Summary: US drama distracts from the difficult and ambitious economic program. European and Japanese developments have been constructive. Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance. The no-drama Obama has given way to “The Donald” who appears to be providing more melodrama than an Emmy-winning soap opera. To be sure it is not just him. Hope triumphed over reason among those who thought that the US economy would be ramped to 3%-4% growth, if not higher. Talk of impeachment, or the fact that some betting internet sites now show odds favoring Trump not completing his term, seem far-fetched. This is not to say impossible. The claim is more modest. It is still early days of the three ongoing investigations into Russia’s involvement in the US election (Senate, House of Representatives, and FBI). Once again, the cover-up may prove to be more problematic than the offense in the first place. The wall between confidential information and public knowledge always seemed to be a bit porous.

Topics:

Marc Chandler considers the following as important: $CNY, EUR, Featured, FX Trends, GBP, JPY, newsletter, TLT, USD

This could be interesting, too:

Nachrichten Ticker - www.finanzen.ch writes Die Performance der Kryptowährungen in KW 9: Das hat sich bei Bitcoin, Ether & Co. getan

Nachrichten Ticker - www.finanzen.ch writes Wer verbirgt sich hinter der Ethereum-Technologie?

Martin Hartmann writes Eine Analyse nach den Lehren von Milton Friedman

Marc Chandler writes March 2025 Monthly

Summary:

US drama distracts from the difficult and ambitious economic program.

European and Japanese developments have been constructive.

Bank of Canada is the only G7 central bank that meets, and it is not expected to shift from its cautious stance.

The no-drama Obama has given way to “The Donald” who appears to be providing more melodrama than an Emmy-winning soap opera. To be sure it is not just him. Hope triumphed over reason among those who thought that the US economy would be ramped to 3%-4% growth, if not higher. Talk of impeachment, or the fact that some betting internet sites now show odds favoring Trump not completing his term, seem far-fetched. This is not to say impossible. The claim is more modest. It is still early days of the three ongoing investigations into Russia’s involvement in the US election (Senate, House of Representatives, and FBI). Once again, the cover-up may prove to be more problematic than the offense in the first place.

The wall between confidential information and public knowledge always seemed to be a bit porous. What media outlets do not cite “unnamed sources” or attribute comments to persons who are not authorized to share them? However, the Washington Post, New York Times, and to a lesser extent the Wall Street Journal, appear to be special recipients of a steady flow of such leaks. There were only a few people, for example, that would know how Trump discussed the firing of Comey with Russian officials in the White House.

Former FBI Director, Comey is now scheduled to testify before the Senate Intelligence Committee after Memorial Day. However, already it seems the lines are being drawn. It is his word against the President’s. Just before the weekend, as Trump began his first trip abroad, it was reported that someone close to the President had been identified as a “person of interest” (suspected to be involved but not formally accused). It has spurred furious speculation as to the person’s identity.

And therein lies the dollar’s problem. Until Trump manages to get ahead of the curve and stop the hemorrhaging to mix metaphors, the Russian investigation will consume more attention and resources, and sap the enthusiasm for the economic program. The President needs for any person of interest, even if it is a family member, to remove themselves until the situation is cleared.

This news stream is unlikely to improve anytime soon, and the legislative challenges being faced, separate from the Russia meme, will also come back to the fore. Recall, ahead of Trump’s 100th day in office, the House of Representative’s rushed through a health care bill. Some members acknowledged not having read the bill in its entirety. In an unusual fashion, there was a floor vote before the CBO could score it.

This is an important step in the overall strategy. To establish the conditions that can lead to the reconciliation process between the House and Senate versions, the bill cannot lead to a larger deficit ten years out. The version that passed the House was not sent to the Senate. It was the awaiting the CBO evaluation. The CBO scored the bill a couple of times in March, but it has been amended. The results may require new changes to the measure, which would require another vote in the House.

