“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.” 13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England Introduction A central bank Gold Pool which many people will be familiar with operated in the gold market between November 1961 and March 1968. That Gold Pool was known as the London Gold Pool. This article is not about the 1961-1968 London Gold Pool. This article is about collusive central bank discussions relating to an entirely different and more recent central bank Gold Pool arrangement. These discussions about a second Gold Pool began in late 1979, i.e. more than 11 years after the London Gold Pool had been abandoned. This article is Part 1 of a 2 part series. Part 2 will be published shortly. These discussions about a new Gold Pool arrangement took place in an era of soaring free market gold prices and in the midst of the run-up in the gold price to US0 in January 1980.

Topics:

Ronan Manly considers the following as important: Abdulaziz Al-Quraishi, Al Quraishi, Anthony Solomon, Banca d'Italia, Bank for International Settlements, Bank of England, banque de France, Basel Gold Pool, Basle Gold Pool, Bernard Clappier, Bill Miller, Bundesbank, Carlo Ciampi, Cecil de Strycker, Christopher McMahon, David Walker, Deutsche Bank, Deutsche Bundesbank, Eddie George, Featured, Federal Reserve Board, frbny, Fritz Leutwiler, Gold and its price, gold for oil, Gordon Richardson, Helmut Schmidt, Henry Wallich, HSBC, JLS, John Sangster, Karl Otto Pohl, Kit Mcmahon, London Gold Pool, Midland Bank, newsletter, oil for gold, Otmar Emminger, Paolo Baffi, Paul Jeanty, Paul Volcker, Renaud de La Genière, Rene Larre, SAMA, Samuel Montagu, Saud Arabian Monetary Authority, Swiss National Bank, Tony Solomon, Uncategorized, US Treasury, William Miller, Winifried Guth

This could be interesting, too:

investrends.ch writes Bloomberg: DWS stoppt Private-Credit-Geschäft in Asien

investrends.ch writes Deutsche Bundesbank warnt vor wachsenden Systemrisiken

investrends.ch writes Deutsche Bank bleibt auf Rekordkurs

investrends.ch writes HSBC bildet Milliarden-Rückstellung wegen Rechtsstreits um Madoff-Betrug

“In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.”

13 December 1979 – Kit McMahon to Gordon Richardson, Bank of England

Introduction

A central bank Gold Pool which many people will be familiar with operated in the gold market between November 1961 and March 1968. That Gold Pool was known as the London Gold Pool.

This article is not about the 1961-1968 London Gold Pool. This article is about collusive central bank discussions relating to an entirely different and more recent central bank Gold Pool arrangement. These discussions about a second Gold Pool began in late 1979, i.e. more than 11 years after the London Gold Pool had been abandoned. This article is Part 1 of a 2 part series. Part 2 will be published shortly.

These discussions about a new Gold Pool arrangement took place in an era of soaring free market gold prices and in the midst of the run-up in the gold price to US$850 in January 1980.

The discussions and meetings about a new Gold Pool in 1979 and 1980 and beyond which are detailed below, occurred at the highest levels in the central banking world and involved the world’s most powerful central bankers, some of whose names will be familiar to readers. The aim of these central bank discussions and meetings was to reach agreement on joint central bank action to subdue and manipulate the free market gold price in the early 1980s. Many of these collusive meetings were private meetings between a handful of Group of 10 (G10) central bank governors, and took place in the actual office of the president of the Bank of International Settlements in Basle, Switzerland.

Above all, these central bank meetings show intent. Intent by a group of powerful central banks to manipulate a free market gold price so as to distort free market gold pricing signals. So these documents are timeless in that regard. The documents also illustrate the concern that a rising gold price in the free market creates for senior central bankers, and importantly, also shows that these same central bankers have no qualms, at least from a legal or moral perspective, of intervening to manipulate a gold price when they see it as a threat to their fiat currency monetary system.

The 1961-1968 London Gold Pool was a collusive arrangement between 8 major central banks to attempt to keep a lid on the official gold price at US $35 per ounce. That Gold Pool was instigated at the headquarters of the Bank for International Settlements (BIS) in Basle, Switzerland and monitored at the BIS by the governors of the Pool’s member central banks. However, day-to-day activities of the 1961-1968 Gold Pool were executed by the Pool’s agent, the Bank of England in London. Hence it was dubbed the London Gold Pool. Famously, this London Gold Pool collapsed on Thursday 14 March 1968 when speculative buying in the London Gold Market overwhelmed available Gold Pool supplies from member central banks.

Whereas the members of the 1961-1968 London Gold Pool consisted of the central banks of the United States, United Kingdom, West Germany, the Netherlands, Switzerland, France, Belgium and Italy, the discussions about a new Gold Pool that took place in 1979, 1980 and beyond, involved the very same central banks.

The 1961 -1968 Gold Pool was both a selling syndicate, where the members pooled their gold reserves to intervene in the London gold market, and a buying syndicate where the member central banks attempted to replenish gold that had been used in the gold price capping operations. Similarly, as you will see below, the discussions on a new Gold Pool in 1979 and 1980 involved participant West European central banks which on the whole wished to be able to buy gold for the Pool as well as sell gold from the Pool.

| Central to illustrating how the most powerful central bankers in the world colluded to attempt to establish a new Gold Pool are a number of internal documents from the Bank of England which provide a detailed blueprint on the evolution of these collusive discussions at the BIS, as well as providing detailed insights into the thinking of the senior Bank of England executives involved in the meetings. These internal correspondence documents from 1979 and 1980 can be thought of as the equivalent of internal emails in the era before corporate email systems.

