX Rates Investors favor risk assets today. Global stocks are moving higher in the wake of the pre-weekend US rally that saw the S&P 500 close at record levels. Bond yields are mostly firmer, again with US move in response to the robust employment report setting the tone in Asia. European bonds participated in most of the pre-weekend move and are consolidating today with a...

Read More »Great Graphic: Oil Recovery Extends

Summary: Oil prices extend last week’s rally. Last week’s rally was driven by the fall of gasoline inventories. Today’s advance was helped by speculation over next month’s IEA meeting. This Great Graphic from Bloomberg shows the September light sweet crude oil futures contract since peaking in early June near $52.75. It reached a low last week of about $39.20. The turn last week came on news that although oil...

Read More »China: Political and Economic Developments

Summary: Balance of power in China between “princleling and youth league may be at risk. Foreigners have stopped up their purchases of onshore CNY bonds. Tensions are rising between China and Japan and China and South Korea. This is the period in the monthly cycle that China releases most of its high frequency data. The process is well under way. Over the weekend, China reported its reserve figures that...

Read More »US Economy – Something is not Right

Another Strong Payrolls Report – is it Meaningful? This morning the punters in the casino were cheered up by yet another strong payrolls report, the second in a row. Leaving aside the fact that it will be revised out of all recognition when all is said and done, does it actually mean the economy is strong? As we usually point out at this juncture: apart from the problem that US labor force participation has collapsed...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org