Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern. Industrial Production had seemingly accelerated in March, rising to a 7.6% year-over-year growth rate after being mired stuck around 6% for exactly two years. In April, however, IP was estimated to have increased just 6.5%, leaving for at least one month only dreams of recovery. April retail sales were 10.7% more than in April 2016, which is almost exactly the average growth rate over the last 33 months dating back to summer 2014. Perhaps the biggest disappointment was Fixed Asset Investment. Much like capex, FAI is the real engine of China’s social harmony as well as its economic progress. Private FAI accounts for that country’s urbanization and therefore modernization. Throughout the past four years, the private sector has been cutting back sharply in Fixed Asset Investment leaving the economic system hugely vulnerable.

Topics:

Jeffrey P. Snider considers the following as important: China, currencies, depression, Dollar, economy, exports, fai, Featured, Federal Reserve/Monetary Policy, fixed asset investment, Global Economy, global trade, industrial production, Markets, newsletter, Retail sales, Statistics

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

| Chinese economic data for April 2017 has been uniformly disappointing. External trade numbers resembled too much commodity prices, leaving an emphasis on them rather than actual economic forces. The latest figures for the Big 3, Industrial Production, Retail Sales, and Fixed Asset Investment, unfortunately also remained true to the pattern.

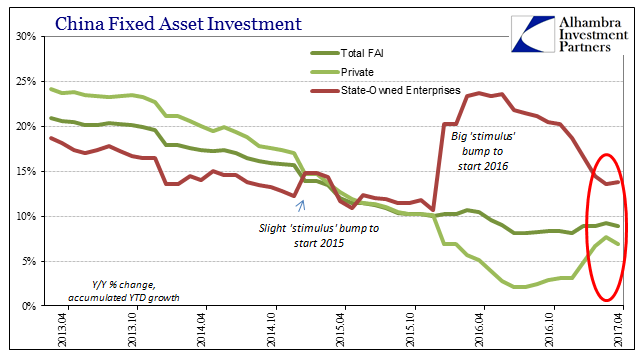

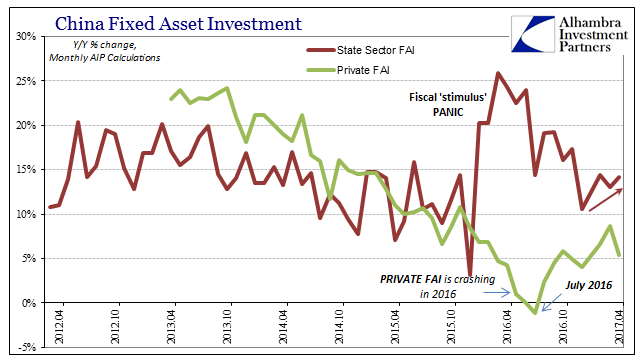

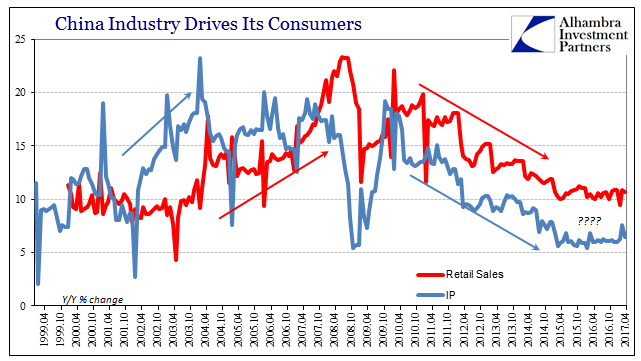

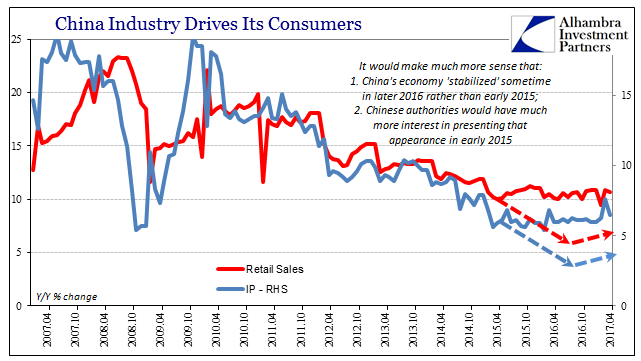

Industrial Production had seemingly accelerated in March, rising to a 7.6% year-over-year growth rate after being mired stuck around 6% for exactly two years. In April, however, IP was estimated to have increased just 6.5%, leaving for at least one month only dreams of recovery. April retail sales were 10.7% more than in April 2016, which is almost exactly the average growth rate over the last 33 months dating back to summer 2014. Perhaps the biggest disappointment was Fixed Asset Investment. Much like capex, FAI is the real engine of China’s social harmony as well as its economic progress. Private FAI accounts for that country’s urbanization and therefore modernization. Throughout the past four years, the private sector has been cutting back sharply in Fixed Asset Investment leaving the economic system hugely vulnerable. By my calculation, it actually contracted year-over-year in July last year, a serious warning for a system where FAI is supposed to grow at better than 20% consistently. Authorities had already responded months before that negative number, ushering in a massive “stimulus” through the FAI channel but in the state-owned rather than private sector. For several months last year and to start 2017, it appeared to be working. Private FAI growth rates turned positive and then modestly accelerated. It was that middling rebound that should have caught focus instead of the mere direction for it, but in this day and age every small positive is amplified into the greatest thing ever.