As you will see below, so many names of high level central bankers crop up in the discussions and documents, that to provide context, this necessitated some short background summaries on who these people were and what roles they occupied. It is also necessary to provide some brief context on gold price movements during the period under discussion. |

|

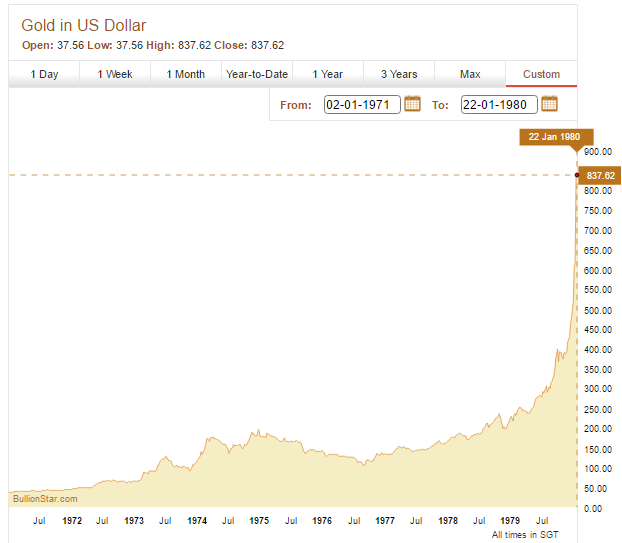

The Gold Price Run-up during 1979 and 1980When the London Gold Pool collapsed in mid-March 1968, a two-tier gold market took its place, with the private market gold price breaking higher, while central banks continued to trade gold with the Federal Reserve Bank of New York (FRBNY) and US Treasury at the official price of US$ 35 per ounce. However, in August 1971, Nixon closed this FRBNY / Treasury ‘Gold Window’ by ending the convertibility of US dollar liabilities into gold that had been an option for foreign central banks and foreign governments. This was the birth of the free-floating gold price. By the end of 1974, the US dollar gold price had soared to $187 per troy ounce. Following this, the next 3 years saw the gold price first trade down to near $100 during August 1976 before resuming its uptrend. Year-end gold prices over this period were in the $135 – $165 range. In 1978, the price again broke to a record high and finished the year at $226 per ounce. See chart below. |

Gold Price January 1971 to January 1980(see more posts on Gold prices, ) Source: BullionStar charts - Click to enlarge |

| But it was in 1979 that the US dollar gold price really took off, setting record after record. In July 1979, the $300 level was breached for the first time. During October 1979, the gold price then took out $400 for the first time. During December 1979, the gold price hit $500. While these late 1979 price increases were in themselves phenomenal, what then occurred in January 1980 was even more striking, for in the space of a few weeks, the price rocketed up first through $600, then $700, and then through the $800 level before peaking in late January 1980 at a then record of $850 per ounce. See chart below.

The mid-1970s saw a flurry of official gold sales to the market which although strategically designed in part to subdue the gold price, in practice didn’t achieve that goal over the medium term. Between June 1976 and May 1980, the International Monetary Fund sold 25 million ounces (777 tonnes) of gold in 45 public auctions. Between May 1978 and November 1979, the US Treasury sold 8.05 million ounces of high grade gold (99.5% fine) and 7.75 million ounces of low grade gold (90% fine) in 23 auctions to the private market. That’s just over 15 million ounces (466 tonnes) of gold in total auctioned by the Treasury. The last US Treasury auctions were on 16 October 1979 when 750,000 ounces of low grade coin bars were auctioned, and then on 1 November 1979 when the Treasury implemented a variable sales quantity approach and auctioned 1,250,000 ounces of low grade coin bars. On 15 January 1980, the US Treasury Secretary announced an official end of US gold sales. As the 1980 annual report of the bank for International Settlements noted when reviewing the 1979 gold market: “The further increase in [gold] supplies was overshadowed by the dramatic rise in the demand for gold which, in the space of little over a year, caused the London market price to increase more than fourfold to a peak of $850 per ounce in January 1980.” “In addition to its sheer magnitude, last year’s [1979] gold price rise had three other remarkable features: firstly, it took place against all major currencies, including those whose value had increased most during the 1970s. Secondly, it took place at a time of generally rising interest rates in the industrialised world, one effect of which was to increase the cost of holding gold. Thirdly, it took place at a time when, by and large, the dollar was strengthening in the exchange markets.” It is against this background of surging gold prices, pre-existing gold auctions, turmoil in currency markets, slow growth and high inflation, that the first of the collusive Gold Pool discussions took place between September 1979 and January 1980 at the BIS. |

