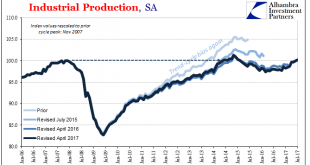

Industrial Production disappointed in the US last month, dragged down by auto production. Despite the return of an oil sector tailwind, IP was up just 2.2% year-over-year in July 2017 according to Federal Reserve statistics. It marks the fourth consecutive month stuck around 2% growth. The lack of further acceleration is unusual in the historical context, especially following an extended period of contraction. This...

Read More »Weekly Speculative Positions (as of August 15): Speculators Add to Sterling and Peso Shorts, While Cutting Euro and Canadian Dollar Longs

Swiss Franc Speculators were net short CHF in January 2015, shortly before the end of the peg, with 26.4K contracts. Then again in December 2015, when they expected a Fed rate hike, with 25.5K contracts. The biggest short CHF, however, happened in June 2007, when speculators were net short 80K contracts. Shortly after, the U.S. subprime crisis started. The carry trade against CHF collapsed. The...

Read More »FX Weekly Preview: Transitioning to a New Phase

Summary: Jackson Hole marks the end of the investors’ summer and a beginning of a challenging several weeks. The abandonment of national business leaders from Trump’s advisory board and strong words by Republican Senator Corker, followed by the dismissal of the controversial Bannon, could be a turning point. Neither Yellen nor Draghi may not even address the current policy stance as they discuss the topic at hand,...

Read More »FX Weekly Review, August 14 – August 19: CHF Recovers after Dovish Draghi Comments

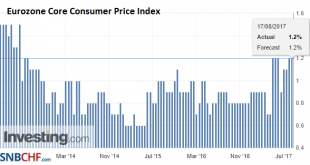

Overview The euro has lost some momentum versus the franc, the main reason is as usual monetary policy: Draghi does not want to talk about an early end of his bond buying programming at Jackson Hole. This had been confirmed by economic data: only 1.2% core inflation compared to a long-term inflation target of 2%. Consequently the Swissie appreciated during the week. Eurozone Core Consumer Price Index (CPI) YoY, Jul...

Read More »Gold, Silver Consolidate On Last Weeks Gains, Palladium Surges 36% YTD To 16 Year High

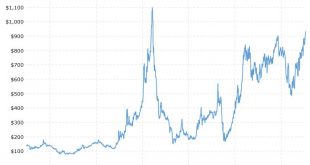

Gold and silver rise as stocks fall sharply after Barcelona attack Gold, silver 0.6% higher in week after last weeks 2%, 5% rise Palladium +36% ytd, breaks out & reaches 16 year high (chart) Gold to silver ratio falls to mid 75s after silver gains last week Perfect storm of financial and geopolitical tensions is driving safe haven demand and should see higher prices Weekly close over $1,300 could see gold quickly...

Read More »Swiss Asset Manager Settles US Tax Evasion Charges

Under the US Department of Justice’s 2013 ‘Swiss Bank Program’, 80 Swiss or Swiss-based banks paid $1.36 billion in fines for helping clients evade US taxes (Keystone) The Geneva asset management firm Prime Partners has agreed to pay $5 million (CHF4.8 million) to the United States to settle charges for tax evasion and assisting US taxpayers in opening and maintaining undeclared foreign bank accounts from 2001 to 2010....

Read More »Higher Swiss health premiums for those with high deductibles challenged by commission

In June 2017, Switzerland’s Federal Council announced plans to reduce the discounts offered to those willing to risk paying the first chunk of their annual medical bills. The plan included reducing the maximum premium discounts given for opting for deductibles, the amount paid by the insured before insurance kicks in. © Ginasanders | Dreamstime - Click to enlarge On Tuesday, according to 20 Minutes, a commission for...

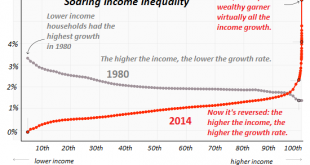

Read More »Why We’re Doomed: Our Economy’s Toxic Inequality

Anyone who thinks our toxic financial system is stable is delusional. Why are we doomed? Those consuming over-amped “news” feeds may be tempted to answer the culture wars, nuclear war with North Korea or the Trump Presidency. The one guaranteed source of doom is our broken financial system, which is visible in this chart of income inequality from the New York Times: Our Broken Economy, in One Simple Chart. While the...

Read More »Gold Hedges USD Devaluation, Rise in Oil, Food and Cost of Living Since 1971 – Must See Charts

Gold hedges massive ongoing devaluation of U.S. Dollar 46th anniversary of ‘Tricky Dicky’ ending Gold Standard (see video) Savings destroyed by currency creation and now negative interest rates Long-term inflation figures show gold a hedge against rising cost of fuel, food and cost of living $20 food and beverages basket of 1971 cost $120.17 in 2017 Household items increased by average of 2000% and oil by 5,373% since...

Read More »Markets Exaggerate, That is what They Do

Summary: FOMC minutes were not as dovish as spins suggest. ECB record was not as dovish as market response appears. Divergence is still intact. First, we told you that the FOMC minutes were not as dovish as the dollar and US Treasury yields may have suggested to many observers. Neither timing of the balance sheet adjustment (Sept announcement) or the odds of a rate hike before year-end changed. The dollar and...

Read More » Swiss Economicblogs.org

Swiss Economicblogs.org