Summary: The Canadian dollar’s link to oil has loosened. Its sensitivity to interest rates has increased. Lumber issue is coming to a head shortly. Of the majors, only sterling was weaker than the Canadian dollar in Q3. Sterling’s drop was a function of its decision to leave the EU and ease monetary policy. The Canadian dollar fell 1.6% compared with sterling’s 2.6% fall. The other dollar-bloc currencies...

Read More »Statistics on tourist accommodation in August 2016: Overnight stays decline in August 2016

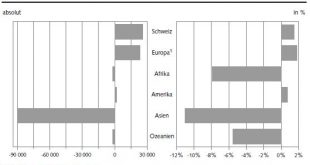

06.10.2016 09:15 – FSO, Tourism (0353-1609-80) Statistics on tourist accommodation in August 2016 Overnight stays decline in August 2016 Neuchâtel, 06.10.2016 (FSO) – The Swiss hotel industry registered 4.1 million overnight stays in August 2016, which corresponds to a decrease of 1.0% (-43,000 overnight stays) compared with August 2015. Foreign visitors generated 2.4 million overnight stays, representing a...

Read More »FX Daily, October 05: Euro Remains Firm Despite Dubious Tapering Story

Swiss Franc EUR/CHF - Euro Swiss Franc, October 05 2016. Federal Reserve While the markets can be an incredibly efficient discounting mechanism, it sometimes is also an echo chamber. What began off as a Bloomberg report indicated that there was an agreement at the ECB that when it decided to end its asset purchases, it would gradually taper back rather than come to a fast stop, by the end of the day, it had...

Read More »London Gold and Silver Fix lawsuits

By Allan Flynn, Guest Post at BullionStar.com Five months have lapsed without decision, since London gold and silver benchmark-rigging class action lawsuits received a cool response in a Manhattan court. Transcripts from April hearings show, in the absence of direct evidence, the claims dissected by a “very skeptical” judge, and criticized by defendants for lack of facts suggesting collusion, among other things. Judge...

Read More »Why Portugal Matters

Summary: DBRS reviews its investment grade rating of Portugal on Oct 21. A cut in its rating would have far reaching implications. A cut in the outlook is more likely than a cut the rating. Many observers continue to tout Italian risks as the greatest in the euro area into the year end. The constitutional referendum that would emasculate the Senate, and end the perfect bicameralism that has contributed to...

Read More »It’s Time We Crush the Putrid Roach Motels of Philanthro-Crony-Capitalism, Starting with the Clinton Foundation

Philanthro-crony-capitalist corruption in the U.S. has reached levels that put Lower Slobovia to shame. Granted, the fantasy of philanthrocapitalism is appealing: take a bunch of fabulously successful entrepreneurial billionaires, grant their foundations tax-free status, and then unleash them on the world as philanthropists who will solve problems by applying the incentives of capitalism. While this sounds great in a...

Read More »50 Slides for Gold Bulls – The New Incrementum Chart Book

A Companion Update to this Year’s “In Gold We Trust” Report Our good friends Ronnie Stoeferle and Mark Valek of Incrementum AG have just published a new chart book, which recaps and updates charts originally shown in this year’s 10th anniversary edition of the “In Gold We Trust” report and provides an overview of recent developments relevant to the gold market. The chart book can be downloaded in PDF form via the...

Read More »Will The ECB Buy Stocks?

Authored by Nick Kounis and Kim Liu via ABN AMRO, Debate about the ECB’s stimulus options have continued to rage, with an equity purchase plan mentioned as a possibility We think the ECB could legally buy ETFs that fit its requirements… … but it would be controversial and we question the benefits An ETF programme could total EUR 200bn, which would not be large compared to the overall QE programme …and assuming a...

Read More »FX Daily, October 04: Sterling’s Slide Continues, EUR/CHF Soars Again

Swiss Franc The EUR/CHF has soared again. Later during the day, it has even achieved 1.0970. EUR-CHF - Euro Swiss Franc, October 04 2016. - Click to enlarge Federal Reserve UK Prime Minister May’s comments at the Tory Party Conference over the weekend played up the risk of what has been dubbed a hard Brexit and triggered a slide in sterling saw it fall to new 30-year+ low against the dollar just below $1.2760. A...

Read More »Cool Video: Bloomberg TV-Dollar Supercycle and Brexit

Summary: I reiterated my long-standing view that the euro is going to retest its record lows before the Obama Dollar Rally is over. I warn that the UK’s quest to regain sovereignty is an illusion. I announce that my new book will be published in early December or early January. I was on Bloomberg TV earlier today with Tom Keene, the one of a kind anchor, and Booth Business School Professor Luigi Zingales. ...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org