|

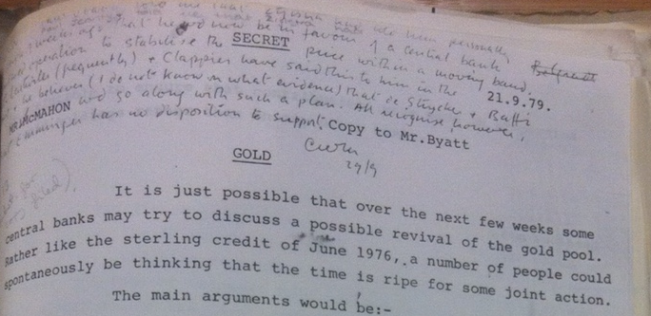

Gold Pool RevivalThere now follows a series of confidential memorandums and briefings from the Bank of England, the first of which, marked ‘SECRET‘ was an analysis written by the Bank of England’s John Sangster to the attention of the Bank of England’s Christopher McMahon. Documents are in blue text and italics, with bold and underlining added where appropriate. A lot of the text in the documents is self-explanatory and the underlying and bold text just draws attention to sections of particular interest. Christopher McMahon, known as ‘Kit’ McMahon, was an executive director at the Bank of England from 1970 to 1980, before becoming Deputy Governor of the Bank of England on 1 March 1980. Prior to McMahon’s promotion, Jasper Hollom was Deputy Governor of the Bank of England. Kit McMahon’s full name is Christopher William McMahon, hence he signed his his internal Bank of England memos and correspondence with the initials ‘CWM’. McMahon left the Bank of England in 1986 to take up the role of Chief Executive and Deputy Chairman of Midland Bank. In 1987, McMahon was also made Chairman of Midland Bank. McMahon left Midland in 1991. Since 1974, Midland Bank had also owned Samuel Montagu, one of the five traditional bullion firms of the London Gold Market. HSBC acquired full ownership of Midland in 1992 after acquiring a 15% stake in 1987 when McMahon was Chairman and Chief Executive of Midland. See profiles of McMahon here and here. John Sangster’s full name was John Laing Sangster, hence he signed his internal Bank of England memos and analysis with the initials ‘JLS’. During the 1970s and early 1980s, Sangster was the Bank of England’s foreign exchange and gold specialist. In March 1980, Sangster became one of six newly appointed assistant directors at the Bank of England. To give some idea of the senior level at which Sangster was operating at that time at the Bank, when he was promoted to assistant director in March 1980, two of Sangster’s contemporaries that also made assistant director at the time were Eddie George (gilt-edged operations area) and David Walker (economics area). Sangster retired from the Bank of England in 1982. Eddie George went on to be Governor of the Bank of England from 1993 to 2003. David Walker went on to head a whole host of institutions in the City of London including the chairmanship of Barclays Bank. The first document which follows was written on 21 September 1979 when the gold price closed at $376.41. SECRET 21.9.1979 Mr McMahon Copy to Mr Byatt Gold It is just possible that over the next few weeks some central banks may try to discuss a possible revival of the gold pool. Rather like the sterling credit of June 1976, a number of people could spontaneously be thinking that the time is ripe for some joint action. The main arguments would be: – (a) gold is even now so much part of the international monetary system that its present performance is a significant element in general currency instability; (b) whereas previously the weakness in the dollar had been boosting gold, latterly the strength of gold has itself contributed to the dollar’s renewed weakness; (c) the market now looks overbought, and there is a need to break the psychology of “the market can only go one way and that is up”. Such an attitude has obvious dangers in any market but given gold’s residual monetary connections, there must be a danger that financial institutions could become over exposed in this area; (d) a joint demonstration by central banks would be all the more salutary since the market firmly believes that central banks are only interested in putting a floor under the price and that none wishes to stem its rise. (e) it could flush out more Russian selling There would obviously be no question of any permanent stabilisation of the gold price, merely at a critical time holding it within a target area. Such an operation could be mounted alongside the existing US auctions, although it is arguable that these have become too predictable and could, for the time being at least, be better subsumed in a new gold pool arrangement. As far as I know, nothing has yet been mooted to or by the FRBNY, and if there is no American interest the matter would be dropped. Nor would others consider the proposal, if there were no provision for the recapture of gold, were the market temporarily mastered. There is nothing for us to do at the moment but be aware of the potential for discussion.. If the idea got off the ground and given the comparative paucity of our gold holding, it would obviously [page 2] be preferable to ensure that contributions were made in proportion to gold holdings rather than on any other basis. 21st September 1979 JLS The actual memorandum from JLS to McMahon can be seen here: Page 1 and Page 2. The links may take a little while to load first time. Not surprisingly, as the Bank of England’s gold and foreign exchange specialist, Sangster was privy to the views and conversations of other central banks in this area at that time, for he correctly predicted that a group of central banks were about to embark on discussions about a new Gold Pool. Sangster also correctly predicted that the European central banks’ preferred structure of the interventions be in the form of a Pool in which the gold used could be recaptured. Notably, Sangster’s assessment of the need for American buyin to the scheme also proved accurate. It was convention in that day at the Bank of England for internal correspondence to be circulated to the recipients who then read it and added hand-written notes which they signed with their initials before returning the original circulated pages to the author. This was in the time before the advent of corporate email. In the above memorandum, a hand-written note by Kit McMahon signed with the initials CWM at the top of page 1 reads as follows: “Paul Jeanty told me that Zijlstra had told him personally a couple of weeks ago that he would now be in favour of a central bank operation to stabilise the price within a moving band. Leutwiler (frequently) and Clappier have said this to him in the past and he believes (I do not know on what evidence) that de Stryker and Baffi would go along with such a plan. All recognise, however, that Emminger has no disposition to support. CWM 29/9″ As above, there will be many famous names throughout this article, each of which needs to be briefly profiled so as to add context. At the time of this correspondence, Paul Jeanty was Deputy Chairman of Samuel Montagu & Co, one of the five bullion dealers in the London Gold Market. Samuel Montagu & Co had been a wholly owned subsidiary of Midland Bank since 1974. |

A Who’s Who of Central Bankers

Zijlstra refers to Dr. Jelle Zijlstra, Chairman and President of the Bank for International Settlements (BIS) from 1967 to December 1981. Zijlstra was also simultaneously President of the Dutch central bank, De Nederlandsche Bank (DNB) from 1967 until the end of 1981. Notably, Zijlstra was also Dutch Prime Minister for a short period during 1966-67.

Leutwiler refers to Fritz Leutwiler, Chairman of the Swiss National Bank (Switzerland’s central bank) from May 1974 to December 1984. Leutwiler was also a member of the board of the BIS from 1974 to 1984, and served as President of the BIS between January 1982 and December 1984, as well as Chairman of the Board of the BIS from January 1982 to December 1984.

De Stryker refers to Cecil de Strycker, Governor of the National Bank of Belgium from February 1975 to the end of February 1982. At that time, De Stryker was also president of the European Monetary Cooperation Fund and then president of the Committee of Governors of the Central Banks of the Member States of the European Economic Community.

Clappier refers to Bernard Clappier, Governor of the Banque de France from 1974 to 1979. Clappier was also vice-governor of the Banque de France from 1964 to 1973.

The reference to Baffi is Paolo Baffi, Governor of the Banca d’Italia from July 1975 until October 1979, and also a board member of the BIS since 1975. Baffi became Vice-Chairman of the BIS in 1988.

Emminger refers to Otmar Emminger, President of the Deutsche Bundesbank from 1 June 1977 to 31 December 1979. Emminger was one of the principal architects of the IMF’s synthetic Special Drawing Right (SDR) in 1969 which was designed to be a competitor of and replacement for gold.

The next document below, from 18 October 1979 contains references to the above people and also references to other important central bankers, so it is best, at this stage, to explain these additional names also.

THE GOVERNOR of the Bank of England – Gordon Richardson. Richardson was Governor of the Bank of England for 10 years from 1973 to 1983, and a non-executive director of the Bank of England between 1967 and 1973. He was chairman of J. Henry Schroder Wagg from 1962 to 1972, and chairman of Schroders from 1966 to 1973. Richardson was also a director of Saudi International Bank in London. Saudi International Bank was formerly known as Al Bank Al Saudi Al Alami when it was incorporated in London in 1975, and is now known as Gulf International Bank UK Limited.