United StatesPolitics looks to continue to trump economics. There are three US economic data points in the week ahead. First, the estimate for Q1 GDP is expected to be revised up, perhaps to almost 1.0% from 0.7%. It will not change the disappointment, but we note that during this expansion growth in the January-March period has averaged 1.1% annualized. Second, details about April merchandise trade, inventories and durable goods orders will help shape expectations for Q2 GDP. The New York Fed GDP tracker rose 0.4 percentage points to 2.3%. As of May 16, the Atlanta Fed’s GDPNow was tracking 4.1% for Q2 up from 3.6% on May 12. Third, the minutes from the FOMC meeting earlier this month will be released. The meeting itself was a non-event. The FOMC statement was little changed but clearly looked through the recent soft economic data. The minutes are not some objective recording of what was said. They must be understood as a communication tool, but the market understands the message that the FOMC sees its objectives sufficient close to allow it to continue to normalize monetary policy, and soon to reduce the balance sheet. While anything the Fed reveals about the evolution of its thinking on its balance sheet strategy will be scrutinized by market participants, its deliberative style and the apparent lack of urgency suggests little fresh information is likely yet. If things are not going particularly well in the US presently, it would appear it is their own doing. On the other hand, Europe seems to be doing well; The populist-nationalist threat has been turned back. The French 10-year premium had risen to nearly 70 bp over Germany. It stands near 46 bp now, just above the top of the 20 bp-40bp range seen over the past couple of years. Before the Great Financial Crisis, there was often no premium. |

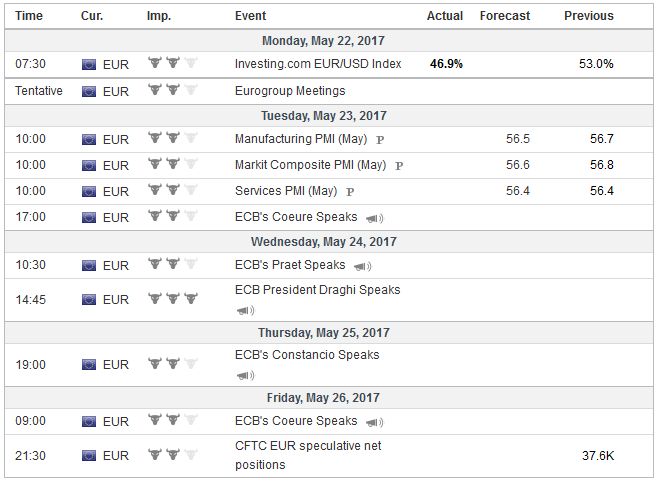

Economic Events: United States, Week May 22 |

EurozoneThe economy is doing well. Growth is steady at levels understood to be above trend, which means output gaps are closing. The optimism is not just being expressed by creditors like Germany and Austria, but by the head of the ECB. Draghi has been sounding increasing confident that the expansion is broadening and deepening, and becoming more resilient. Even if this week’s flash PMI readings pull back a little, as the many expect, barring a significant surprise, they will remain above the Q1 average. There is some risk the market gets ahead of itself. The economic improvement is a necessary but insufficient condition to exit the unorthodox monetary policies. Inflation is key. A change in the risk assessment to a more balanced setting or an acknowledgment that interest rates are not going to be cut further would merely confirm what investors already know. Meanwhile, speculative sentiment has swung sharply in favor of the euro and Europe. Speculators in the futures market are net long euros for the first time in three years. Many of the major houses have been touting the attractiveness of European equities. The NASDAQ has held its own (13% year-to-date), but the S&P 500 (6.4%) has underperformed the major European markets (France 9.5%, Germany 10.1%, Italy 12.1%, and Spain 15.9%). Many investors would be content with these returns for the entire year, rather than five and a half months. It is fine and good that France has elected a new president and there appears to be a potential political realignment. It too may be necessary but ultimately insufficient. The goods still have to be delivered. France needs to get its economic house in order before its leadership in Europe can be taken seriously. The solution to France’s pressing problem are not to be in Brussels or treaty changes, but structural reforms. |