|

China Fixed Asset Investment, April 2013 - April 2017 |

| For April 2017, the accumulated growth rate (which is how China’s National Bureau of Statistics presents FAI) for the four months together was 8.9%, down slightly from 9.2% YTD in March. Among the subsectors, the accumulated growth rate for Private FAI was 6.9%, down from 7.7% the month before. That means for the month of April alone, year-over-year Private FAI grew by just 5.4%.

It appears as if Chinese officials had been like the Western media completely fooled by the plus sign for the improvement on the private side. FAI through the SOE’s was scaled back quite significantly during the last half of 2016, and was to begin 2017 more judicious in its presence. For the month of April, it appears as if the checking of “stimulus” was halted if not slightly reversed likely in response to lackluster private activity. |

China Fixed Asset Investment, April 2013 - April 2017 |

| If we analyze these figures on a monthly basis, however, it may be that the Chinese government has been slowly rebuilding official sector momentum going back to December last year.

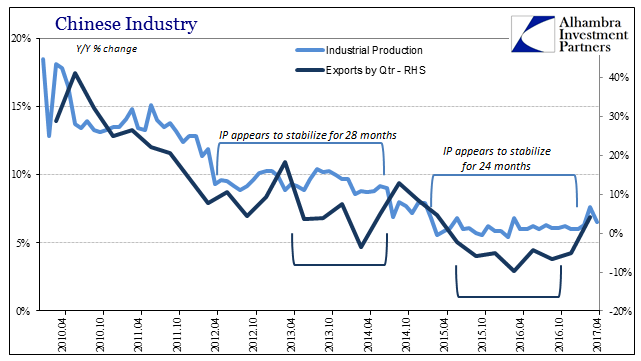

It could also be that April’s disappointing economic statistics are all just a single month of downside variation, and that for May the positive “reflation” direction will find its footing once more. But there is more going on here where the monthly SOE FAI estimates could be interpreted as a visible signal of unease about the true state of China’s economy. The other two economic accounts refer to this possibility but more as an inconsistency than anything directly observable. What I mean is that both Retail Sales as well as Industrial Production have been largely stable for more than two years. Even last month’s jump to 7.6% in IP wasn’t unique, as upward variation has been calculated two other times during this period (both to 6.8%). In their history, each statistic has exhibited this kind of low variation before, but never under these circumstances and not for this length of time. But what really raises questions is the timing. Are we supposed to believe that after turning lower in the middle of 2014, maybe as early as late 2013, China’s economy just stabilized in the first few months of 2015? Considering what was taking place at that time, it stretches reasonable assessment. Given what came shortly after, however, leaves it downright far-fetched. The trend in FAI only injects further doubts, for it wasn’t until July 2016 that this crucial area of China’s economy finally bottomed out, almost a year and a half after IP and Retail Sales. |

China Industry Drives Its Consumers, April 1999 - April 2017 |

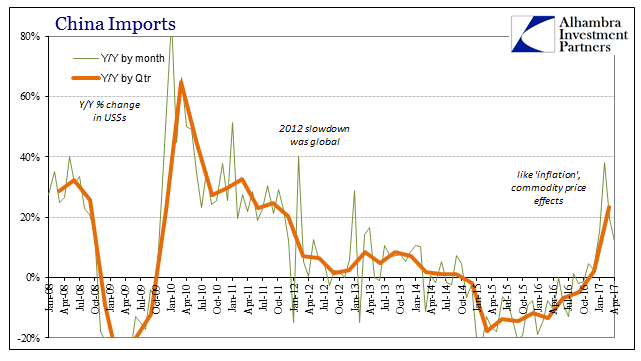

| China’s exports have exhibited a relatively good correlation with at least Industrial Production, which only makes perfect sense given the orientation of the whole economy. The export figures don’t suggest the worst until March 2016, and really don’t suggest anything like a rebound until last September. It’s quite an amazing oasis of calm amidst growing monetary and financial chaos that in other accounts registered increasing concern – so much so that in January 2016, as noted above, Chinese authorities initiated a massive “stimulus” not just fiscally but more importantly monetarily in RMB.