Ciampi refers to Carlo Ciampi. Ciampi was Governor of Banca d’Italia from October 1979 to April 1993, and also Vice-Chairman of the Bank for International Settlements between 1994 and 1996. Notably, Ciampi was also Prime Minister of Italy from April 1993 until May 1994, and President of Italy from May 1999 until May 2006.

Schmidt refers to Helmut Schmidt, Chancellor (head of state) of the Federal Republic of Germany (West Germany) from 1974 to 1982.

Guth refers to Wilfried Guth, Chairman of the Board of Deutsche Bank (the commercial bank) from 1976, and from 1985 Chairman of the Supervisory Board of Deutsche Bank until 1990.

Al Quraishi refers to Abdulaziz Al-Quraishi. Al-Quraishi was Governor of the Saudi Arabian Monetary Agency (SAMA) from 1974 to 1983. He was also Chairman of Saudi International Bank in London from 1987 to 1996, and was on the Board of Saudi International Bank at the same time as Gordon Richardson.

The Americans: Miller, Solomon, Volcker and Wallich

Miller refers to William Miller. Miller was US Secretary of the Treasury from August 1979 to January 1981. Before that, he was chairman of the Board of Governors of the Federal Reserve System from March 1978 to August 1979.

Solomon refers to Anthony Solomon. From March 1977 to March 1980, Solomon was US Undersecretary of the Treasury for Monetary Affairs. In April 1980, he became President of the New York Fed and stayed in that position until the end of 1984.

Volcker refers to Paul Volcker. In August 1979, Volcker took over from Miller as chairman of the Board of Governors of the Federal Reserve System. Prior to that, Volcker was President of the New York Fed from 1975 to 1979. Volcker had also been Undersecretary of the Treasury for Monetary Affairs 1969 to 1974.

Wallich is a reference to Henry Wallich. Wallich was an economist, who among other things, was a member of the Board of Governors of the Federal Reserve System from 1974 to 1986. He was also a member of the Congressional Gold Commission in 1981-1982.

Gold Pool Discussions in Belgrade

This second document below was written by Kit McMahon on 18 October 1979 and addressed to the Bank of England Governor, Gordon Richardson. On 18 October 1979 the gold price closed at $386.84. The reference to Belgrade refers to the annual conference of the International Monetary Fund and World Bank which took place at the beginning of October 1979 at the Sava Center in Belgrade, the capital of the former Yugoslavia. Finance ministers and central bankers from 138 countries attended this IMF annual conference in Belgrade.

SECRET

18.10.79

THE GOVERNOR O/R

Gold

Paul Jeanty came to see me this afternoon to report on a conversation be had with Leutwiler the other day in Zurich.

Leutwiler told him that the Americans had come to see him in Belgrade (the whole team of them – Miller, Solomon, Volcker and Wallich). To Fritz’s great surprise they had asked him whether he might organise a gold selling operation (it was mainly Volcker and Solomon who did the talking). They had apparently mentioned the possibility of being prepared to sell 10% of official reserves and were apparently prepared to join in themselves.

Fritz had replied that if an operation was mounted, nothing like 10% of reserves would be necessary; but that any gold that he sold he would want to buy back later on at a lower price. Again to his surprise the Americans had not demurred at this – a very big change from previous attitudes.

Fritz had told Jeanty, what Jeanty already knew, that Zijlstra would be interested; however, apparently Clappier indicated that he was against. This was a reversal of view which Leutwiler attributed to pressure from the Élysée which was itself influenced by the Germans. Leutwiler had also said that whereas Baffi had been in favour he had no knowledge of Ciampi’s attitude.

Emminger continued to be strongly against. Apparently, however, some attempt had been made to persuade Schmidt of the value of this idea. According to Leutwiler, Guth had urged it on him, but Schmidt does not appear to be prepared to oppose the Bundesbank.

There seems to be some disposition among those in favour to believe that OPEC are increasingly concerned that gold is outpacing oil and increasingly prepared to use this as an argument for higher oil prices. Jeanty asked Leutwiler whether he was sure that Al Quraishi would not rock the boat

Page 2

and start buying if other central banks sent the price down. Leutwiler had assured him that he had often discussed it with Quraishi and that there would be no problem there. He then apparently gave a very interesting piece of information that Quraishi and Zijlstra are meeting with Emminger in Frankfurt next Tuesday – though not necessarily on this subject. Jeanty suggested it might be a plea to be allowed to diversify.

Finally, according to Jeanty, Fritz had asked if he would be likely to be seeing me, making it fairly clear that he would like the gist of these conversations to get to us. He knew that our reserves are small but he hoped that we might provide moral backing for an initiative to put pressure on Emminger.

I applied to all this, as I have to similar discussions on previous occasions, in a rather discouraging way, saying that while I disliked the instability of the gold price, I thought it was symptomatic more than causal of currency problems and that their would be a sharp fall if and when Volcker’s policy succeeded. Moreover, while it would be easy and nice for central banks to force the price down too hard and quickly, thereafter – and particularly when they started buying back, they could well find that they were riding a tiger.

I would have said this to Jeanty whatever my views, but in fact I remain extremely doubtful about the wisdom of any enterprise of this kind – at least divorced from much more wide-ranging agreements about currency stability. However, I thought the conversation was of interest in a number of ways not least in providing further evidence of the way central bankers will talk to major operators in the gold market. I imagine you might want to have some further conversations on this subject with your colleagues in Basle.

CWM

18th October 1979

The above memorandum from McMahon to Richardson can be seen here: Page 1 and Page 2. The links may take a little while to load first time.

The following key points are notable from McMahon’s analysis. Zijlstra, as BIS President and as president of the Dutch central bank was in clear favour of the Gold Pool idea.

At the IMF conference in Belgrade at the start of October 1979, the representatives of the US Treasury (Miller and Solomon) and of the Fed Board of Governors (Volcker and Wallich) approached Fritz Leutwiler, chairman of the Swiss National Bank to discuss coordinated gold sales.

At the time, this was alluded to within the financial media, but only in a very general way and there was no mention of a Gold Pool. On 2 October 1979, the New York Times wrote:

“The United States Government, weighing new plans to stabilize the dollar on exchange markets, suggested today that it might increased the amount of gold it offers at monthly auctions and that it was considering the possibility of internationally coordinated bullion sales.

