A longer working life can counteract the demography-related shortage of skilled workers and spiraling social security expenditure. For this to happen, however, the reintegration of older employees must be improved and gainful employment made more attractive beyond the age of retirement. New, innovative concepts are needed that point the way toward a labor market that is more flexible and better-oriented to the needs...

Read More »Weekly Speculative Positions (as of July 18): Speculators short CHF against USD again

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Don’t Be Confused by the Facts or Why Neither the Data nor the Fed Will Alter Market Trends

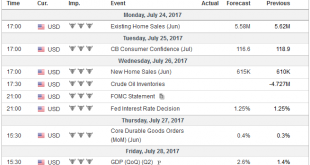

Summary: FOMC is the highlight of the week. Early look at July inflation in Europe may see less pressure. Overall household consumption in Japan is rising, helped by robust labor market, but little new price pressures. The data this week is expected to confirm what many investors have come to assume. The US economy accelerated in Q2. The eurozone economy is enjoying steady growth, but the momentum appears to...

Read More »Emerging Markets: Week Ahead Preview

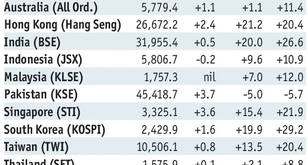

Stock Markets EM FX was mixed on Friday, but largely firmer over the entire week. Top performers were BRL, KRW, and ZAR, while the worst were ARS, MXN, and RUB. FOMC meeting this week poses some potential risks to the global liquidity story that’s supporting EM. Within EM, the low inflation/easy monetary policy narrative should continue with data and events this week. Stock Markets Emerging Markets, July 22 - Click...

Read More »FX Weekly Review, July 17 – July 22: Euro and CHF move upwards against Dollar

Swiss Franc vs USD and EUR Both Swiss Franc and Euro were moving upwards against the dollar. So CHF gained 3% versus the dollar in the last month. The Euro is the strongest currency. CHF lost around 1.3% against the Euro. EUR/CHF and USD/CHF, July 22(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge Swiss Franc Currency Index (3 years) The Swiss Franc index is the trade-weighted...

Read More »Official: Internal review clears Swiss arms shipments

SECO director Ineichen-Fleisch defended the agency’s handling of the arms deal. The head of a Swiss federal office says its handling of export permits for arms manufacturers is improving in the wake of a criminal probe into past shipments. An internal review cleared a federal employee of wrongdoing after prosecutors questioned the handling of a Bernese arms manufacturer’s requests to ship weapons to Kazakhstan in 2008...

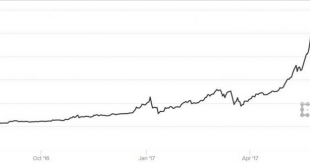

Read More »Millennials Can Punt On Bitcoin, Own Gold and Silver For Long Term

– Bitcoin volatility shows not currency or safe haven but speculation – Volatility still very high in bitcoin and crypto currencies (see charts) – Bitcoin fell 25% over weekend; Recent high of $3,000 fell to below $1,900 – Bitcoin least volatile of cryptos, around 75% annualised volatility – Gold much more stable at just 10% annualised volatility – Bitcoin volatility against USD about 5-7 times vol of traditional...

Read More »Pharma remains king of Swiss exports

Swiss watch sales abroad have stabilised so far this year (Keystone) Pharmaceutical and chemical goods pushed Swiss exports to record highs in the first half of this year. The value of goods sold abroad peaked at CHF109.6 billion ($105 billion) in the first six months of 2017 – a 4.4% rise on the previous year. Swiss exports were further boosted by resurgence in demand from China that saw a 20% increase in value of...

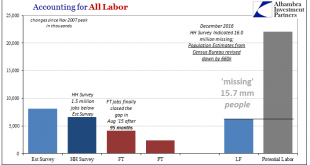

Read More »Reports on a Quarterly Survey Conducted: Qualifying Shortage (Labor)

There isn’t a day that goes by in 2017 where some study is released or anecdote is published purporting a sinister labor market development. There is a shortage of workers, we are told, often a very big one. The idea is simple enough; the media has been writing for years that the US economy was recovering, and they would very much like to either see one and be proven right (and that recent revived populism is...

Read More »Congress’s Radical Plan to End Illegal Money

What Constitution? One of the many downfalls of being the United States Secretary of the Treasury is the requirement to place one’s autograph on the face of the Federal Reserve’s legal tender notes. There, on public display, is an overt record of a critical defect. A signature endorsement of a Federal Reserve note by the Treasury Secretary represents their personal ratification of unconstitutional money. If you...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org