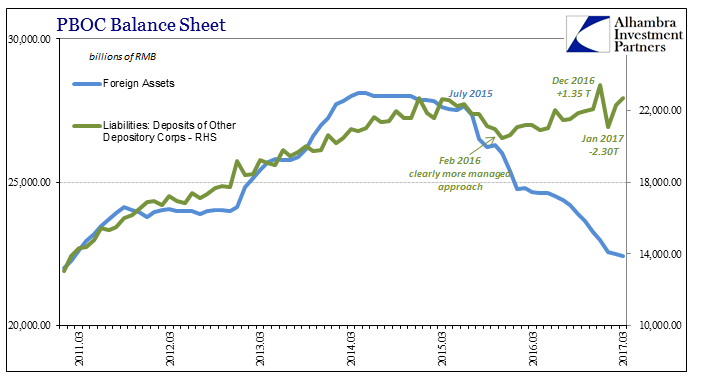

Why would they do that if China’s economy was rebalancing in a relatively steady fashion? It would seem to be more reasonable that Chinese authorities had great interest in early 2015 to make it seem like China’s economy was as stable as suggested by IP and Retail Sales. That was perfectly consistent with other official responses at the time which were focused on influencing sentiment (such as rate cuts that made look like the PBOC was doing something substantial) rather than actual measures (where they instead allowed growth in bank reserves to slow and then actually contract), all to make it seem like what was taking place was of no great concern. The media, as usual, dutifully played along by reciting the narrative of top-down control; if China’s economy was slowing it was because that is what authorities wanted. The activity to start last year proves, actually, that it wasn’t, meaning that either China’s officials were caught completely by surprise or they changed tactics from attempting to instill confidence through appearances to actually doing things. I think it very likely the latter explanation is the correct one, and furthermore I think we are witnessing repetition in early 2017. In other words, by later 2016 it does appear as if Chinese authorities at least on the fiscal side (monetarily is an altogether different story) were back to being content over improvement in sentiment, either just hoping or actually expecting that rebounding confidence tied to global “reflation” would succeed, therefore scaling back in SOE FAI. |

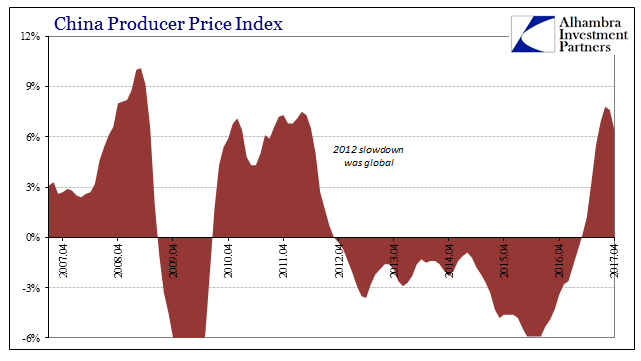

Chinese Industry, April 2010 - April 2017 |

| If that was the case (twice), then it may be that China’s economy is with respect to Retail Sales and Industrial Production in somewhat worse shape than it may otherwise appear (which, again, might have been the whole point, to disguise the depths of the downturn). That would account for why despite all the positivity in sentiment there really isn’t anything to it; a year or so after the worst, there is no momentum in anything now that commodity prices have stalled (a stall almost certainly related to the absence of actual economic impetus). | |

| As is the case now and will always, I will point out that I have no evidence that China’s government is faking or managing their economic statistics. My goal is instead to point out the inconsistencies as part of an overall thesis about why momentum in particular is missing in 2017 when by all historical comparisons it should not be. If I had to guess, both IP and Retail Sales kept decelerating like FAI until the middle of 2016 before accelerating only modestly toward the end of last year with commodity prices. It may be that China’s economy is still improving now (April), but it may be as commodity prices overall conditions have started to retrench again.

|

China Produce Price Index, April 2007 - April 2017(see more posts on China Producer Price Index, ) |

| If what I present is correct, and, again, there is no direct evidence that it is, then you can at least understand the motivations for these various ambiguities. Confidence is a major part of the orthodox textbook, believed to be a powerful contributor if properly motivated and influenced. In early 2015, the Chinese were seeking something like a “soft landing” under the banner of reform; wanting to get past the high-energy monetarization of 2009 and 2012 having by 2013 recognized the dangers of bubbles as well as the irreconcilable position they would be in if they went “too far” with it. |

China Imports, January 2008 - April 2017(see more posts on China Imports, ) |

| It wasn’t until late 2015/early 2016 that they realized by conditions of the “dollar” the Chinese economy had been pushed way too far, and that the dangers of a full economic stall were far more than mere confidence manipulation could manage. The economy was not stable because the problem was not strictly China; it was a global affair.

Having entertained “reflation” now and increasingly finding it hollow and unsubstantial, where does that leave China, the global economy, and the “dollar”? Chinese Retail Sales and Industrial Production may still be stable as constructed statistics, but underneath them is almost certainly the same tormenting decay that has each and every time over the last ten years thwarted (easily) all official plans everywhere. |

PBOC Balance Sheet, March 2011 - March 2017 |

Tags: China,currencies,depression,dollar,economy,exports,fai,Featured,Federal Reserve/Monetary Policy,fixed asset investment,Global Economy,global trade,industrial production,Markets,newsletter,Retail sales,statistics