Anthony M Solomon, Treasury Secretary for Monetary Affairs, said the international effort had been discussed with ‘various’ Government representatives on the fringes of the Belgrade annual meeting of the IMF and World Bank.”

The Americans appear to have had a change of mind by the time they met in Belgrade since they were by then comfortable with the notion of recapturing any gold used in price manipulation operations. i.e. a Gold Pool, but by implication they had previously not been in favour of trying to recapture any gold sold.

Note that Volcker and Miller had also met with Helmut Schmidt and Otmar Emminger in Hamburg on their way to Belgrade when they held a meeting to discuss how best to defend the US dollar on the currency markets.

Bernard Clappier, governor of the Banque de France, was by then less in favour of a Pool due to political pressure from the Élysée, which in this context refers to the French Council of Ministers who meet at the Élysée Palace, home of the French president. But that French reluctance was attributed to influence from the Bundesbank which was itself reluctant to engage in the scheme, but as revealed below, this was more due to the Bundesbank’s desire that the US monetary authorities fix the larger currency / dollar issues of the day in parallel with engaging in any Gold Pool operations.

Volcker Headed back to Washington for FOMC Meeting

During the Belgrade IMF conference, Paul Volcker had unexpectedly and suddenly left Belgrade on Tuesday 2nd October and headed back to Washington. He did this to convene a special secret and previously unscheduled meeting of the Fed’s FOMC which occurred on Saturday 6 October 1979. It was at this meeting that Volcker announced the now famous change in Fed policy that saw it shift its focus to monitoring and managing the volume of bank reserves in the financial system as opposed to trying to micro manage the federal funds rate level, and which ushered in much higher interest rates and a recession in an attempt to rein in inflation.

But there are also some interesting references in the transcripts of that 6 October FOMC meeting and in a transcript of a 5 October FOMC conference call preparatory meeting, that make reference to the discussions on gold that Volcker, Miller, Solomon and Wallich had with their European central banker peers while in Belgrade. In the 5 October FOMC conference call meeting Volcker said:

“Let me summarize some of this by saying that late last week–actually beginning before then but particularly late last week and in the very early part of this week–these markets, by which I mean the gold market very obviously and the foreign exchange markets, were “depressed.” I guess that’s the right word. And the atmosphere was very nervous. I think that has been largely turned around by an expectation that there will be some action.“

In its 6 October 1979 FOMC meeting, Volcker makes reference to the soundings which the Americans made in Belgrade with other central bankers:

“The possibility of gold sales has been canvassed up and down. “

“The question has been debated up and down and I think it is essentially unsettled. There is a possibility [of gold sales], particularly if the gold market acts up again, but there has been no firm consensus reached on that point simply because in our mutual discussions some concern was expressed about whether they are effective or not effective over a period of time. They might be effective immediately. But if the gold sales have a nice effect immediately and we test it a little while later and the gold price goes up again, the question arises: Is it confidence inspiring or is it not?

Or is it really better over a period of time just to leave the [gold] market alone? I think that question has to be left on that basis for the time being.”

“We will have cooperation, I think, from our foreign partners either on gold or on intervention to the degree that they feel that we have done something here; that is an essential part of setting the stage. We will get that kind of cooperation, I suppose, with the limitations of enthusiasm that are inherent in my earlier comments. I don’t mean to suggest that that type of activity is “out” if we mutually think it is advantageous. On the contrary, it is ‘”in” over a period of time with an appropriate background. But it is not “in” in the sense of announcing an international package of that type this weekend.”

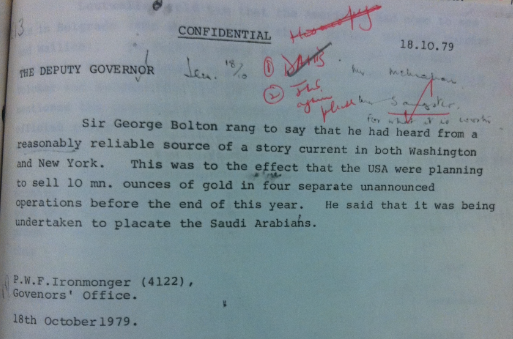

Interestingly, on the same day, 18 October 1979, a former Bank of England executive, George Bolton, rang the Bank of England to relay news about rumoured clandestine gold sales by the US to the Saudis:

18.10.79

THE DEPUTY GOVERNOR Copies to DAHB and JLS

Sir George Bolton rang to say that he had heard from a reasonably reliable source of a story current in both Washington and New York. This was to the effect that the USA were planning to sell 10 mn. ounces of gold in four separate unannounced operations before the end of this year. He said that it was being undertaken to placate the Saudi Arabians.

P.W.F. Ironmonger,

Governor’s Office

18th October 1979

| Sir George Bolton had been an executive director of the Bank of England in the 1950s and a non-executive director of the Bank of England in the 1960s, and is attributed as having playing an important role in the development of the Eurodollar market in London. It is not clear why Bolton was still relaying market intelligence to the Bank of England in 1979. Perhaps he did this on an informal basis for the Governors.

However, it is very interesting that Bolton said that the Americans were selling 10 million ounces (311 tonnes) of gold to the Saudis to placate them, and this ties in with McMahon’s comments to Richardson that “OPEC are increasingly concerned that gold is outpacing oil”, but that Al Quraishi of the Saudi Arabian Monetary Authority (SAMA) “would not rock the boat” and buy gold on the market if a new gold pool was selling, but that at the same time Leutwiler thought that Al Quraishi and SAMA were eager to “diversify” i.e. reinvest their oil revenues in a more diversified way including in physical gold. Since the last US Treasury gold auction was on 1 November 1979 for 1.25 million ounces of low grade coin bar gold, were 10 million ounces of gold sold directly to the Saudis out of US gold stockpiles, 10 million ounces which were never reported to the market? Or did the US use another central bank’s gold as part of a gold swap to ‘placate’ the Saudis with? These questions remain unanswered, but its important to remember the gold and oil connection and the importance to which the Western European and US monetary authorities attached to ‘keeping the Saudis happy’. More on these oil and gold connections in Part 2. |

