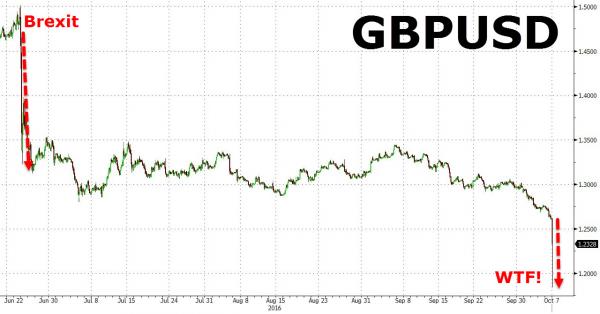

As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up. GBP/USD, October 7 - Click to enlarge What caused the move? While nobody knows the catalyst behind the flash crash yet, Bloomberg has compiled several potential explanations. “The GBP/USD slide could be due to erroneous order and/or flows related to stop-loss orders or options given USD/JPY or EUR/USD aren’t moving much”, says Toshihiko Sakai, Tokyo-based chief manager of FX and financial products trading at Mitsubishi UFJ Trust & Banking. “Looks like there was a large GBP sell order amid thin liquidity”, says Kyosuke Suzuki, head of FX and money-market sales at Societe Generale. Others believe that the massive move has been partly attributed to algos failing after traders targeted downside option barriers, say three Asia-based FX dealers. Traders typically place their nearest orders within 100 ticks of spot, which was at roughly 1.26 before today’s plunge. The drop accelerated as liquidity disappeared, and dealers failed to load bids into their trading platforms, say traders.

Topics:

Tyler Durden considers the following as important: Featured, FX Trends, newsletter, Swiss National Bank, Twitter

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| As reported moments ago, just around 7:07pm ET, cable snapped and plunged by what some say may have been as much as 1200 pips, dropping from 1.26 to as low as 1.14 according to some brokers, before snapping back up. |

GBP/USD, October 7 |

What caused the move? While nobody knows the catalyst behind the flash crash yet, Bloomberg has compiled several potential explanations.

|

GBP/USD, January 2016 - October 2016 |

Hopefully we will have a clear, official, and accurate answer from regulators for the crash soon: investors faith in broken markets is already non-existent as it is. However, if the May 2010 flash crash is any indication, the reason behind the collapse may not be forthcoming until 2021, and even then it will be blamed on some spoofer, living in his parents’ basement.

Another question: whether any FX brokerages will need a bailout a la the infamous FXCM, in the aftermath of the Swiss National Bank revaluation of January 2015, as clients find themselves margined out and underwater even as cable is steadily recovering most, if not all losses.

Whatever the reason, however, Kuroda will take two.

“Can i leave the EU too?” pic.twitter.com/hoXLxZ7vY5

— zerohedge (@zerohedge) October 6, 2016