See the introduction and the video for the terms gold basis, co-basis, backwardation and contango. How to Earn Money that Will Soon be Worthless Real Quick There is a often-promoted plan to grow your wealth. Here’s the background. The dollar is going to be worthless. Soon! The reason is because [their peeps in high places tell them / the Chinese / end of the petrodollar / historical fiat currencies / Rothschild Jekyll...

Read More »Weekly Speculative Positions (as of May 16): Yen and Aussie Bears Push Forward, while Sterling Bears Continue to Run for Cover

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Nothing Like A Good US Drama

Summary: US drama distracts from the difficult and ambitious economic program. European and Japanese developments have been constructive. Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance. The no-drama Obama has given way to “The Donald” who appears to be providing more melodrama than an Emmy-winning soap opera. To be sure it is not just him. Hope...

Read More »Emerging Markets: Preview of the Week Ahead

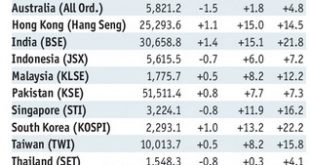

Stock Markets EM FX ended last week on a firm note, shrugging off political risk that consumed markets earlier in the week. With US rates remaining low, the dollar remains under pressure against the majors, and so EM FX is likely to benefit also. Yet we warn investors not to jump back into EM countries that are inherently riskier, such as Brazil, South Africa, and Turkey. We continue to favor Asia in the current...

Read More »Strong Swiss franc could be over reckons currency strategist at UBS

© Alys | Dreamstime.com Tribune de Genève. After more than two years of a highly overvalued franc, relative to the euro, the currency should ease in the near term reckons Thomas Flury, senior currency strategist at UBS. He expects a euro to be worth 1.14 francs in 6 months and 1.16 within a year. Emmanuel Macron’s victory and Marine Le Pen’s defeat in the second round of France’s presidential election support this...

Read More »Political Lobbying on the Rise in Switzerland

Links between parliamentarians in Bern and lobby groups have grown steadily in recent years, according to a study by the Universities of Lausanne and Geneva. Between 2007 and 2015, these sorts of ties between interest groups and politicians increased by 20%. Links between parliamentarians and interest groups grew by 20% between 2007 and 2015. - Click to enlarge The academic research, featured in Swiss newspaper Le...

Read More »New Gold Pool at the BIS Basle, Switzerland: Part 1

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England Introduction A central bank Gold Pool which many people will be familiar with operated in the...

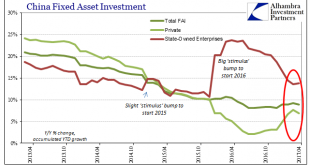

Read More »Trying To Reconcile Accounts; China

Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6%...

Read More »“Sell in May”: Good Advice – But Is There a Better Way?

Selling in May, With Precision If you “sell in May and go away”, you are definitely on the right side of the trend from a statistical perspective: While gains were achieved in the summer months in three of the eleven largest stock markets in the world, they amounted to less than one percent on average. In six countries stocks even exhibited losses! Only in two countries would an investment represent an interesting...

Read More »Emerging Markets: What Has Changed

Summary China’s government approved the creation of a bond link between Hong Kong and the mainland. S&P upgraded Indonesia one notch to investment grade BBB- with stable. Fitch revised the outlook on Vietnam’s BB- rating from stable to positive. Egypt will announce a package of social spending soon. Moody’s changed the outlook on Poland’s A2 rating from negative to stable. Brazil press reported that meat-packing...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org