|

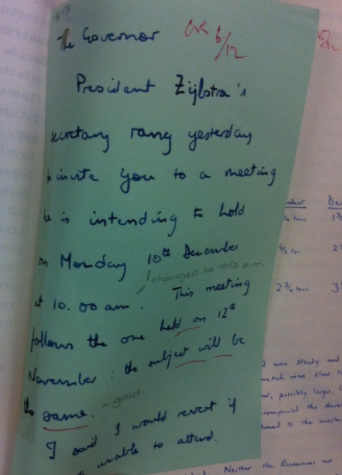

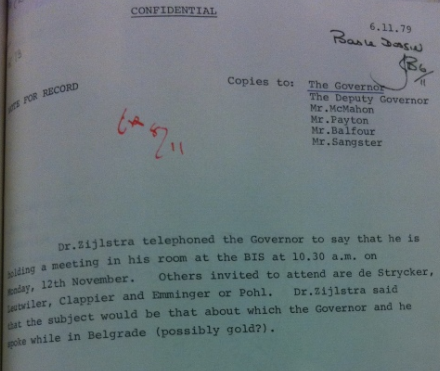

First Gold Pool Meeting – 12 November 1979In the above memorandum dated 18 October 1979 that Kit McMahon sent to Govenror Gordon Richardson about the Belgrade discussions and the establishment of a new Gold Pool, there is a hand-written reply in red pen from Richardson to McMahon written on 4 November 1979, as follows: ‘CWM, Thank you for this interesting note which I read some days ago. I agree with your comment at X at the bottom of Page 2. I will pursue with Fritz at Basle but I wonder if it has not now died. GR 4/11’ Fritz refers to Fritz Leutwiler, then Chairman of the Swiss National Bank. X refers to “conversation was of interest in a number of ways not least in providing further evidence of the way central bankers will talk to major operators in the gold market”. A hand-written reply from McMahon to Richardson reads “possible but still worth raising, CWM”. There is also another handwritten note at the top of page 1 which reads “Copy for November Basle Dossier”. However, the Gold Pool initiative did not die as Richardson thought it might, for on Tuesday 6 November 1979, Zijlstra called a meeting for the following Monday 12 November to take place at his office at the BIS, and invited the central bank governors of the Bank of England, the Bundesbank, the Banque de France, the Swiss National Bank, the Belgian central bank, and of course, the Dutch central bank which was represented by Zijlstra himself. CONFIDENTIAL NOTE FOR RECORD Copies to: The Governor, The Deputy Governor, Mr McMahon, Mr Payton, Mr Balfour, Mr Sangster “Dr. Zijlstra telephoned the Governor to say that he is holding a meeting in his room at the BIS at 10:30am on Monday 12th November. Others invited to attend are de Strycker, Leutwiler, Clappier and Emminger or Pohl. Dr. Zijlstra said that the subject would be that about which the Governor and he spoke while in Belgrade (possibly gold).” L.C.W Mayes, Handwritten on the note was “Basle Dossier“, and the initials GR in red (for Gordon Richard) with the date 8/11. The last few months of 1979 was a period that witnessed new governors being installed at both the Banque de France and Banca d’Italia and a new president at the Bundesbank. At the Banca d’Italia, Paolo Baffi resigned on 7 October 1979, and Carlo Ciampi (then deputy governor) became governor. At the Banque de France, Bernard Clappier stepped down as governor on 23 November 1979 , and Renaud de La Genière took his place. At the Bundesbank, Otmar Emminger retired in December 1979, and Karl Otto Pohl became President. This explains why the meeting invitation above says “Emminger or Pohl” because November and December 1979 was a transition time at the Bundesbank between Emminger and Pohl. Pohl only joined the Bundesbank in 1977, first serving as vice-president between 1 June 1977 to 31 December 1979. Pohl then became president of the Bundesbank on 1 January 1980 and remained as Bundesbank President until 31 July 1991. This adhoc Gold Pool discussion meeting by a subset of G10 central bank governors at the BIS in Basle, Switzerland, was the first of 3 such meetings that took place on 12 November 1979, 10 December 1979, and 7 January 1980, respectively, and variously involved G10 central banker governors Zijlstra, Leutwiler, Richardson, Emminger, Pöhl, McMahon, de Strycker, de la Genière, Clappier, as well as René Larre, the BIS General Manager. The Bank of England archives only have a summary of the meeting which took place on 10 December 1979 (which is covered below). The very fact that there is a record of the 10 December 1979 meeting is itself a streak of luck since Kit McMahon attended the meeting that day in the place of Gordon Richardson, since, according to the Governor’s Diary for that day, Richardson had to leave the BIS early on 10 December to return to London in order to attend a meeting with the Prime Minister Margaret Thatcher at 10 Downing Street. Additionally, when asked for minutes of these 3 meetings from 12 November 1979, 10 December 1979, and 7 January 1980 where the attendees were the above governors, the BIS Archives claimed it did not have such minutes and responded: “The Gold Pool came to an end in 1968, so I take it that you are referring to meetings of the Gold and Foreign Exchange Committee. We do have some minutes for this meeting, but unfortunately not for the period which interests you.” |

|

Preparing for the 12 November Gold Pool Meeting

Hand-written on the invitation notice for the 12 November meeting is a note from McMahon to Sangster which says: “JLS, Can you provide a short brief & factual background and thoughts on the advisability of any form of central bank action? (see attached note of a conversation with Jeanty)”. [This is the ‘Paul Jeanty came to see me‘ memorandum from above].

Sangster saw this note from McMahon on 7 November and responded as follows (remember that Sangster had read the “Paul Jeanty – Leutwiler” memorandum). Below is the third main document of the series. It was written by John Sangster on 7 November 1979, a day on which the US dollar gold price closed at $382.92.

SECRET

Mr McMahon Copies to: Mr Byatt

(handwritten: ‘Copy to the Governor’)

POSSIBLE GOLD POOL

This heat may be now off this question although on a longer term view gold still looks substantially overpriced, unless oil-producing countries are determined to pre-empt a large proportion of current supplies.

