Nicolas Maduro (blue shirt) at the tomb of former Cuban leader Fidel Castro in Santiago on August 15 (Keystone) Swiss firms have been cutting hundreds of jobs in long-established branch offices in Venezuela, as the oil-producing country experiences an economic and political crisis. “The disaster – economic, social, political and humanitarian – which is engulfing Venezuela with the government of [president] Nicolas...

Read More »L’explosion de la fortune des plus riches en France grâce au Casino. Liliane Held-Khawam

2007. Crise des subprimes. De l’argent public se déverse en abondance dans les circuits financiers mondiaux qui turbinent à la monnaie centrale. Comprenez que c’est de l’argent scripturale bancaire qui a été élevé au rang d’argent garanti par les Etats via leurs banquiers centraux. 2011. Crise des banques européennes. De nouveau, des décisions prises pour soutenir les banques sont prises par les grandes banques...

Read More »United States: Still No Up

The Asian flu of the late 1990’s might have been more accurately described as the Asian dollar flu. It was the first major global test of the mature eurodollar system, and it was a severe disruption in the global economy. It doesn’t register as much here in the United States because of the dot-com bubble and the popular imagination about Alan Greenspan’s monetary stewardship in general. But even in our domestic...

Read More »Global Asset Allocation Update: No Upside To Credit

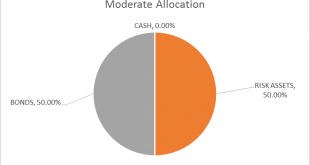

There is no change to the risk budget this month. For the moderate risk investor, the allocation between risk assets and bonds is unchanged at 50/50. There are other changes to the portfolio though so please read on. As I write this the stock market is in the process of taking a dive (well if 1.4% is a “dive”) and one can’t help but wonder if the long awaited and anticipated correction is finally at hand. Which means,...

Read More »FX Daily, August 18: Dollar and Equities Trade Heavily Ahead of the Weekend

Swiss Franc The Euro has fallen by 0.06% to 1.1279 CHF. EUR/CHF and USD/CHF, August 18(see more posts on EUR/CHF, USD/CHF, ) Source: markets.ft.com - Click to enlarge FX Rates The second largest drop in US equities this year has spilled over to drag global markets lower. The MSCI Asia Pacific Index fell nearly 0.5%, snapping a four-day advance and cutting this week’s gain in half. The Dow Jones Stoxx did not...

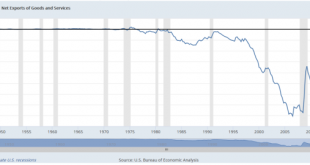

Read More »L’impact de la délocalisation de la production sur la balance commerciale US.

Dans la série sur la balance des paiements et les zooms sur les balances commerciales, voici l’évolution de la balance commerciale américaine. Nous voyons clairement qu’elle était neutralisée à 0 durant l’ère où les devises du monde devaient être arrimées, selon les Accords de Bretton Woods, au dollar qui lui-même était partiellement couvert par l’or. La valeur du dollar devait se référer à un prix fixe de l’or de 35...

Read More »Buy Gold Urges Dalio on Linkedin – “Militaristic Leaders Playing Chicken Risks Hellacious War”

Don’t let “traditional biases” stop you from diversifying into gold – Dalio on Linkedin “Risks are now rising and do not appear appropriately priced in” warns founder of world’s largest hedge fund Geo-political risk from North Korea & “risk of hellacious war” Risk that U.S. debt ceiling not raised; technical US default Safe haven gold likely to benefit by more than dollar, treasuries Investors should allocate at...

Read More »Government compromises on medical tariffs

The Swiss cabinet has approved an amended billing system for medical treatments aimed at creating more transparency and limiting a further increase in healthcare costs. The decision is expected to lead to annual savings of CHF470 million ($483 million) and a drop of about 1.5 percentage points in insurance fees for patients, according to Interior Minister Alain Berset. However, it falls short of initial proposals for...

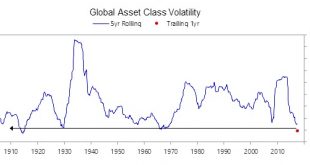

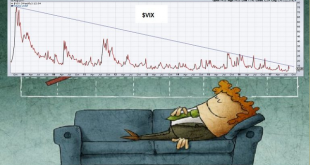

Read More »Is Historically Low Volatility About to Expand?

Suspicion Asleep You have probably noticed it already: stock market volatility has recently all but disappeared. This raises an important question for every investor: Has the market established a permanent plateau of low volatility, or is the current period of low volatility just the calm before the storm? When such questions regarding future market trends arise, it is often worthwhile to examine market history. For...

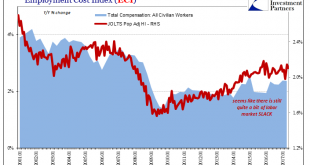

Read More »Data Dependent: Interest Rates Have Nowhere To Go

In October 2015, Federal Reserve Vice Chairman Bill Dudley admitted that the US economy might be slowing. In the typically understated fashion befitting the usual clownshow, he merely was acknowledging what was by then pretty obvious to anyone outside the economics profession. Dudley was at that moment, however, undaunted. His eye was cast toward the unemployment rate and that was nothing but encouraging no matter the...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org