See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. Fundamental Developments – Scarcity of Precious Metals Increases Slightly Not much price action at the metals tables in the casino. Gold -$7, and silver -$0.10. Gold to silver ratio unchanged. This will be a brief report, due to the rigors of travel this week. Gold and silver prices Read on for the only true picture...

Read More »Emerging Markets: Week Ahead Preview

Stock Markets EM FX gained a little traction on Friday, but capped a week of steady losses. As the US election and FOMC meeting next month get closer, we believe markets and risk appetite will remain volatile. So far, September data from the US does not suggest any urgency to hike in November, and so we continue to believe that December is most likely for another hike. Looking at individual countries, South Africa...

Read More »Ganging Up on Gold

So Far a Normal Correction In last week’s update on the gold sector, we mentioned that there was a lot of negative sentiment detectable on an anecdotal basis. From a positioning perspective only the commitments of traders still appeared a bit stretched though, while from a technical perspective we felt that a pullback to the 200-day moving average in both gold and gold stocks shouldn’t be regarded as anything but a...

Read More »FX Daily, October 13: Dollar Edges Higher, though US Rates Soften

Swiss Franc The EUR/CHF remains in the range of 1.0815 to 1.0980. The SNB usually intervenes below 1.0850. I am expecting that speculators are reducing their CHF short positions. More tomorrow. EUR/CHF - Euro Swiss Franc, October 13 2016(see more posts on EUR/CHF, ). - Click to enlarge FX Rates The US dollar is firm, and the euro has slipped below $1.10 for the first time since late-July. Although the dollar’s...

Read More »IMF’s Reserve Data: Dollar Share Little Changed, Yen Share Jumps, Helped By Valuation

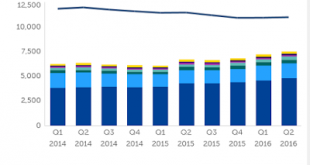

Summary: The increase in the yen’s share of reserves was flattered by the yen’s 9% appreciation. The dollar and euro’s share of reserves were stable. Chinese integration has seen the share of unallocated reserves fall. Starting with Q3 data, (available end of March 2017) will break out the yuan’s share of reserves. The IMF provides the most authoritative data on central bank reserves. The composition is...

Read More »More Swiss visas for non-Europeans in 2017

20 Minutes. Visa quotas for non-EU workers will rise next year. The increased quotas will include 3,000 B-permits and 4,500 L-permits, 1,000 more than this year. These limits are still lower than in 2014, when Swiss politics turned against the free movement of workers from the EU. 2014 quotas of 3,500 B-permits and 5,000 short-term L-permits, were reduced to 2,500 (B) and 4,000 (L), after a referendum to limit...

Read More »This Is How Quiet Fascism Works

Quiet Fascism has no purpose other than to aggregate more power, maintain its secrets and lay waste to anyone who questions its Imperial authority. So my little-visited Wikipedia entry was minding its own business, not bothering anyone, until I dared to criticize the Clinton Foundation. The next day, my Wikipedia entry was taken out and shot by a mysterious “editor.” It was just coincidence, right, that my Wikipedia...

Read More »High Court Hears UK Constitutional Challenge

Summary: Regardless of outcome early next week, the High Court’s decision will likely be appealed. The issue is the role of parliament. The greater the role, the greater the risk of a delay, but also a better chance to minimize a hard Brexit. The UK decision to leave the EU has been both a political and economic shock. The near-term focus now shifts to the constitutional crisis that has ensued. The key issue...

Read More »FX Daily, October 12: May Concedes to Parliament, Sterling Rises after Pounding

Swiss Franc EUR/CHF Overview, October 12 2016(see more posts on EUR/CHF, ) - Click to enlarge FX Rates News that UK Prime Minister May has accepted that Parliament should vote on her plan for exiting the EU stopped sterling’s headlong slide. Sterling had been pounded for roughly 8.5 cents since the start of the month including the last four sessions. The idea that parliament, where the Conservatives enjoy a...

Read More »Sterling: Has the Breaking Point been Reached?

Summary: Sterling’s decline is not longer coinciding with lower rates. Sterling’s decline is boosting inflation expectations. If the inflation expectations are realized (Sept CPI next week), it will quickly erode what ever competitive gains there may have been. Something has changed with sterling. It is not just last week’s flash crash that seems now to be more of a mark down than fat-finger, liquidity or...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org