- $ per fine ounce

- End 1974 almost 200

- September 1976 almost back to 100

- July 1978 through 200

- July 1979 through 300

- October 1979 through 400

There could obviously be endless argument about when the price was right. One can perhaps say no more than that 200 was obviously too high at end of 1974, as 100 was too low almost two years later. If these brackets are omitted, it seems difficult to justify a price over 300 now. I should certainly be reluctant to recommend purchases, other than for the jobbing book, at above this price.

It is largely possible that German opposition to any thoughts of a revived ad hoc gold pool was largely tactical. They did not wish to give the US the excuse for further delay by diverting attention with another attack on symptoms, when a fundamental policy appraisal was under way. This would be rather like the general opposition to the third sterling balance arrangement in 1976 before the IMF deal was complete. If this view of the German opposition were correct, the discussion could now revive with more chance of success – particularly as the gold price has become a reflection on currencies in general and not just on the dollar in particular. If it is thought that the US has now got its policy right the action on the gold price could bring the sort of success that would sustain faith while waiting for the important result to come through. Would such an action be any more than the correction of erratic fluctuations which we all advocate in a greater or lesser degree in currencies, but in a market more notoriously subject to violent swings.

Of course the action might fail when it comes to the other leg of the smoothing operation in that the pool might not succeed in buying back at lower levels all that it had previously sold. That is a risk that would have to be accepted from the outset: there should be no question of chasing the price back beyond the level at which the selling operation started.

Page 2

Given that the US auctions are now discretionary it would obviously be advisable for such sales to be subsumed in any general pool arrangement.

By way of illustration, should we become involved in a G.10 plus Switzerland co-operative endeavour and contributions were clearly in proportion to total gold holdings, our share would be just under 2 7/8%

7th November 1979

JLS

The pages of this memorandum from Sangster to McMahon can be seen here: Page 1 and Page 2. The links may take a little while to load first time.

The following document is the fourth main document in the Bank of England series covered here. This document is the briefing letter from Kit McMahon to Gordon Richardson referring to the Gold Pool discussion meeting which took place in the office of the BIS President Jelle Dijlstra on Monday 10 December 1979. This is probably the most important documented featured in Part 1 of this two part article series, since it provides an in-depth insight into one of the collusive Gold Pool discussion meetings which the most powerful central bank governors of the time attended discussing the creation of a syndicate to manipulate down the free market price of gold. On 10 December 1979, the gold price closed at $428.14.

In the meeting document, the name Larre refers to René Larre, General Manager of the BIS. Larre was BIS General Manager from May 1971 to February 1981.

De la Geniere refers to Renaud de La Genière, Governor of the Banque de France from 1979 to 1984.

The other participants at the 10 December meeting were BIS President Jelle Zijlstra, Chairman of the Swiss National Bank Fritz Leutwiler, Bank of England executive director Kit McMahon, outgoing Bundesbank President Otmar Emminger, incoming Bundesbank president Karl Otto Pohl, and Governor of the National Bank of Belgium Cecil de Strycker.

SECRET

[From McMahon]

To: The Governors Copies to : Mr Payton, Mr Balfour, Mr Sangster , Mr Byatt only

GOLD POOL

In the Governor’s absence I attended the meeting in Zijlstra’s room in the BIS on the afternoon of Monday, 10th December to continue discussions about a possible gold pool. Emminger, de la Geniere, de Strycker, Leutwiler, Larre and Pohl were present.

Larre began by outlining a way in which a possible gold pool might be handled. The BIS could undertake all the operations on behalf of a group of central banks on the basis of rather general criteria which would be reviewed monthly. The criteria would take into account not merely the developments of the price of gold but the affect any such developments appeared to be having on the dollar. Thus they would envisage selling only when gold was relatively strong and the dollar relatively weak and buying only in the reverse circumstances. They thought that they at least might start with a sum of around 20 tons (equals around $300 million at present prices). They could take running profits of losses on their books for a considerable period and though participating central banks would have to envisage the possibility of an ultimate loss or gain in gold, in practice all that might be involved would be a loss or gain in dollars. On this point both Zijlstra and Leutwiler emphasised that they were already liable to suffer substantial losses on their dollar reserves and would not be worried by the potential losses that they might they might sustain on this scheme.

In answer to a question from me, Zijlstra confirmed that the US realised that if any gold pool were developed, the European central banks would intend to buy back in due course any gold they sold. He said they were unhappy that the Europeans were not prepared to sell gold outright but they accepted it. Larre pointed out in parenthesis that Tony Solomon was probably the only American now or in the recent past that would be prepared to accept such a line. He knew that Wallich and probably Volcker was against the whole idea.

Page 2

Zijlstra and Leutwiler said they were both strongly in favour of going ahead on the basis Larre had suggested. They then asked what the other thought.

Emminger said that he had put this proposition to his Central Bank Council who were unanimously against it. His hands were therefore at present totally tied.

De Strycker said he was extremely doubtful about the scheme. He thought it was neither desirable nor necessary and carried considerable dangers. De la Geniere was also negative stressing the great political dangers for him of selling any French gold in this indirect way.

Leutwiler then suggested that they should do it the other way round: wait until the gold price went below 400 and then start the operation by buying. When the BIS had bought, say, 20 tons they would have a masse de manoeuvre which they could then sell. La Geniere said that this might be easier for him and he would consider the possibility of doing something along these lines. Emminger also said, though without much confidence, that it was possible that if the operation were to start along these lines and if it appeared to be going well, it might be possible to persuade the Central Bank Council to join in.

Leutwiler and Zijlstra then said that although they did not think a very large group was necessary to undertake the operation it probably had to be bigger than Two: specifically they really needed either the French of the Germans. Zijlstra said that although he had formal powers to do this he did not wish to do it without carrying his Government with him. The Government was still doubtful and would probably need to know that a number of other countries were going along with it.

At various points during the meeting there was a discussion about publicity for the operation and at an early point Zijlstra said that publicity was both inevitable and desirable if the operation was to have a maximum effect. He brushed aside my suggestion that while the publicity for any selling operations would be helpful, that attached to the later (or on the revised scheme, earlier) buying could be rather inflammatory. However, if the scheme were to be

Page 3

simply a BIS one, publicity would not necessarily, or perhaps desirably, arise. This point was not really addressed in the discussion.