Economic Events: Eurozone, Week May 22 |

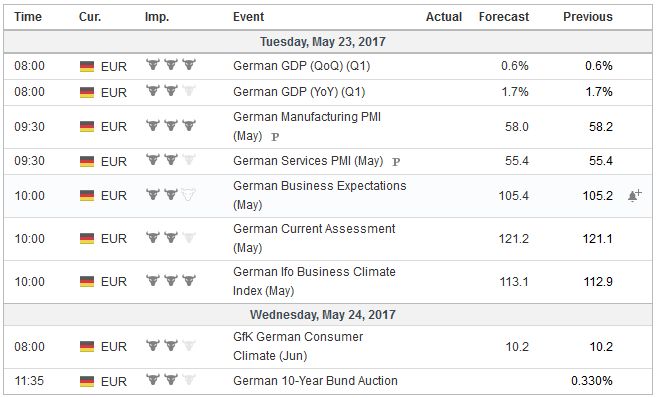

Germany |

Economic Events: Germany, Week May 22 |

JapanThe news stream from Japan has also been positive. Annualized growth surpassed expectations in January-March period. This week’s report should show a modest acceleration in inflation (to 0.4% year-over-year) after declining in February and March). The core rate, which in Japan, excludes fresh food, may also rise to 0.4%, which would be the fastest clip in two years. April trade figures will slow be released. The trade surplus is expected to be smaller than a year ago, and this will see the 12-month rolling average slip for the second consecutive month. Imports and exports expected to have slowed. Note that the May trade balance is almost always (19 of the past 20 years) worse than the April balance. Another sign that Japan’s economic outlook has brightened is that Abe is willing to spend more effort and political capital on his political agenda of changing the constitution to give if a strong defense. Abe has been successful in staying off of the US radar screen, though his defense efforts are consistent with what the US President has advocated. |

Economic Events: Japan, Week May 22 |

Switzerland |

Economic Events: Switzerland, Week May 22 |

The Bank of Canada is the only major central bank meeting in the week ahead. It will retain its current cautiousness with rates remaining on hold. Recent high frequency data was soft. Full-time jobs fell by 31.2k in April, and the participation rate fell 0.3 percentage points to 65.6. Retail sales excluding autos fell, and the three core CPI measures averaged 1.4% in April. The renegotiation of NAFTA is expected to begin in August or September, and there is still risks from the US tax reform, where the Republican leadership in the House is still pushing for a border adjustment tax. The recent downgrade of several Canadian banks, but the underlying concern, the health of household finances, is not a new issue.

Speculators in the futures market had a record net and gross short position as of May 16. We suspect that the price action before the weekend when the US dollar was sold to CAD1.35, its lowest level this month after being unable to resurface above CAD1.36 after the disappointing data, may have spurred a re-think.

Lastly, OPEC meets on May 25. The issue is whether to extend the six-month output cut agreement and whether to make deeper cuts. Saudi Arabia and Russia reportedly will back extending the existing cuts for nine months. Recall when the output restraint was announced, it was thought that six months was all that was needed to bring supply and demand back into equilibrium. Now the thinking that six months is only about 2/5 of the time needed. OPEC could “surprise” the market by agreeing to deeper output cuts. More than half the output cuts have been made up for the US and other non-OPEC countries.

The July Brent and light sweet crude oil futures settled at their best levels in a month before the weekend. Brent had been capped ahead of $53 most of last week before punching through it in the last trading session. The next technical target is seen near $55. The July light sweet crude contract closed above the $50 threshold for the first time since April 20, and is also poised for additional gains. While the US rig count rose for the 18th consecutive week, according to Baker-Hughes, for the first time since February, US output fell on week-to-week basis. The reelection of the Rouhani as President of Iran represents a continuation of policy, whereas if the more conservative Raisi would have won, it would have been seen as more favorable oil prices.

Tags: #GBP,#USD,$CNY,$EUR,$JPY,$TLT,Featured,newsletter