I made a number of sceptical points about the failure of commodity stabilisation schemes of all kinds in the past and the dangers of getting drawn in gradually to bigger and bigger commitments. Leutwiler said that there was no danger because the losses would be small. I said that I envisaged political dangers. If it got known that the central banks were involving themselves in the price of gold, however much they said it was only a smoothing rather than a stabilising operation, they would find themselves on a tiger. If the price of gold went on rising they would either have to increase their efforts or add to the upward pressure o gold by pulling out.

None of this carried any weight with anybody except perhaps de Strycker. In any case I was not asked for any commitment from us. There was, in fact, no discussion of whether or how contributions to the scheme would be based, but presumably it would be in relation to gold holdings so that they would not expect much from us.

The meeting ended with Leutwiler saying he would approach the Canadians and Japanese to see how they felt about the idea while Zijlstra would talk to the Italians. All would then think further about it and revert in January.

I must say I remain personally extremely sceptical about the desirability and efficacy of any scheme along the lines so far suggested.

CWM

13th December 1979

The pages of this meeting description from McMahon can be seen here: Page 1, Page 2 and Page 3. The links may take a little while to load first time.

The Essence of the 10 December Meeting

The following key points are notable from McMahon’s briefing of the 10 December Gold Pool discussions meeting. McMahon opens by stating that the meeting was called “to continue discussions about a possible gold pool“. This proves there was an earlier meeting in November as per the invitation for the November meeting despite the fact that no minutes or summary exist for the November meeting.

Zijlstra and Leutwiler acted as the 2 main advocates of the proposed Gold Pool arrangement. This is important to remember because Zijlstra was the President of the BIS at that time and Leutwiler became President of the BIS at the beginning of 1982 taking over from Zijlstra. So the heads of the BIS in the early 1980s were both firm advocates of the need for a new Gold Pool. Zijlstra and Leutwiler probably also represented the two most independent central banks present at the discussions, namey the Dutch and Swiss central banks.

The following countries were represented at the 10 December meeting: UK, Switzerland, West Germany, France, Netherlands, Belgium. The following central banks were represented at the meeting:

- Zijlstra – BIS and Netherlands central bank

- McMahon – Bank of England

- Emminger – Deutsche Bundesbank

- Pohl – Deutsche Bundesbank

- de la Geniere – Banque de France

- de Strycker – Belgian central bank

- Leutwiler – Swiss National Bank

- Larre – Bank for International Settlements

The fact that Emminger had already put the suggestion to his Central Bank Council implies that this was probably a take-away after the November meeting. According to the Bundesbank 1979 annual report, there were 18 members of the Central bank Council (including Emminger and Pohl).

The market mechanics of the proposals discussed in the meeting are also classic collusive Gold Pool tactics to torpedo the gold price by “selling only when gold was relatively strong and the dollar relatively weak and buying only in the reverse circumstances.”

The discussion also made it clear that the preferred approach would be to operate as both a selling syndicate and a buying consortium as “European central banks would intend to buy back in due course any gold they sold.” It was even suggested that the buying could occur first so as to create an inventory of physical gold with which to use to fund the selling interventions, i.e “wait until the gold price went below 400 and then start the operation by buying. When the BIS had bought, say, 20 tons they would have a masse de manoeuvre which they could then sell.”

Given that René Larre the BIS general manager began the meeting shows that he was coordinating or spearheading this meeting in his capacity as BIS general manager. It is also very interesting that McMahon states that “the BIS could undertake all the operations on behalf of a group of central banks” that could be “reviewed monthly”, which underlines the fact that overall, this could be viewed as a BIS led scheme, controlled and operated out of Basle.

A BIS scheme would also allow the Gold Pool to operate in secrecy, out of public view. In the words of McMahon “if the scheme were to be simply a BIS one, publicity would not necessarily, or perhaps desirably, arise“.

Following this 10 December meeting, the governors returned to their respective banks and recessed for Christmas and New Year, returning to Basle in early January where the next Gold Pool meeting took place on 7 January 1980, in a historic month in which the gold price rocket from $515 to $850 in a matter of weeks.

Conclusion

This concludes Part 1 of the series. There is a lot to digest in the above. Part 2 will continue where we left off, and will cover discussions of this new BIS Gold Pool during the period from January 1980 onwards. For now, some quotes from Part 2:

“This is not to advocate gold for oil directly; the price haggling would be too acrimonious. Market intermediation should allow the G10 to move with the price while attempting to control its pace as well as break off the experiment when possible or necessary.”

– John Sangster to Gordon Richardson, Anthony Loenhis & Kit McMahon, Bank of England, 17 September 1980

“I feel that it is necessary for us, within the Group of Ten and Switzerland, to consider ways to regulate the price of gold, admittedly within fairly broad limits”

– Jelle Zjilstra, BIS Chairman and President and Dutch central bank President, 27 September 1981

“First, there is the meeting on the Gold Pool, then, after lunch, the same faces show up at the G-10″

– Bundesbank President Karl Otto Pohl (who only began working at the Bundesbank in 1977) to journalist Edward Jay Epstein, in a conversation at the Bundesbank in 1983

Ronan Manly

Tags: Abdulaziz Al-Quraishi,Al Quraishi,Anthony Solomon,Banca d'Italia,Bank for International Settlements,Bank of England,Banque de France,Basel Gold Pool,Basle Gold Pool,Bernard Clappier,Bill Miller,Bundesbank,Carlo Ciampi,Cecil de Strycker,Christopher McMahon,David Walker,Deutsche Bank,Deutsche Bundesbank,Eddie George,Featured,Federal Reserve Board,frbny,Fritz Leutwiler,gold for oil,Gordon Richardson,Helmut Schmidt,Henry Wallich,HSBC,JLS,John Sangster,Karl Otto Pohl,Kit Mcmahon,London Gold Pool,Midland Bank,newsletter,oil for gold,Otmar Emminger,Paolo Baffi,Paul Jeanty,Paul Volcker,Renaud de La Genière,Rene Larre,SAMA,Samuel Montagu,Saud Arabian Monetary Authority,Swiss National Bank,Tony Solomon,Uncategorized,US Treasury,William Miller,Winifried Guth